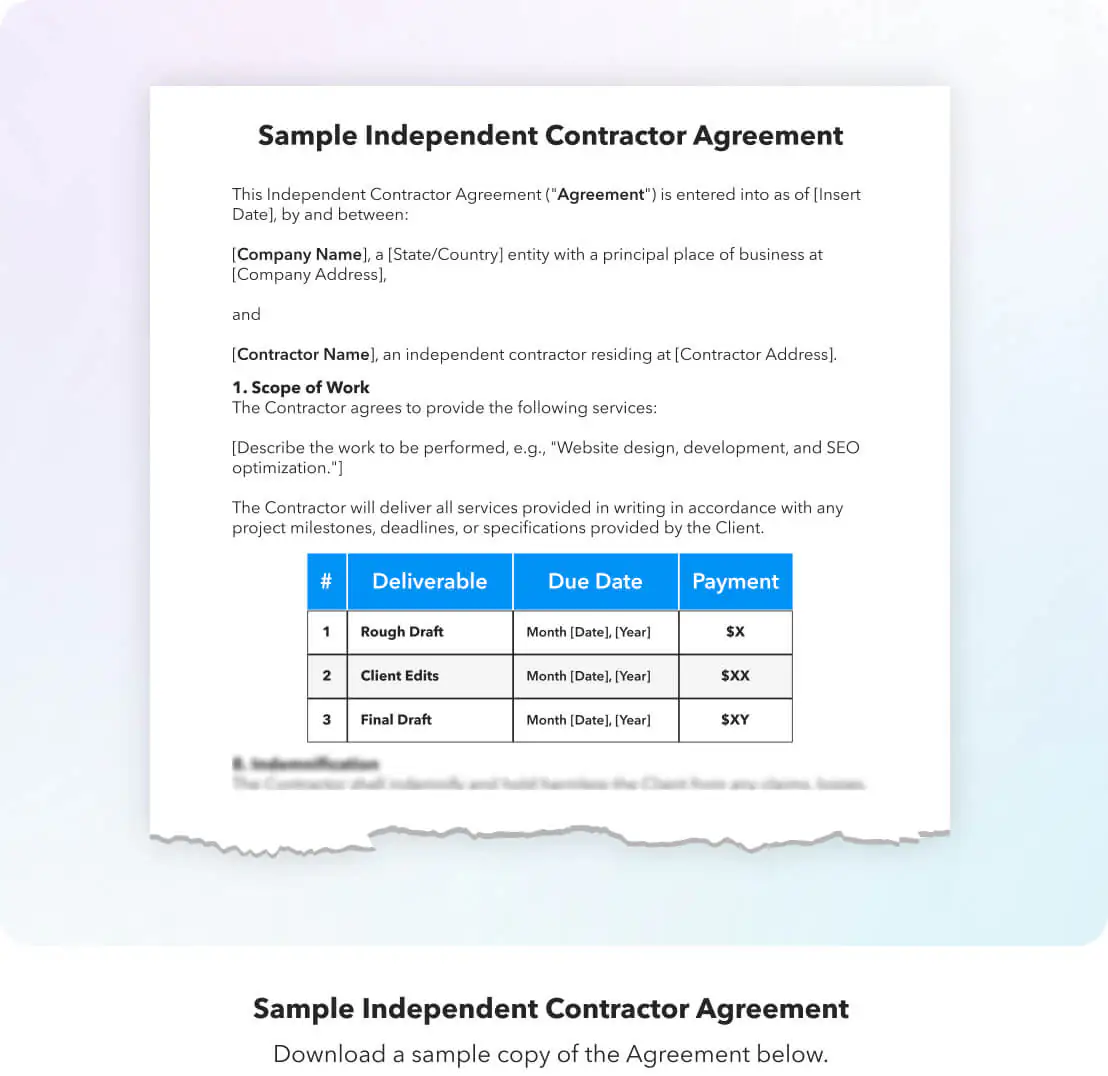

Sample independent contractor agreement PDF

Still not sure what a freelance contract should have? Look no further – we’ve got a sample independent contractor agreement, PDF and notes included, right here.

The specialists at Payoneer Workforce Management have helped various businesses grow their operations by hiring independent contractors. As a result, we have seen a lot of the mistakes business owners make when drafting the independent contractor agreements.

The following article provides a sample independent contractor agreement (PDF download is available at the bottom of the page) as well as advice for how to construct/alter your own.

| Disclaimer: What follows is a general template designed to give business owners a sense of what is typically included in an independent contractor agreement. None of the information that follows qualifies as legal advice. Consult legal counsel before using any sample agreement. |

Download the sample independent contractor agreement.

What do I need to know before using a sample independent contractor agreement?

The following subsections address commonly asked questions about how to send/manage an independent contractor agreement.

Do I need a notary for an independent contractor agreement?

No, but keep a signed copy with both parties in the event of a dispute.

[If international:] What international/local laws affect this contract?

The framework provided above can be used with a few tweaks:

- Section 2 should include information pertaining to currency, payment method, and FX fees, where applicable.

- Section 5 may need to be amended depending on applicable laws to take international copyright laws into account.

- Section 9 should include a governing law clause stating that the laws of the business’s location will govern the agreement, as well as an arbitration clause identifying an international body (e.g., International Chamber of Commerce, American Arbitration Association) to settle disputes.

