Contractor Compliance

Featured resources

Hiring 1099 contractors vs employees

Not sure if you want to be hiring 1099 contractors vs employees? Our guide has all the information you need to get started.

Workforce Management

Contractors vs sole proprietor: Understanding the difference

Learn the differences between an independent contractor vs sole proprietor, including their tax responsibilities, business model, and more with our guide.

Workforce Management

A guide on how to convert a 1099 contractor to a W-2 employee

Learn how to convert a 1099 contractor to a W-2 employee, with key steps on reclassification, legal factors, salary, benefits, and taxes.

Workforce Management

A guide to filing 1099 for foreign contractors

A comprehensive guide to filing 1099 for foreign contractors, types of 1099 forms, and other alternative forms for hiring foreign contractors

Workforce Management

The difference between an independent contractor and a subcontractor

Understand the Difference between an independent contractor and a subcontractor with this guide.

Workforce Management

Understanding the importance of compliance in contractor management

Read our step-by-step guide on understanding the importance of compliance in contractor management, legally and efficiently, complete with compliance tips.

Workforce Management

Contractor vs self-employed: How are they different?

Learn more about how to classify independent contractor self employed workers. Know how each role differs in taxes, control, benefits, and much more.

Workforce Management

Health insurance for contractors

Learn more about health insurance for IT contractors, and help your contractors choose the correct insurance plan. Know the plan types and key considerations.

Workforce Management

What international contractors need to know about 1099s

Learn how 1099 reporting for international contractors works, including tax rules, compliance tips, and whether it's required for overseas freelancers.

Workforce Management

Understanding 1099 tax rates

Learn about the tax rate on 1099 income, key factors that impact it, how to calculate it and more.

Workforce Management

Do 1099 employees get benefits: Understand the difference between W2 and 1099 employees

Do 1099 employees get benefits? What is the difference between W-2 and 1099? Explore the blog to learn 1099 employee benefits in detail.

Workforce Management

1099 tax benefits & deductions

Want to get the most out of your 1099 tax benefits & deductions? We want to help. Our article breaks down the most common deductions and how to get them.

Workforce Management

Can a full-time position be 1099: A comprehensive guide

Can A Full-Time Position Be 1099? Explore this guide to know about what are the rules for 1099 employees, including legal guidelines and classification criteria.

Workforce Management

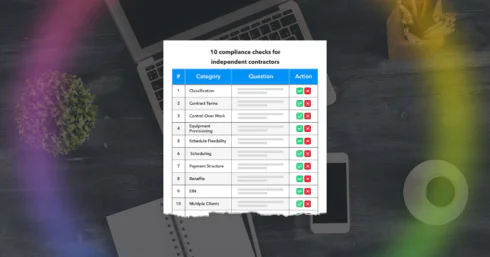

10 compliance checks for independent contractors

Looking for a faster way to determine the proper worker classification? Here’s 10 compliance checks for independent contractors made easy.

Workforce Management

AOR vs EOR: How are they different?

Our latest guide breaks down the key differences so you know exactly when to use each—whether you're scaling with freelancers or full-time talent.

Workforce Management

How to onboard contractors

Knowing how to onboard contractors isn’t just paperwork. It sets the tone for the entire working relationship. Get it right from day one, and the rest falls into place.

Workforce Management

What contractor paperwork do I need?

Contractor paperwork can be incredibly complex, but we’ve got the answers for you here.

Workforce Management

What is a contractor NDA?

You want to ensure that your IP and proprietary software stay safe? You need a contractor NDA that stands up to scrutiny. Learn more about this in the article

Workforce Management

1099 termination letter template

Need to end a contractor relationship the right way? This 1099 termination letter template gives you a clear, compliant starting point, plus helpful guidance.

Workforce Management

Firing a contractor? Take the right steps

Firing a contractor is never an easy decision to make, but it’s important to have the right tools at your side if/when the time comes. This guide tells you everything…

Workforce Management

Legal requirements for hiring independent contractors

Hiring contractors? Know the rules before you onboard. Here's what every business needs to understand about the legal requirements for hiring independent contractors.

Workforce Management

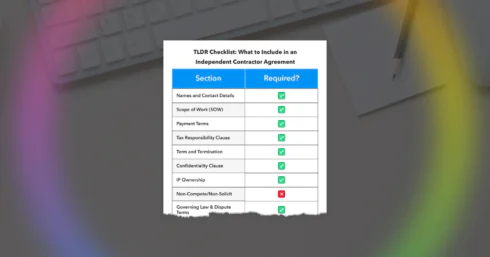

What to include in an independent contractor agreement?

