How to pay VAT from your Payoneer balance with no transfer fees!

Editor’s note: The original post was updated on 29.09.21 for accuracy and comprehensiveness. If you’re a cross-border seller selling to customers in the EU and UK, you’ve likely heard about the recent VAT crack-down on foreign Amazon sellers. Sellers reaching a certain threshold in sales to these markets may owe value added tax (VAT) to the…

Editor’s note: The original post was updated on 29.09.21 for accuracy and comprehensiveness.

If you’re a cross-border seller selling to customers in the EU and UK, you’ve likely heard about the recent VAT crack-down on foreign Amazon sellers. Sellers reaching a certain threshold in sales to these markets may owe value added tax (VAT) to the local European governments.

Payoneer has now made it easier than ever for sellers to settle their VAT obligations to the European authorities. Starting December 2017, Payoneer customers can pay their VAT directly from within their account page, with no transfer fees!

Here’s a step-by-step guide to making VAT payments from your Payoneer account.

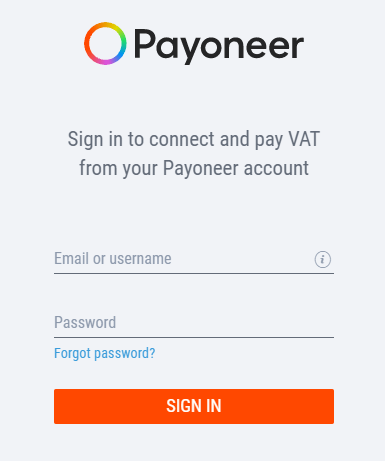

You can pay your VAT directly by clicking here, or by logging into your Payoneer account. Below are instructions for paying through your account:

- Sign in to your Payoneer account. Under the Pay tab, select Pay Your VAT.

- Under the Pay tab, select Pay Your VAT.

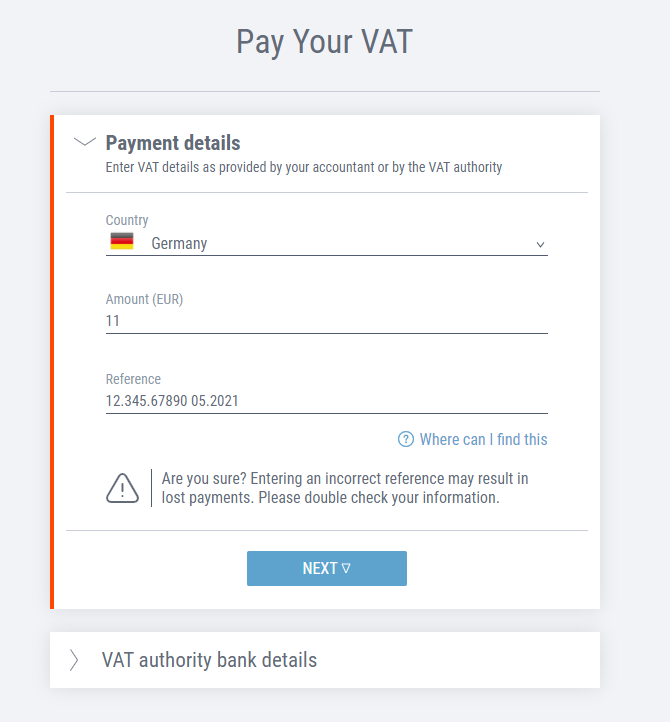

- You will be redirected to the VAT payment platform. Select the country of the VAT authority you would like to pay to.

Don’t see the country you’re looking for? Click on Other countries and search for the country you need. We may not yet support VAT payments for the country you’re looking to pay to.

4. Once you have selected a country, you will be prompted to connect your Payoneer account in order to continue the process. Enter your Payoneer account username and password to proceed.

5. Enter the Amount you would like to pay in VAT. Your available Payoneer currency balance will be displayed below.

- Enter your VAT registration number. If you aren’t sure where to find this, click on Where can I find this?

* If paying to the UK, Payoneer will automatically provide the VAT authority bank account details for you. This account may be different than the account number you’re familiar with, as it is the HMRC collections account for domestic wire transfers and not international ones (read more here).