Also, Contractors located outside the United States may need to complete a W-8BEN form, depending on the applicable tax requirements.

*Always consult legal counsel before applying this template internationally.

Do I need an independent contractor agreement?

Technically, no, but you really should. Without a formal agreement on paper, you run the risk of:

- Project delays due to lack of proof-of-terms

- IRS misclassification

- IP Ownership loss

- More difficult dispute resolutions

Is a Statement-of-Work (SOW) necessary?

No, but most companies prefer to work with one because they lay out the project elements (e.g., deliverables, timeline, payment) in greater detail, which allows for a clearer workflow. SOWs are not, however, a legal requirement.

What legal mistakes should I watch out for?

Entering into a business relationship with a contractor requires careful attention to detail, especially if you aren’t working with an Agent of Record (AOR) or some other contractor management tool. The table below outlines these considerations in regards to the template listed above by section.

Common mistakes with independent contractor agreements

| Section | Subject | Note |

|---|---|---|

| Section 2 | Termination | Failing to clearly outline the terms by which both contractor and company can terminate a contract, as well as observance of local laws regulating the subject. |

| Section 3 | Tax Responsibilities | Failing to identify who is responsible for taking the taxes out of the contractor’s check (this nearly always falls to the contractor), as well as which tax form (W-9/W-8BEN, TIN, 1099) is being used. |

| Section 4 | Classification Status | Treating the contractor as an employee can lead to hefty misclassification fines from both the US and foreign regulating bodies. |

| Section 5 | IP Ownership | Failing to clearly identify who owns the IP and when can lead to messy legal disputes that compromise your work while draining your bank account. |

Is there an easier way to send an independent contractor agreement?

Often, business owners looking to avoid the hassle of sending and managing their own independent contractor agreements choose to outsource this and other related work third-party. These options typically handle the heavy lifting on behalf of the client, allowing them to focus more on the company’s mission.

The most common options include:

| Agent-of-Record (AOR) | Contractor Management Tools | |

|---|---|---|

| Pros | Offers assistance to stay compliant | Centralizes contractor information |

| Seamless Onboarding & IP management | More budget-friendly | |

| Cons | Cost | The company assumes compliance risk |

| Less control over contractor relationships | Limited legal support | |

| Best For | US companies hiring internationally, businesses scaling rapidly without local entities, and businesses needing legal support. | Startups/small businesses wanting more complete in-house control over the contractor management process. |

Sample independent contractor agreement template(PDF Download)

If you’d like to download our sample independent contractor agreement, the PDF is available here.

If you would like more information on how to implement contractor management tools for your business, speak with one of the experts at Payoneer Workforce Management using the link below.

Related resources

Latest articles

-

Looking for an employer of record in Moldova? Here’s what you need to know

Explore how Payoneer Workforce Management helps manage onboarding, payroll, benefits and more in the Republic of Moldova, while simplifying talent engagement in the country.

-

PayPal to Payoneer: All You Need to Know

Learn how to transfer money from PayPal to Payoneer, compare fees, and explore alternatives for users in Pakistan. A complete guide to linking Payoneer and PayPal.

-

How to Use Data Analytics to Improve Payment Processing Efficiency

Learn how to leverage payment data analytics to optimise payment processing efficiency, reduce transaction costs, improve approvals, and gain actionable insights.

-

Payment Confirmation Guide: How to Know Your Money Arrived Safely

Learn how to confirm your payment was received, track its status, and understand typical processing times with Payoneer’s international payment tools.

-

Using an Employer of Record in Taiwan

Learn how an Employer of Record in Taiwan helps you onboard, pay, and manage talent without a local entity. This blog also covers essential information on Taiwanese payroll, labor laws, leave policies, and more.

-

Using an employer of record in Sri Lanka

Explore key Sri Lankan legal regulations and employment nuances that you need to keep track of. Learn how you can utilize an EOR in Sri Lanka to support local team expansion, including onboarding, payroll, benefits, and more.

Disclaimer

The information in this article/on this page is intended for marketing and informational purposes only and does not constitute legal, financial, tax, or professional advice in any context. Payoneer and Payoneer Workforce Management are not liable for the accuracy, completeness or reliability of the information provided herein. Any opinions expressed are those of the individual author and may not reflect the views of Payoneer or Payoneer Workforce Management. All representations and warranties regarding the information presented are disclaimed. The information in this article/on this page reflects the details available at the time of publication. For the most up-to-date information, please consult a Payoneer and/or Payoneer Workforce Management representative or account executive.

Availability of cards and other products is subject to customer’s eligibility. Not all products are available in all jurisdictions in the same manner. Nothing herein should be understood as solicitation outside the jurisdiction where Payoneer Inc. or its affiliates is licensed to engage in payment services, unless permitted by applicable laws. Depending on or your eligibility, you may be offered the Corporate Purchasing Mastercard, issued by First Century Bank, N.A., under a license by Mastercard® and provided to you by Payoneer Inc., or the Payoneer Business Premium Debit Mastercard®, issued and provided from Ireland by Payoneer Europe Limited under a license by Mastercard®.

Skuad Pte Limited (a Payoneer group company) and its affiliates & subsidiaries provide EoR, AoR, and contractor management services.