How to use Payoneer

Featured resources

Getting paid via Bill.com? Make the most of your earnings by getting paid to your USD account with Payoneer!

If you’re working with American clients, or you’re a US payee sending payments to international contractors, suppliers, and agencies, you might already be familiar with Bill.com. Bill.com is a cloud-based payment platform that helps thousands of Americans pay their invoices to contractors and suppliers around the world. Small business owners and contractors send in their […]

Business, General Payments, How to use Payoneer

Payoneer, SWIFT and ACH Transfers: What’s the Difference?

If you're a Ukrainian freelancer, entrepreneur, or business owner working with international clients, you've likely faced this question: What’s the best way to receive cross-border payments? SWIFT transfers, ACH, and platforms like Payoneer all offer different benefits — but choosing the wrong one can cost you time, money, and peace of mind.

Business, General Payments, How to use Payoneer

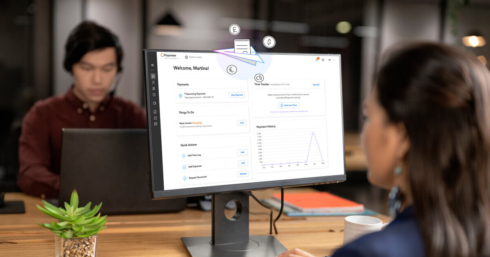

The Best Ways to Receive Payment Online as an International Business

Getting paid across borders shouldn’t feel like crossing a minefield. Yet for many small businesses and freelancers, international payments still come with frustrating roadblocks—high fees, poor exchange rates, slow transfers, and complex compliance. The good news? Platforms like Payoneer are changing the game. With multi-currency accounts, seamless global integrations, and transparent fees, Payoneer makes it easier than ever to receive international payments online. In this guide, we explore the best ways to get paid internationally, compare common methods like SWIFT and ACH transfers, and explain why Payoneer stands out as the go-to solution for businesses ready to scale globally.

Business, General Payments, How to use Payoneer

Best Online Payment Systems for a Small Business

Today’s online payment systems make it easier than ever for small to medium-sized businesses to accept payments securely, quickly, and globally. Whether you're selling locally or working with international clients, having the right payment solution in place is essential for growth and customer satisfaction. In this guide, we break down the most popular small business payment processors — from PayPal and Stripe to Square and Payoneer — and compare their features, fees, and best use cases. We’ll also walk you through how to set up your payment system, what to look for when evaluating your options, and why Payoneer stands out for businesses with global ambitions.

Business, General Payments, How to use Payoneer

How to make an invoice: a step-by-step guide

In this guide, we’ll walk you through everything you need to know: from what an invoice is and what it should include, to the difference between templates and invoice generators — and how Payoneer makes the whole process easier. Whether you’re sending your first invoice or looking to streamline your current system, you’ll find helpful tips, common pitfalls to avoid, and answers to frequently asked questions.

Business, General Payments, How to use Payoneer

How Singapore’s Fintech Sector Is Helping B2B Exporters Manage Tariff Challenges

When your biggest client gets hit with a 25% import duty, waiting days for a bank transfer can cost you more than time—it can cost you opportunities. Currency swings, payment delays, and rigid financial systems put Singapore exporters at risk in a volatile trade environment. Thankfully, Singapore’s fintech ecosystem is built for this. Exporters now have smarter ways to manage payments, hold multiple currencies, and stay agile in the face of disruption. This blog explores how the right financial tools can help Singapore businesses not just survive—but thrive—in a changing global economy.

Business, General Payments, How to use Payoneer

Pay your contractors and remote employees in Pakistan

Pakistan is the world’s 8th fastest growing freelance economy and one of the leading global hubs for freelance software engineers.

Business, How to use Payoneer

Using your Payoneer account just got even more secure!

Sending international payments demands the highest levels of trust. That’s why here at Payoneer we place security as our top priority and do everything possible to keep your money safe and secure.

How to use Payoneer

Mastering international B2B payments: A practical handbook for digital business owners

A handy guide to international B2B payments for entrepreneurs and digital business owners

Business, How to use Payoneer

Bill vs invoice – what’s the difference between?

