What to include in an independent contractor agreement?

Hiring contractors? Here’s what should be included in an independent contractor agreement—so you can stay compliant, protect your business, and scale with confidence.

When working with independent contractors, especially across borders, a well-drafted contractor agreement isn’t just good practice; it’s essential for legal protection and long-term success.

So, what should be included in an independent contractor agreement? At a minimum, a strong agreement should:

- Clearly define the relationship between your business and the contractor

- Set expectations around deliverables, timelines, payment cycle, and communication

- Outline each party’s responsibilities and obligations

- Support compliance with relevant labor laws and tax regulations

To help growing businesses stay compliant and mitigate misclassification risks, we’ve broken down what should be included in an independent contractor agreement and why each section plays a critical role.

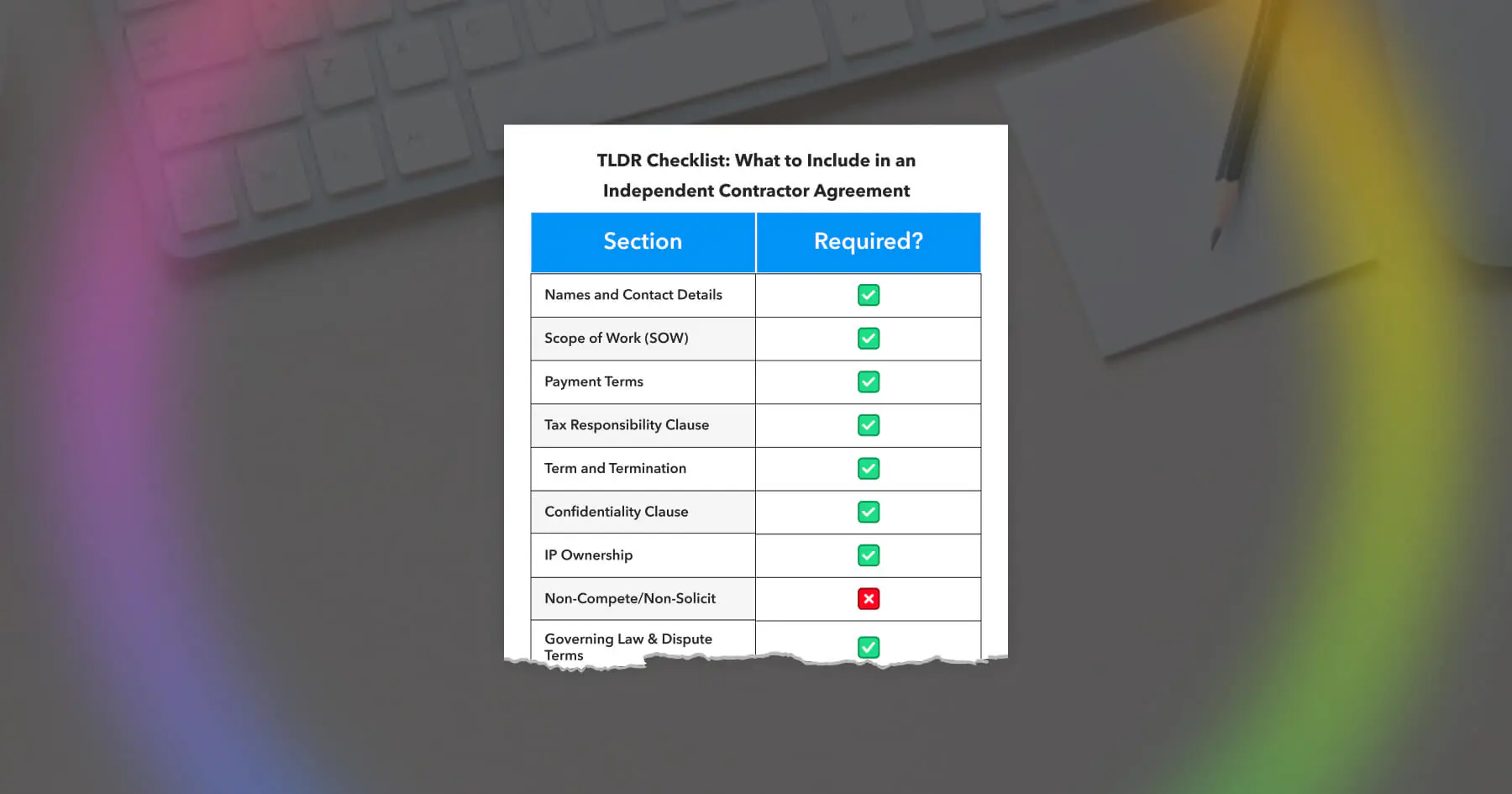

TLDR Checklist: What to include in an independent contractor agreement

Before breaking down each section in detail, here’s a quick, broad, and easy-to-understand checklist that lists what to include in an independent contractor agreement.

| Section | Required? | Why It Matters |

|---|---|---|

| Names and Contact Details | ✅ | Identifies legal parties involved |

| Scope of Work (SOW) | ✅ | Aligns expectations and deliverables |

| Payment Terms | ✅ | Avoids confusion around compensation and timing |

| Tax Responsibility Clause | ✅ | Protects from worker misclassification |

| Term and Termination | ✅ | Sets clear start, end, and exit conditions |

| Confidentiality Clause | ✅ | Protects business data and IP |

| IP Ownership | ✅ | To clearly define ownership of IP |

| Non-Compete/Non-Solicit | ❌ | Optional, use only where enforceable |

| Governing Law & Dispute Terms | ✅ | Prepares both parties for conflict resolution |

| Data Protection Clause | ✅ | To stay compliant with global data laws |

| Signatures | ✅ | To make the agreement binding |

1) Clear identification of the parties

Every independent contractor agreement should begin by clearly stating:

- The hiring entity’s legal name and address

- The contractor’s full legal name and address

- Effective date of agreement

This helps ensure that there’s no ambiguity around who is agreeing to what.

2) Scope of work

