How to withdraw funds from Payoneer to your bank account

More topics Payoneer offers several easy, quick, and low-cost ways to receive funds from global clients, and once you’ve done so, there are many ways you can use your earnings. Once of the most useful ways, though, is to withdraw your earnings, at any time, to your local bank account. After all, Payoneer connects with…

Payoneer offers several easy, quick, and low-cost ways to receive funds from global clients, and once you’ve done so, there are many ways you can use your earnings. Once of the most useful ways, though, is to withdraw your earnings, at any time, to your local bank account. After all, Payoneer connects with local banks in over 150 countries and territories!

So, if you already have funds in your account and want to know how to withdraw them to your local bank without any headaches, high fees and poor conversion rates, follow the simple instructions below:

How to withdraw money to your bank account

1. Sign in to Payoneer.

2. From the menu, go to Withdraw >> To Bank Account.

If you have not yet added a bank account to withdraw your funds to, you will see a page with guidelines on how to add a bank to your Payoneer account.

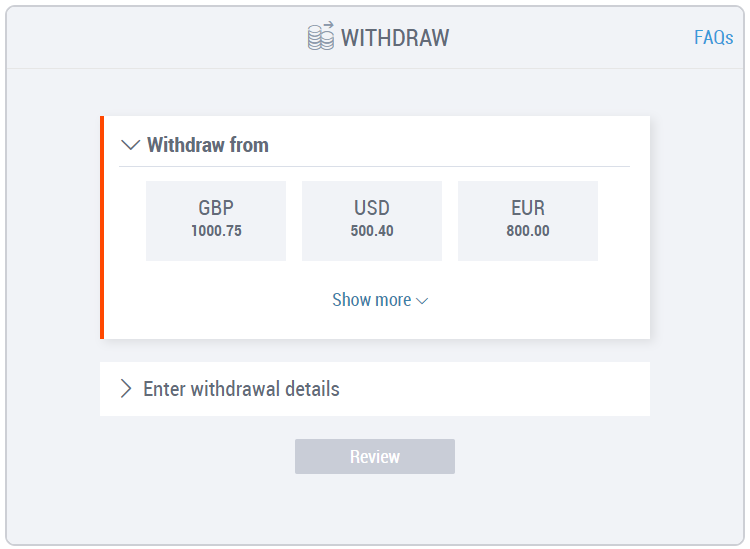

3. Select the currency balance or card you want to withdraw funds from.

4. Enter the withdrawal details, as displayed in the example below:

A. Select the bank account you want to withdraw funds to.

If you need to add a new bank account, click here or follow the instructions on the Bank Accounts tutorial.

B. Enter the amount you want to withdraw. Note your available balance, displayed at the top of the page.

C. If you like, enter a description of the withdrawal for your records. This is not a mandatory field.5. Click . The withdrawal summary will then be displayed.

6. Review the details of your withdrawal and make sure everything is correct. If you need to change anything, click Edit and make the necessary changes.

7. After you’ve check that everything is correct, mark the checkbox ‘I approve this transaction’ and click .

8. That’s it! You will receive an email confirmation after completing the withdrawal and your funds will be available in your account within 3-5 business days.

To check if the service is supported for your country, please click here. Please note that this service is subject to availability.

For more information, please read the FAQ in our Support Center.

Related resources

Latest articles

-

Using an Employer of Record in Morocco

Looking for an Employer of Record in Morocco? See how Payoneer Workforce Management’s EOR services help simplify engaging talent in Morocco.

-

Using an Employer of Record in Jordan

Need an Employer of Record in Jordan? Here’s what you need to know about using an EOR in Jordan and how Payoneer Workforce Management can help you engage talent in Jordan.

-

Multi-currency Account: How It Helps Businesses Work With Customers Around the World

Optimize international payments for your IT, eCommerce, or SaaS business with a multicurrency account and easily receive funds from clients from abroad.

-

How to Open an Electronic Wallet: A Guide for Entrepreneurs and Businesses

How quickly and easily can you create an invoice with Payoneer? Learn how it helps businesses accept international payments, track them, and save time.

-

Wire Transfer in Ukraine: What Businesses Need to Know

Wire transfer in Ukraine for business, complete guide: how to make a transfer and receive an international Wire transfer on the account, terms and fees, tips, and examples.

-

Swift, ACH, or Wire: Which International Payment Method Should Businesses Choose?

SWIFT, ACH, or Wire for Ukrainian business: how they work, how they differ, which is cheaper and faster.

Disclaimer

The information in this article/on this page is intended for marketing and informational purposes only and does not constitute legal, financial, tax, or professional advice in any context. Payoneer and Payoneer Workforce Management are not liable for the accuracy, completeness or reliability of the information provided herein. Any opinions expressed are those of the individual author and may not reflect the views of Payoneer or Payoneer Workforce Management. All representations and warranties regarding the information presented are disclaimed. The information in this article/on this page reflects the details available at the time of publication. For the most up-to-date information, please consult a Payoneer and/or Payoneer Workforce Management representative or account executive.

Availability of cards and other products is subject to customer’s eligibility. Not all products are available in all jurisdictions in the same manner. Nothing herein should be understood as solicitation outside the jurisdiction where Payoneer Inc. or its affiliates is licensed to engage in payment services, unless permitted by applicable laws. Depending on or your eligibility, you may be offered the Corporate Purchasing Mastercard, issued by First Century Bank, N.A., under a license by Mastercard® and provided to you by Payoneer Inc., or the Payoneer Business Premium Debit Mastercard®, issued and provided from Ireland by Payoneer Europe Limited under a license by Mastercard®.

Skuad Pte Limited (a Payoneer group company) and its affiliates & subsidiaries provide EoR, AoR, and contractor management services.