Securing Your Payoneer Account

More topics At Payoneer, we know that we’re in the trust business, and that a large part of that trust is in knowing that your funds are safe when you work with us. Choosing a payment service is a critical decision, and while low fees, flexible payment options and other value-added services are great, these…

At Payoneer, we know that we’re in the trust business, and that a large part of that trust is in knowing that your funds are safe when you work with us.

Choosing a payment service is a critical decision, and while low fees, flexible payment options and other value-added services are great, these solutions must also be paired with a company that’s built on a rock-solid security infrastructure. With millions of customers worldwide turning to Payoneer to manage their cross-border payments and help grow their businesses, our number one priority is ensuring your account’s security.

Payoneer’s technology, operations and experience have proven invaluable in preventing all kinds of cyberattacks targeting our users. This has been clearly shown in our multilayered approach to account takeover (ATO) mitigation, one of the cornerstones of our cybersecurity strategy.

To give you a better idea of why so many users trust Payoneer, here we’ll be demonstrating how our combination of security tools and risk management capabilities protect you from account takeover attacks.

But first, let’s go over what an ATO is and its potential consequences.

What is an Account Takeover?

ATO involves an attacker stealing a user’s login credentials to break into their account, where they can access private information. There are several common methods that are used to get into an account, including:

- Credential stuffing – Credential stuffing involves an attacker accessing an account using stolen login details from a previous data breach.

- Social engineering – Social engineering involves a hacker posing as a site administrator or another trusted figure and convincing a user to provide their login details. Phishing emails and text messages are two of the most popular to execute a social engineering attack.

- Brute force attacks – Brute forcing is an attack in which attackers use a bot to enter a mass number of username/password combinations in a platform until an account is successfully breached.

For users, there are a few easy steps that you can take to prevent account takeovers. For starters, make sure you use a unique password whenever subscribing to a new online service. Doing so means that even if one of your accounts is compromised, an attacker won’t be able to use credential stuffing to break into your other platforms. Additionally, it’s important to keep an eye out for emails and messages that could be part of a social engineering attack and to never provide your password to anyone. Note that Payoneer will NEVER ask for your username or password over email, phone or chat.

Below are some of the steps that Payoneer takes to both mitigate and detect ATOs.

Payoneer’s Multilayered Approach to ATO Prevention and Detection

To prevent account takeovers, we employ a number of proactive methods that keep bots and hackers from reaching a user’s account. These include:

- 2-step verification (2SV) – Payoneer uses 2-step verification to help ensure that no malicious actors are able to break into your account. 2-step verification adds an extra step to certain account-related activities by sending a code to your mobile device or via phone call, which you’ll need to enter in before you can continue navigating through your account.*

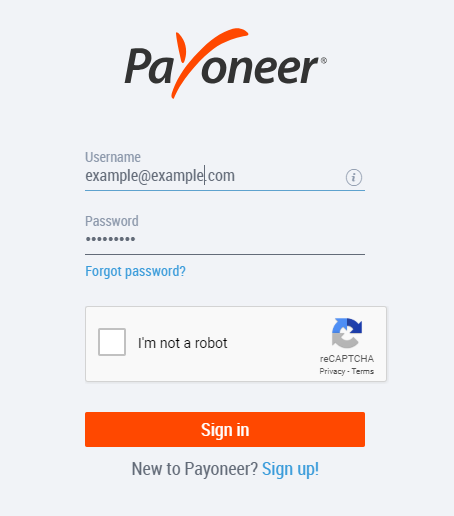

- CAPTCHA requests – We use CAPTCHA challenges in several places on our system, including our login page. This prevents bots from brute forcing a user account.

- Web Application Firewalls (WAFs) – Payoneer uses both cloud-based and in-house WAFs to detect bots and prevent them from reaching our site.

- Bot-locating software – Payoneer uses software that tracks bot activity on our website according to such factors as typing speeds and mouse movements. In addition, we’re able to obfuscate password fields in web browsers to prevent bots from recording user passwords.

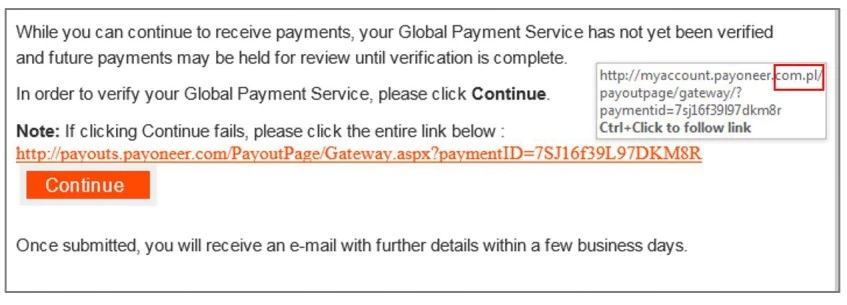

- Duplicate-site tracking – One of the methods attackers use to execute an ATO involves duplicating a site on a different domain name. A social engineering attack is then used to fool users into visiting the fraudulent site and entering their login details. We use advanced software to track duplicate sites, and after verifying that they are indeed fraudulent, take them down.