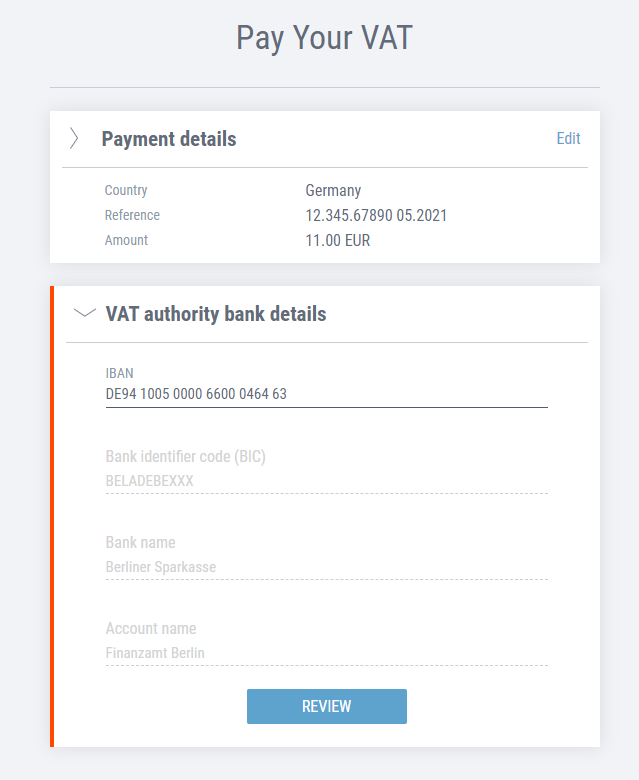

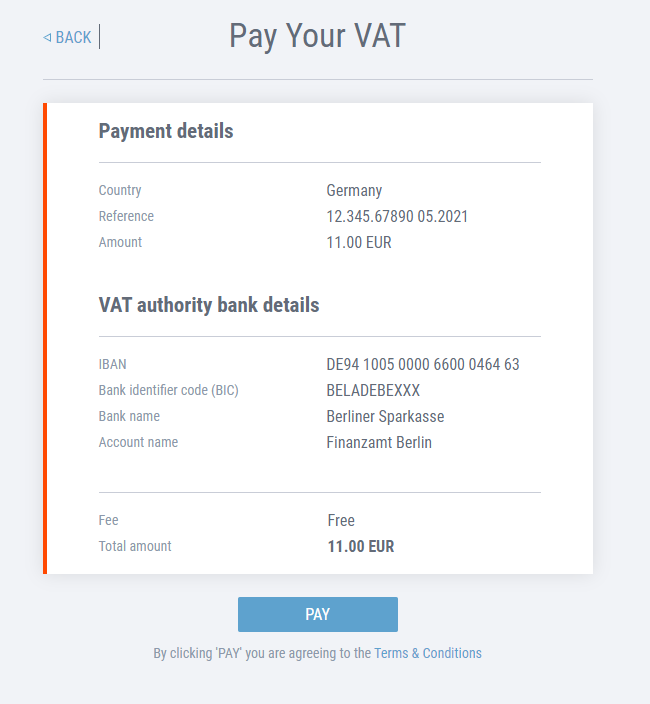

** If paying to a different country (not the UK), you will need to provide the Account Number (IBAN) for the government collections account in this country. Once you fill out the IBAN, the Bank Identifier Code (BIC) and Account Name will load automatically.

Here is an example of a payment made to the German VAT authorities:

Once the IBAN is entered, the remaining details will be automatically populated.