Welcome to our guide on the differences between invoices and bill documents. As an eSeller, you’re familiar with these terms but may not know exactly what sets them apart. Not to worry, today we will tackle the topic of bills vs invoices.

How to use Payoneer

Using JazzCash to receive payments with Payoneer just got even better!

If you’re a freelancer based in Pakistan, its quite possible you’re using the JazzCash app, right? And if you’re already a Payoneer customer, you may well have connected your JazzCash account to your Payoneer account to make managing your business payments easy. If so, you’ll be pleased to know that you can now use ‘Request […]

Business, How to use Payoneer

Purchase order vs invoice: how to spot the difference

Are you a small business owner looking to manage your finances more effectively? One key aspect of financial management is understanding the difference between purchase orders and invoices. While both are essential for recording transactions and managing cash flow, they serve different purposes in the purchasing process.

How to use Payoneer

Adsense Payments

HOW TO GET PAID FROM ADSENSE & YOUTUBE? To get paid by AdSense, you will need a traditional bank account or a multicurrency account provided by Payoneer. The AdSense payment cycle is monthly, and you accrue estimated earnings over the course of a month, and then at the beginning of the following month your earnings […]

General Payments, How to use Payoneer

How to manage Value Added Tax (VAT)

The quick & easy guide to managing VAT If you’re an eSeller looking to grow your business globally, it’s essential to understand the effects of Value Added Tax (VAT) on your operations. In the US, VAT is similar to sales tax, with one key distinction: sales tax is only charged at the point of sale, […]

General Payments, How to use Payoneer

Payoneer’s wire transfer tutorial for freelancers and business owners

Welcome to our definitive guide on sending and receiving money internationally – a must-read for every business owner making their mark globally.

How to use Payoneer

Announcing Payoneer’s new integration with Zoho Books

Payoneer already provides you with ways to save money on international payments and the amount of effort it takes to manage invoices. But now we have launched a new direct integration with Zoho Books, the online invoicing and business management software, to make business administrative tasks even easier when you connect your Payoneer and Zoho […]

Country Guides, General Payments, How to use Payoneer

Guide to structuring your US entity and corporate tax compliance

As the world turns it back on pandemic restrictions and lockdowns, more and more businesses are not only striving to get back on their feet but also expand into newer and unchartered territories. While there are many ways to expand your business internationally, the most preferred is the direct route of incorporating your business in […]

How to use Payoneer, Industry Pulse

How hedging strategies can help cross-border SMBs minimize currency risk

As a small or medium-sized business (SMB) operating internationally, fluctuations in currency exchange rates can have a significant impact on your bottom line. Whether you’re importing goods from overseas or selling products abroad, currency fluctuations can cause unexpected expenses or lost profits. However, there are strategies that SMBs can use to minimize the risk of […]

How to use Payoneer

Uncovering the challenges & opportunities in cross-border payments

Cross-border payments have become increasingly important for small and medium-sized businesses (SMBs) that, in today’s digital economy, can leverage the range of talent and vendors that are now more accessible to them. However, there are several challenges that come with making international payments, and it’s essential for SMBs to understand them in order to navigate […]

How to use Payoneer

How to send or schedule payments to your recipient’s bank account

At Payoneer, our focus is always on helping you pay and get paid quicker and easier than ever – wherever your team is based. We understand that speed and certainty are crucial for any business. That’s why we make it easy to pay your contractors, employees, or suppliers straight to their bank account. By sending […]

Business, How to use Payoneer

The difference between an estimate and an invoice

When it comes to accounting and paperwork, small businesses and freelancers have a lot to keep track of. Fortunately, business software like Free Invoice Builder helps streamline the process and keeps all your documents organized. Two important business documents you’ll need to know are estimates and invoices. While there are similarities between the two, they […]

Country Guides, General Payments, How to use Payoneer

Join Singapore’s Thriving eCommerce Market and Get Paid in Singapore Dollars!

Did you know? Singapore ranks as the fastest growing eCommerce industry in Southeast Asia. In addition, the country is home to a very stable economy and English-speaking residents who have plenty of disposable income, making it an ideal region for cross-border sellers like you. And now, with Payoneer’s Singapore Dollar (SGD) receiving account, it’s easier […]

How to use Payoneer

How to pay VAT from your Payoneer balance with no transfer fees!