The scope of work defines exactly what the contractor is being hired to do, including:

- A detailed description of services

- Key deliverables and milestones

- Deadlines or project timelines

- Tools or platforms used, if relevant

- Payment Terms

A vague scope invites disputes, while precise expectations prevent misalignment and make it easier to track performance.

3) Independent contractor status & tax responsibility

Needs to be explicit about:

- Compensation amount or rate (e.g., hourly, milestone-based, flat fee)

- Payment schedule (e.g., upon milestone completion)

- Currency and method of payment

- Any reimbursement or expenses covered

When hiring internationally, it’s critical to consider tax withholding obligations, foreign exchange fees, and local regulations.

4) Term and termination

This section should define:

- Contract start and end dates (if applicable)

- Whether or not the contract auto-renews

- Conditions for termination (e.g., notice period, breach of contract).

5) Confidentiality and non-disclosure

This section outlines information that protects sensitive business information, such as:

- What constitutes confidential information

- How must that information be handled

- Duration of confidentiality obligations (often beyond the contract’s end)

This step is critical if the contractor handles proprietary data or works alongside internal teams.

6) Intellectual Property (IP) rights

This portion spells out who owns what, such as:

- Who owns the work product (software, content, designs)

- Whether IP is assigned to the company or licensed on their behalf

- Any potential exceptions, such as pre-existing contractor tools or libraries

It’s worth noting that in most jurisdictions, work done by a contractor is not automatically owned by the client unless explicitly stated.

7) Non-compete and non-solicitation (Optional but important)

Depending on your business needs and local laws, you may include:

- A non-compete clause to prevent the contractor from working with your direct competitors.

- A non-solicitation clause to prevent them from poaching other clients or employees.

Enforceability varies drastically by country. Avoid blanket restrictions in regions where they are likely to fail in court.

8) Governance law and dispute resolution

This section establishes:

- Which country/state’s laws govern the contract

- How disputes will be resolved, such as arbitration, mediation, courts, etc.