- Proactive user-account searches – Payoneer uses multiple cyber-intelligence services to proactively search both the clear and dark web for compromised customer account details. If a user’s login information is found, they are immediately notified and their password is changed.

While the above steps can effectively block many ATO attempts, we know that they are not always enough. Hackers are constantly developing new tools and methods to break into user accounts, meaning it’s not enough to just prevent attacks. On top of the prevention systems outlined above, we have implemented other sophisticated tools and capabilities to detect attacks:

1.The Gatekeeper: Adaptive Authentication

Adaptive authentication is an intuitive user verification system that evaluates risk factors, e.g., country, IP address and transaction size to flag any account abnormalities. After detecting activity that might signal an ATO, the system issues additional identification steps, such as 2SV and security questions, to ensure account security.

Our threat detection system uses the latest statistical machine learning technology. This allows us to adapt and record new threats in real-time, always staying a few steps ahead of the hackers and ensuring complete data protection for our users.

2. The Selector: Rule-Based Monitoring

Our rule-based monitoring engine is a backend tool that uses predefined rules to identify suspicious behavior in a user’s account. Once a rule is triggered, our forensic analysts can investigate the situation to determine if an account has been taken over.

For example, an abnormally large account transfer, especially to a new Payoneer account, is likely to trigger our rule engine and lead to an investigation. If an ATO is then identified, account activity is suspended immediately and the account owner is notified.

3. The Protector: Risk Models and Behavior Profiling

We use complex risk model and behavior profiling programs to analyze suspicious user transactions. The information we get from these analyses is then used to predict malicious future behavior that might signal an account takeover.

For example, our risk models consider data related to suspicious behavior, such as an unusual number of cross-border payments to a specific country or high transaction volumes from a new device, and uses it to flag accounts displaying the same behavior.

4. The Failsafe: Customer Feedback

We know that no matter how advanced the technology we use, there is still no substitute for human intuition. That’s why we keep a constant open line of communication with our users—doing so allows us to rapidly detect suspicious account activity, which we can then flag and apply to the steps outlined above.

ATO is an inherent threat that requires proactive and innovative mitigation steps on the parts of both users and service providers. While we’re unable to disclose all of our security measures here, we can say that our mitigation methods actively block malicious actors and bots from accessing sensitive data, while ensuring that we’re able to immediately address any suspicious activity to secure your account.

It is for this reason, and many more, that some of the world’s leading digital brands, including Amazon, Airbnb and Google, together with millions of SMBs worldwide have put their trust in Payoneer, knowing that account security is always at the front of our mind. If you have any further questions about account security, please contact your customer success manager or our customer care team and we’ll be happy to help.

* Currently, 2-step verification is available in Europe and certain other countries, and is expected to be fully rolled out in the coming months.

Editor’s Note: The original post was updated on 13.02.2020 for accuracy and comprehensiveness.

Related resources

Latest articles

-

Using an Employer of Record in Morocco

Looking for an Employer of Record in Morocco? See how Payoneer Workforce Management’s EOR services help simplify engaging talent in Morocco.

-

Using an Employer of Record in Jordan

Need an Employer of Record in Jordan? Here’s what you need to know about using an EOR in Jordan and how Payoneer Workforce Management can help you engage talent in Jordan.

-

Multi-currency Account: How It Helps Businesses Work With Customers Around the World

Optimize international payments for your IT, eCommerce, or SaaS business with a multicurrency account and easily receive funds from clients from abroad.

-

How to Open an Electronic Wallet: A Guide for Entrepreneurs and Businesses

How quickly and easily can you create an invoice with Payoneer? Learn how it helps businesses accept international payments, track them, and save time.

-

Wire Transfer in Ukraine: What Businesses Need to Know

Wire transfer in Ukraine for business, complete guide: how to make a transfer and receive an international Wire transfer on the account, terms and fees, tips, and examples.

-

Swift, ACH, or Wire: Which International Payment Method Should Businesses Choose?

SWIFT, ACH, or Wire for Ukrainian business: how they work, how they differ, which is cheaper and faster.

Disclaimer

The information in this article/on this page is intended for marketing and informational purposes only and does not constitute legal, financial, tax, or professional advice in any context. Payoneer and Payoneer Workforce Management are not liable for the accuracy, completeness or reliability of the information provided herein. Any opinions expressed are those of the individual author and may not reflect the views of Payoneer or Payoneer Workforce Management. All representations and warranties regarding the information presented are disclaimed. The information in this article/on this page reflects the details available at the time of publication. For the most up-to-date information, please consult a Payoneer and/or Payoneer Workforce Management representative or account executive.

Availability of cards and other products is subject to customer’s eligibility. Not all products are available in all jurisdictions in the same manner. Nothing herein should be understood as solicitation outside the jurisdiction where Payoneer Inc. or its affiliates is licensed to engage in payment services, unless permitted by applicable laws. Depending on or your eligibility, you may be offered the Corporate Purchasing Mastercard, issued by First Century Bank, N.A., under a license by Mastercard® and provided to you by Payoneer Inc., or the Payoneer Business Premium Debit Mastercard®, issued and provided from Ireland by Payoneer Europe Limited under a license by Mastercard®.

Skuad Pte Limited (a Payoneer group company) and its affiliates & subsidiaries provide EoR, AoR, and contractor management services.