Editor’s note: The original post was updated on 29.09.21 for accuracy and comprehensiveness. If you’re a cross-border seller selling to customers in the EU and UK, you’ve likely heard about the recent VAT crack-down on foreign Amazon sellers. Sellers reaching a certain threshold in sales to these markets may owe value added tax (VAT) to the […]

Business, How to use Payoneer

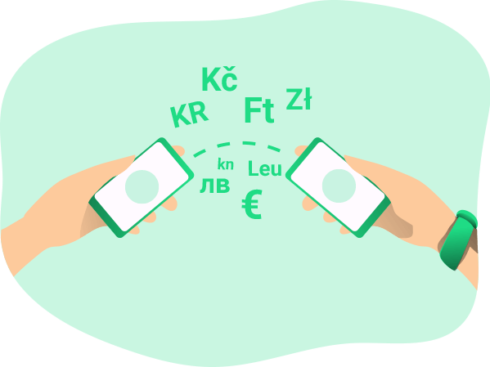

3 ways you’re missing out by not invoicing in a foreign currency

As an SMB operating across borders, have you ever struggled with invoicing your overseas partners in their local currency? It’s a common challenge that many businesses face when trying to manage their finances and cash flow. In this blog post, we’ll explore the benefits of invoicing in foreign currencies and how it can help your […]

How to use Payoneer

Is Payoneer right for you? Everything you need to know.

Payoneer is the world’s go-to partner for digital commerce everywhere, used by millions of businesses worldwide to send and receive payments internationally. If you’re a small to medium sized business, needing to pay international suppliers or contractors or get paid from overseas clients at a competitive exchange rate, and you’re looking for a low cost, […]

Business, General Payments, How to use Payoneer

Bank wire transfers with Payoneer, SWIFT & others

Here at Payoneer, we work hard to ensure you have the best bank transfer options available. That’s why, as a Payoneer client, you have several banking methods available – Local transfers and SWIFT (Wire) transfers. In this article, we will introduce you to both these payment methods and provide a helpful guide on when to […]

How to use Payoneer

Meet the Winners of the Payoneer Design Contest!

Earlier this year, we opened a worldwide contest to find some of the best talent to design the most eye-catching and fun images for a range of merchandise that you can now find in the Payoneer Merch Store. We were looking for the most out-of-the-box ideas based on the concept of ‘Universal Opportunities’, or our […]

How to use Payoneer

Welcoming John Caplan as our new co-Chief Executive Officer

It’s a great pleasure to announce today that we have appointed John Caplan as our co-CEO. John and I will lead the company as co-CEOs through the end of 2023, when John will take the helm as CEO and I will continue in a strategic role. Before I tell you more about John and how […]

Business, Country Guides, How to use Payoneer

How to open an ecommerce business in Hong Kong

Ecommerce is booming around the world, so it’s a great time to expand your business to make more online sales in more parts of the world. That’s why more ecommerce companies are asking how to register a company in Hong Kong, a convenient location for serving customers across South-East Asia. Running a legal entity in […]

Business, Country Guides, How to use Payoneer

You’ve Sent Your Payment – Now Make Sure It Arrives to Its Destination

When it comes to paying your contractors, suppliers and remote employees, knowing that your funds reached their destination in full and on time is critical for maintaining a healthy relationship with your service providers. Effectively tracking payments, however, requires a robust and transparent solution that gives you a birds-eye-view as to where your funds are […]

General Payments, How to use Payoneer

How to Get Paid on OnlineJobs.ph Using Payoneer

OnlineJobs.ph offers a great way to earn money while working remotely, but you still need to get paid. Whether your clients are in the US, UK, AU or anywhere else in the world, you want to be paid on time without losing part of your income on high bank transfer fees or poor exchange rates. […]

How to use Payoneer

Phishing and identity theft: what you need to know and how to stay alert

“Phishing” is when someone tries to contact you pretending to be from a legitimate organization (Payoneer, in our example), and asks you to provide sensitive account information, in an attempt to access your account without your authorization. Here’s what you need to know about phishing and what you can do to prevent it. Signs you may […]