- Jurisdiction and venue for any legal proceedings.

This clause helps prevent confusion when conflicts arise.

9) Data protection and compliance (Especially for global teams)

If contractors have access to any customer data, this section is crucial. It includes:

- Any commitments to comply with applicable data protection laws.

- Obligations for handling, storing, and transferring data.

- Security measures and breach notification responsibilities.

10) Signature and execution

Every independent contractor agreement should end with:

- Space for both parties to sign and date

- Optional: digital signature verification, depending on local requirements

Build it right from the start with Payoneer Workforce Management

If your company plans to scale, whether you’re adding five contractors or fifty, a standardized, legally sound contractor agreement is a must. It protects everyone involved, promotes timely deliverables, clarifies accountability, and ensures you’re backed by audit-ready compliance documentation.

Knowing what should be included in an independent contractor agreement is essential to getting it right from the start. That’s why Payoneer Workforce Management goes far beyond just basic contract templates. We provide support to streamline every step of the contractor management process, from onboarding to payment.

Here’s what you get:

- Comprehensive onboarding workflows

- Contractor classification support

- Payments in 70+ currencies

- Support across 160+ countries

With Payoneer Workforce Management, you can confidently scale your international workforce with our guidance on what should be included in an independent contractor agreement, while reducing complexities.

If you’re ready to take charge of your workforce, reach out today for a free demo.

Related resources

Latest articles

-

Looking for an employer of record in Moldova? Here’s what you need to know

Explore how Payoneer Workforce Management helps manage onboarding, payroll, benefits and more in the Republic of Moldova, while simplifying talent engagement in the country.

-

PayPal to Payoneer: All You Need to Know

Learn how to transfer money from PayPal to Payoneer, compare fees, and explore alternatives for users in Pakistan. A complete guide to linking Payoneer and PayPal.

-

How to Use Data Analytics to Improve Payment Processing Efficiency

Learn how to leverage payment data analytics to optimise payment processing efficiency, reduce transaction costs, improve approvals, and gain actionable insights.

-

Payment Confirmation Guide: How to Know Your Money Arrived Safely

Learn how to confirm your payment was received, track its status, and understand typical processing times with Payoneer’s international payment tools.

-

Using an Employer of Record in Taiwan

Learn how an Employer of Record in Taiwan helps you onboard, pay, and manage talent without a local entity. This blog also covers essential information on Taiwanese payroll, labor laws, leave policies, and more.

-

Using an employer of record in Sri Lanka

Explore key Sri Lankan legal regulations and employment nuances that you need to keep track of. Learn how you can utilize an EOR in Sri Lanka to support local team expansion, including onboarding, payroll, benefits, and more.

Disclaimer

The information in this article/on this page is intended for marketing and informational purposes only and does not constitute legal, financial, tax, or professional advice in any context. Payoneer and Payoneer Workforce Management are not liable for the accuracy, completeness or reliability of the information provided herein. Any opinions expressed are those of the individual author and may not reflect the views of Payoneer or Payoneer Workforce Management. All representations and warranties regarding the information presented are disclaimed. The information in this article/on this page reflects the details available at the time of publication. For the most up-to-date information, please consult a Payoneer and/or Payoneer Workforce Management representative or account executive.

Availability of cards and other products is subject to customer’s eligibility. Not all products are available in all jurisdictions in the same manner. Nothing herein should be understood as solicitation outside the jurisdiction where Payoneer Inc. or its affiliates is licensed to engage in payment services, unless permitted by applicable laws. Depending on or your eligibility, you may be offered the Corporate Purchasing Mastercard, issued by First Century Bank, N.A., under a license by Mastercard® and provided to you by Payoneer Inc., or the Payoneer Business Premium Debit Mastercard®, issued and provided from Ireland by Payoneer Europe Limited under a license by Mastercard®.

Skuad Pte Limited (a Payoneer group company) and its affiliates & subsidiaries provide EoR, AoR, and contractor management services.