Hiring contractors? Here’s what should be included in an independent contractor agreement—so you can stay compliant, protect your business, and scale with confidence.

Main Featured, Workforce Management

Hiring 1099 contractors vs employees

Not sure if you want to be hiring 1099 contractors vs employees? Our guide has all the information you need to get started.

Workforce Management

What is a 1096 Form

What is IRS Form 1096, and do you need to file it? This quick guide breaks down who it applies to, when it's required, and why it matters for businesses…

Workforce Management

What is Form W-4

What is Form W4? This quick guide explains what it does, when you need it, and how to avoid the most common mistakes.

Workforce Management

What is Form W9?

What is Form W9? It’s the standard form for US-based contractors, but it’s actually a bit more complicated. We’ve got the full breakdown for you here.

Workforce Management

What is a 1099 MISC?

Confused by the 1099 MISC? Aren’t sure if you even need to fill it out? Payoneer workforce management has you covered with advice for freelancers and business owners alike.

Workforce Management

Employee misclassification lawsuits & penalties

Need some help understanding employee misclassification lawsuits and penalties? We’ve got your guide right here.

Workforce Management

How to fill out a 1099 NEC form

This clear, step-by-step guide helps employers handle contractor payments with confidence—perfect for businesses tapping into freelance and global talent.

Workforce Management

What is the W-8BEN-E Form

What is the W-8BEN-E form and do you need it? We’ve got all the answers you’re looking for to expand your international workforce

Workforce Management

IRS 20-point checklist for independent contractors

Need a quick and easy way to navigate your IRS 20-point checklist? Look no further. Payoneer Workforce Management team provides a free online checklist with PDF download.

Workforce Management

Freelancer vs Contractor: does it matter?

Aren’t sure about the difference between “freelancer” vs “contractor.” It’s both simpler and more complex than you think.

Workforce Management

How to send a 1099 to a contractor

Unsure of how to send a 1099 to a contractor? It’s a deceptively complex process, but we break it down for you here.

Workforce Management

Independent contractor vs employee: A simple guide

Struggling to navigate the difference between independent contractors vs employees? Our quick guide breaks it down and offers simple, compliant solutions for global hiring.

Workforce Management

Tax forms every business needs for hiring contractors

Looking at hiring contractors but you aren’t sure what you need? Check out our breakdown of tax forms every business needs for hiring contractors.

Workforce Management

1099 vs W2: Pros and Cons

Deciding between a 1099 vs W2? Pros and cons are just the start. Check out this breakdown of the two to see which one meets your needs.

Workforce Management

How to hire international contractors

Wondering how to hire international contractors? Check out our primer on the ins and outs, including recommendations for getting started

Workforce Management

How to pay independent contractors

Wondering how to pay independent contractors? Our step-by-step guide breaks down what to consider so you can pay them correctly and stay compliant.

Workforce Management

How to hire independent contractors

Unsure of how to hire independent contractors? Our team made this handy guide for business owners looking to expand their teams.

Workforce Management

What is a 1099 employee? A complete guide

What is a 1099 employee? Our quick guide gives you the clarity you need to hire internationally and tap into global talent with confidence.

Explore more

Disclaimer

The information in this article/on this page is intended for marketing and informational purposes only and does not constitute legal, financial, tax, or professional advice in any context. Payoneer and Payoneer Workforce Management are not liable for the accuracy, completeness or reliability of the information provided herein. Any opinions expressed are those of the individual author and may not reflect the views of Payoneer or Payoneer Workforce Management. All representations and warranties regarding the information presented are disclaimed. The information in this article/on this page reflects the details available at the time of publication. For the most up-to-date information, please consult a Payoneer and/or Payoneer Workforce Management representative or account executive.

Availability of cards and other products is subject to customer’s eligibility. Not all products are available in all jurisdictions in the same manner. Nothing herein should be understood as solicitation outside the jurisdiction where Payoneer Inc. or its affiliates is licensed to engage in payment services, unless permitted by applicable laws. Depending on or your eligibility, you may be offered the Corporate Purchasing Mastercard, issued by First Century Bank, N.A., under a license by Mastercard® and provided to you by Payoneer Inc., or the Payoneer Business Premium Debit Mastercard®, issued and provided from Ireland by Payoneer Europe Limited under a license by Mastercard®.

Skuad Pte Limited (a Payoneer group company) and its affiliates & subsidiaries provide EoR, AoR, and contractor management services.