Business, How to use Payoneer

Amazon Launches in the Netherlands! Here’s How to Get Paid from Amazon Seller Central NL

Great news for Dutch eSellers! Amazon has officially launched in the Netherlands enabling thousands of local retailers to expand their businesses. Amazon has been serving customers in the Netherlands for quite a few years – since 2014, when they launched an eBook shop on Amazon.nl. Prime was launched in 2017, enabling customers to enjoy fast […]

Business, How to use Payoneer

JazzCash and Payoneer Team up to Make Freelance Payments Easy

Exciting news for freelancers in Pakistan! Payoneer has recently partnered with JazzCash, a mobile payment provider in Pakistan, enabling you to receive funds from your Payoneer account directly into your JazzCash account. The majority of freelancers in Pakistan use Payoneer to receive international payments from marketplaces and direct clients and then withdraw fund via their […]

How to use Payoneer

Registering for a Payoneer Account to Manage Your eBay Payouts

Please note: This partnership is only available in specific countries. Payoneer’s partnership with eBay enables sellers from all over the world to streamline their eBay payouts, allowing them to effectively manage their global eBay transactions using our comprehensive payments solution. In this step-by-step guide, we’ll outline how to sync your eBay account with Payoneer, register […]

How to use Payoneer

First Payoneer Meetup in Peshawar Brings Together Businesses and Global Clients

Earlier in July, Payoneer held its very first meetup in Peshawar, Pakistan on the topic of International Payment Solutions for Businesses in Pakistan. The event commenced with a brief introduction on Payoneer and how we aim to go beyond and empower global growth for online professionals & businesses along with our widespread partner network. Mohsin […]

How to use Payoneer

How to Connect My Payoneer Account to a Marketplace, Network or Site

Are you a freelancer working on Upwork or Fiverr? Or perhaps you are selling on Lazada or Wish? Payoneer has partnered with leading eCommerce and freelance marketplaces, affiliate networks, and business applications to provide you with quick, convenient, and low-cost solutions to pay and get paid internationally. Read on to learn how you can connect with any of our 2,000+ partners in just a few simple steps. […]

Business, General Payments, How to use Payoneer

Possible Reasons Why Your Bank Transfer is Delayed

One of the most frustrating experiences in the business world is waiting for your payment to come through. You love your work but getting paid is also pretty important to you – after all, you need to eat and to pay your rent! Your client notifies you that they sent their payment, but your bank […]

How to use Payoneer

Payoneer Guest Blogger Agreement

By signing below, you confirm that you have read, and agree to, the terms of this agreement. Regarding images: Related resources Latest articles

How to use Payoneer

Proof of Residence: Why It’s Needed and How Best to Provide It

When opening a Payoneer account, you might be asked to provide a proof of residence documenting that the address you used to register is indeed where you live. We request proof of residence for several reasons, namely, to protect all our customers’ accounts. Along with the other verification procedures set by the different regulatory bodies […]

How to use Payoneer

What’s Coming Up at Payoneer? Mobile App Facelift, New Bank Partnerships and More!

We’re constantly striving to expand our offerings, helping to ensure that you have the most comfortable, seamless experience possible with Payoneer. Whether it’s product upgrades, new partnerships or innovative ways to pay for essential services, our goal is to simplify your payment experience so you can focus on what’s most important – growing your business. […]

How to use Payoneer

How to manage currencies to simplify your global payments

Editor’s note: This service is currently not available in India and Korea. When doing business internationally, you need easy access to funds in major foreign currencies at all times. At Payoneer, you can easily manage your currencies to ensure that you have the currency you need for your payments. Simply transfer between your different Payoneer […]

Business, How to use Payoneer

How to Add Fiscal Representative(ES/FR/IT) Bank Accounts into Payoneer VAT Portal

Payoneer has launched VAT Payment service to help users pay VAT easily. while in Spain, Italy and France, we have more complicated payment flows to follow, which is, pay to fiscal representative. As for now, we do have multiple bank accounts supported in each country, however, there are still more fiscal rep accounts that haven’t […]