7. Once done, click on Review.

8. Review the VAT payment details before submitting for payment.

9. Once you’ve reviewed the details, if all looks good, click Pay.

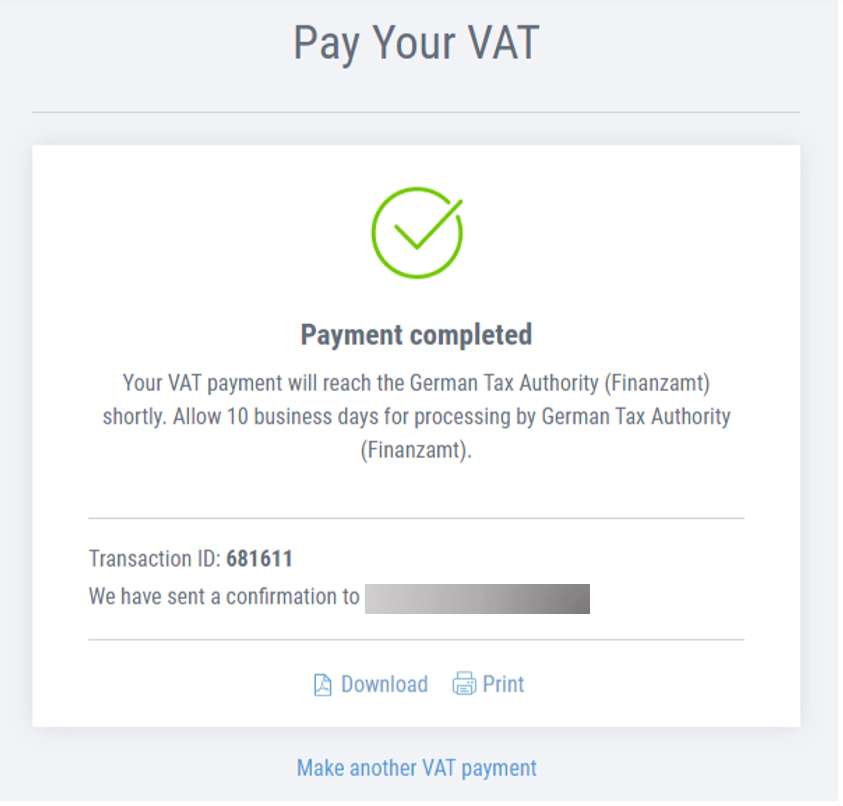

10. That’s it! You will see this authorization screen. Download or Print a summary and confirmation of your VAT payment for your records.

Do you have questions?

Head over to our VAT FAQ and you may find the answer there, or get in touch with Customer Care.

[cta-button text=”Click here to pay your VAT!” url=”https://vat.payoneer.com/?utm_source=blog&utm_medium=referral” color=”#FF4800″ type=”content-download”]

Related resources

Latest articles

-

Employment laws in Sweden

Explore the employment laws in Sweden, a comprehensive guide to employees’ rights, employer obligations, and fair labor practices.

-

Employment laws in Poland

Explore the ins and outs of employment laws in Poland, an info-rich guide to employees’ rights, employer obligations, and fair labor practices that shape the future.

-

Employment laws in Indonesia

Find out more about Indonesia labor laws that dictate how employees should be contracted, managed, and paid, both on a national and state/territory level.

-

Employment laws in France

Learn about France’s labor laws dictating minimum wage, benefits, and more. Plus, discover the consequences of non-compliance with employment laws in France.

-

Employment laws in Spain

Find out more about Spain’s labor laws, from contracts and benefits to termination rules.

-

Employment laws in Australia

Find out more about the employment laws in Australia that dictate how employees should be contracted, managed, and paid, both on a national and state/territory level.

Disclaimer

The information in this article/on this page is intended for marketing and informational purposes only and does not constitute legal, financial, tax, or professional advice in any context. Payoneer and Payoneer Workforce Management are not liable for the accuracy, completeness or reliability of the information provided herein. Any opinions expressed are those of the individual author and may not reflect the views of Payoneer or Payoneer Workforce Management. All representations and warranties regarding the information presented are disclaimed. The information in this article/on this page reflects the details available at the time of publication. For the most up-to-date information, please consult a Payoneer and/or Payoneer Workforce Management representative or account executive.

Availability of cards and other products is subject to customer’s eligibility. Not all products are available in all jurisdictions in the same manner. Nothing herein should be understood as solicitation outside the jurisdiction where Payoneer Inc. or its affiliates is licensed to engage in payment services, unless permitted by applicable laws. Depending on or your eligibility, you may be offered the Corporate Purchasing Mastercard, issued by First Century Bank, N.A., under a license by Mastercard® and provided to you by Payoneer Inc., or the Payoneer Business Premium Debit Mastercard®, issued and provided from Ireland by Payoneer Europe Limited under a license by Mastercard®.

Skuad Pte Limited (a Payoneer group company) and its affiliates & subsidiaries provide EoR, AoR, and contractor management services.