How to use Payoneer

Payoneer Hosts NYC Fintech Women Meetup

This week, Payoneer along with NYC Fintech Women hosted an engaging meetup event during New York Fintech Week. 75 participants attended, bringing together innovative women in fintech to network and discuss everything from wealth management to payments and more. Attendees were able to share different ideas and opportunities as well as help inspire one another. […]

Business, Country Guides, How to use Payoneer

Paying into a Fiscal Representative Bank Account

If you’re a cross-border eSeller in the EU and UK, you’re likely to use Payoneer’s VAT Service which enables you to easily pay required VAT for free, save on conversion fees and receive peace of mind that your payment will arrive on time. For some, paying VAT in France, Italy, Poland and Spain can be […]

Business, How to use Payoneer

How To Update Your Local INR Bank Details

Whether you’re a small business, consultant or professional, getting paid is critical. With Payoneer, funds are transferred quickly and securely from companies worldwide to your local bank account in INR at low cost. Read on for a step-by-step guide to updating your personal bank account details with Payoneer. To Update Your Bank Details In compliance […]

Business, How to use Payoneer

Payoneer Now Integrated with Envoice

When you’re working for yourself, successful time management is crucial. Wasting too much time on the lateral tasks and not on your actual work can make freelancing more complicated than it needs to be. The global freelance community is growing at a staggering rate, and technology is catching up. There are many tools at the freelancer’s […]

How to use Payoneer

Getting paid by other Payoneer users? Get access to all of Payoneer’s billing tools!

Do you receive payments from clients or business partners with Payoneer’s Make a Payment service? We’ve got good news for you! Starting today, you can send invoices, reminders, and manage your payments, while enjoying Make a Payment‘s free and fast account-to-account payment service. The beauty of the Make a Payment service is threefold: It’s FREE – Payoneer […]

![[VIDEO] How to request a payment from your Payoneer account - how to send a payment request visual 2 [VIDEO] How to request a payment from your Payoneer account](https://www.payoneer.com/wp-content/uploads/how-to-send-a-payment-request-visual-2.png)

How to use Payoneer

[VIDEO] How to request a payment from your Payoneer account

Whether you’re a freelancer who’s just finished a project or a contractor who needs to bill a retainer fee, Payoneer’s Request a Payment makes it easier than ever to get paid. How does it work? 1. Sign in to your Payoneer account. Before you can start sending payment requests, you will be asked to provide information that […]

How to use Payoneer

The First Payoneer Meetup in Sri Lanka!

Editor’s note: This is a guest post from Lasantha Wickramasinghe, Payoneer Brand Ambassador for Sri Lanka. Freelancing and online entrepreneurship is booming in Sri Lanka. Most of the freelancers and online entrepreneurs in the country prefer to use Payoneer, so that they can gain access to the funds earned by offering products or services to international […]

How to use Payoneer

How to Integrate eZ Cash with Payoneer

Great news for Payoneer and eZ Cash users! You can now withdraw funds directly from your Payoneer account to your eZ Cash account in Sri Lankan rupees, easily and quickly. eZ Cash is an e-wallet service, enabling users to perform a wide array of financial transactions, directly from their mobile device. The ease and simplicity […]

Business, General Payments, How to use Payoneer

How to withdraw funds from Payoneer to your bank account

Payoneer offers several easy, quick, and low-cost ways to receive funds from global clients, and once you’ve done so, there are many ways you can use your earnings. Once of the most useful ways, though, is to withdraw your earnings, at any time, to your local bank account. After all, Payoneer connects with local banks […]

How to use Payoneer

JPY is here – Payoneer customers can now receive payments from Japanese companies!

Asia-Pacific is now the largest regional marketplace for eCommerce. Though small (about the size of California), Japan is an eCommerce powerhouse. It ranks fourth overall in eCommerce sales, behind China, the US, and the UK, with estimated sales of $80 billion. But looking to the near future, we see even more opportunity as Japan’s […]

General Payments, How to use Payoneer

Credit Card Chargebacks: Everything Merchants Need to Know

What is a Credit card Chargeback? A chargeback (also known as reversal) is a form of buyer’s protection provided by the credit card’s issuing bank, which allows customers to file a complaint regarding fraudulent transactions or a service dispute on their card statement. Once the buyer files a dispute, the issuing bank launches an investigation […]

How to use Payoneer

Attach invoices, contracts and more when you request a payment

Whether your clients are around the corner or 5 time-zones away, billing them and receiving payments has never been easier. Payoneer’s Request a Payment enables freelancers, contractors and professionals to send out payment requests for work completed. The clients can then choose to pay via payment options, including credit/debit card, ACH bank debit and local bank transfer (via the […]

General Payments, How to use Payoneer

8 Tips for Keeping Your Card Details Secure

Whether we mean to or not, we share a lot of our personal banking information with others on a daily basis. This happens in many situations: when we pay online for a product or a service, when we withdraw cash from the ATM machine, when we transfer money to a different account, when we login to […]

How to use Payoneer

Filling out your address when signing up to Payoneer is important- here’s why

As a Payoneer user, there may come a time when you need to renew your card or reorder a lost or stolen card. In order to ensure that your card makes it safe and sound to its desired destination, you need to make sure that you provide your address details in the most accurate way possible. Providing […]

How to use Payoneer

4 Tips for Sending and Receiving Money Online

The world gets smaller every day. People leave their home countries for distant destinations, companies work with freelancers and consultants on the other side of the globe, and retailers expand their operations so they can sell their wares not just to neighbors down the road, but to shoppers in foreign lands. What does this mean […]

How to use Payoneer

How Payoneer Calculates Withdrawal Fees

We know how important it is for you to have low-cost ways to access your international payments. At Payoneer, you can easily withdraw funds to your local bank account in your local currency, at outstanding rates. To understand exactly how Payoneer calculates withdrawal fees, let’s look at a real life example… Meet Sandra, a freelance […]

General Payments, How to use Payoneer

How to Activate My Payoneer Card

Want to get started using your virtual Payoneer card? Read on for a step-by-step card activation guide. Step 1 Sign in to Payoneer. Step 2 Select Settings > Card Management, locate the card you would like to activate and click ACTIVATE. Step 3 Fill in your card details You will see an online confirmation that your card has […]

How to use Payoneer

Gearlaunch: Grow, Build and Scale Your Custom Apparel Business

For professional sellers of custom apparel, GearLaunch is the most powerful platform on the market to grow, build and scale your business. Sellers can manage every aspect of their business: GearLaunch removes the common pain points and risks associated with online selling by taking care of the fulfillment, shipping, and customer service for all products sold. More […]

How to use Payoneer

1st Payoneer Forum in Guangzhou, China – Huge Surprises

The breaking news has spread among the cross-border e-seller community: the Payoneer Forum will be hosted in Guangzhou, Xiamen, Shenzhen, and Yiwu, one after another this summer. The theme is ‘Reevaluation of E-commerce’, hosting Amazon, Wish, Lazada, JD and other major marketplaces, as well as top sellers in the industry. Let’s take a look at the […]

How to use Payoneer

The Payoneer Networking Dinner, Islamabad

Payoneer Brand Ambassador, Arif Malik, hosted our first ever Networking Dinner in Islamabad last week. This event was developed in order for Payoneer users to meet fellow colleagues in a relaxed atmosphere. Freelance experts from all over joined together to discuss many things related to freelancing, Payoneer services, and of course the Cricket World Cup! […]

How to use Payoneer

Payoneer Forum Was a Blast in ShenZhen, China!

Last Thursday, the Payoneer Forum arrived in ShenZhen, China. Over 1,200 crossborder sellers from global marketplaces like Amazon, Lazada, Linio, Wish, and JD came together for three inspirational panels and seven lectures all aimed at providing tips for the upcoming holiday season. Payoneer team member were all in attendance, including CEO, Scott Galit and Patrcik de Courcy, Head of Asia-PacificCarol. […]

General Payments, How to use Payoneer

Money Transfer Services: What You Need to Know

Today’s world is more connected than ever, providing employees with new opportunities to work with employers overseas and enter international markets. If you’re looking for work that better suits your skill set and preferences, taking advantage of these opportunities can be exactly what you need to help you in achieving your goals. However, at the […]