What is a 1099 employee? A complete guide

What is a 1099 employee? Our quick guide gives you the clarity you need to hire internationally and tap into global talent with confidence.

Over the last few years, business owners in the U.S. have increasingly turned to overseas hiring following the proliferation of remote work to access a broader talent pool while maintaining cost efficiency through flexible, contract-based work arrangements.

This makes correct employment classification more important than ever.

As a result, there’s often confusion around employment classification, especially when it comes to 1099 employees, who are sometimes mistakenly lumped in with all remote workers.

If you’re asking, “What is a 1099 employee?”—you’re not alone. It’s a common question and one that comes up frequently as businesses scale and tap into global talent.

First off, 1099 employees aren’t technically employees at all–this term is used informally to refer to independent contractors who are paid for their services without being on the company’s payroll.

What is a 1099 employee?

| ✅ Self-employed (whether they be a freelancer, contractor, consultant, etc.) ✅ In control of how, when, and where they work ✅ Responsible for their own taxes (there are no withholdings such as Social Security or Medicare from the payer) ✅ Not entitled to employee benefits such as health insurance, paid time off (PTO), or unemployment benefits. |

At Payoneer Workforce Management, we understand the importance of building your team with the right people from the start. That’s why we’ve created this comprehensive guide for 1099 employees—to help you navigate the classification process with clarity and confidence.

What is a 1099 employee? (Cont.)

The “1099” in the term 1099 employee comes from the IRS Form 1099, a series of tax documents used to report various types of non-employee income. Independent contractors—often referred to as 1099 employees—don’t have taxes withheld by an employer. Instead, they use these forms to report the income they’ve earned throughout the year when filing their taxes.

The counterpart to a 1099 employee is a W-2 employee, named after IRS Form W-2, which employers issue to report wages, salaries, and tax withholdings for traditional employees. In contrast to 1099 contractors, W-2 employees have their income tax, Social Security, and Medicare contributions automatically deducted from their paychecks by their employer.

The other aspect that makes it difficult to answer the question “What is a 1099 employee” is that there are several types of 1099 forms that may be used to report different kinds of income, including:

Common types of IRS 1099 forms and what they report

| 1099-NEC | Used to report payments to independent contractors (the primary form for 1099 workers) |

| 1099-MISC | Reports miscellaneous income (e.g., rent, prizes, royalties) |

| 1099-K | Reports payments received via third-party platforms (e.g., PayPal, Stripe) |

| 1099-INT | Reports interest income (from banks, etc.) |

| 1099-DIV | Reports dividends and distributions |

| 1099-B | Reports income from broker or barter exchanges (stocks, trades) |

| 1099-R | Reports retirement account distributions |

| 1099-G | Reports government payments (e.g., unemployment compensation) |

| 1099-C | Reports canceled debts |

| 1099-Q | Reports distributions from education savings accounts |

| 1099-S | Reports proceeds from real estate transactions |

1099 Employees vs W-2 Employees

Can I hire 1099 employees overseas?

No, anyone hired remotely to work for you overseas, even if they are independent contractors or freelancers, will not receive a Form 1099. This is because IRS Form 1099 is specifically designed for U.S. freelancers or contractors. Instead, they will receive a Form W-8BEN to confirm their foreign tax status.

The IRS takes this route for reporting overseas workers because no U.S. taxes are withheld from overseas pay. Instead, they will be beholden to their own country’s tax laws and regulations. However, companies hiring overseas also need to be aware of these unique tax laws in addition to their own.

How do I pay my overseas workers?

If you’re one of the many businesses looking to tap into the growing labor markets across borders, you’ll need to be aware of the challenges associated with sending international payments, such as:

- Currency exchange rates

- Banking fees

- Potential delays

- Cultural differences

- Local and provincial labor and tax laws

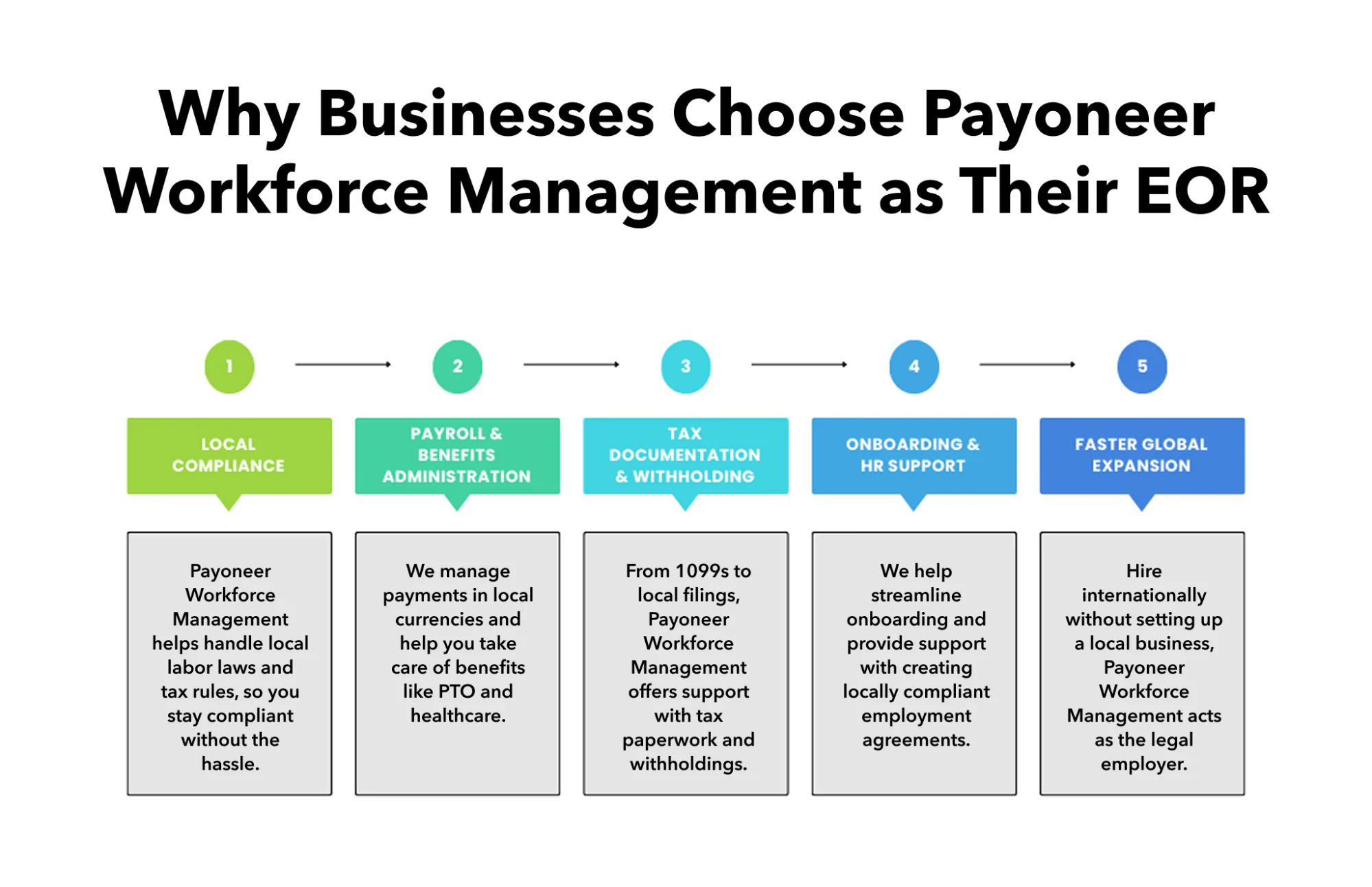

| The smart way to hire overseas workers for many businesses is by partnering with an Employer of Record (EOR) like Payoneer Workforce Management. Why? Because Payoneer Workforce Management helps you take care of the backend—local compliance, tax paperwork, payroll, and even benefits—so you don’t have to spin up a foreign entity just to build your global team. |

Think globally, pay intelligently with Payoneer Workforce Management

When asking, “What is a 1099 employee?” it’s important to understand how classification impacts your hiring strategy—especially when it comes to building an international team. Since overseas workers typically can’t be classified as 1099 employees under U.S. tax law, choosing the right path forward is essential. That’s where many businesses turn to an EOR.

At Payoneer Workforce Management, we help businesses expand their talent pool, boost productivity, and protect their bottom line —all while handling the compliance, tax, and administrative work that comes with international hiring with our suite of contract management services.

So you can stay focused on growth, not paperwork.

FAQs

1. Does an employer withhold taxes for a 1099 worker?

No, employers do not withhold taxes for 1099 workers. Independent contractors are responsible for paying their own income and self-employment taxes.

2. Is it better to have 1099 or W-2 employees?

It depends on your business needs. 1099 workers offer flexibility and lower costs, but can’t be closely managed like employees. W-2 employees provide more control and stability but come with higher costs and more compliance requirements.

3. What type of worker qualifies to receive a 1099?

A worker qualifies for a 1099 if they are an independent contractor who controls how and when they work, uses their own tools, and works with multiple clients. They are not considered employees under IRS guidelines.

Related resources

Latest articles

-

Looking for an employer of record in Moldova? Here’s what you need to know

Explore how Payoneer Workforce Management helps manage onboarding, payroll, benefits and more in the Republic of Moldova, while simplifying talent engagement in the country.

-

PayPal to Payoneer: All You Need to Know

Learn how to transfer money from PayPal to Payoneer, compare fees, and explore alternatives for users in Pakistan. A complete guide to linking Payoneer and PayPal.

-

How to Use Data Analytics to Improve Payment Processing Efficiency

Learn how to leverage payment data analytics to optimise payment processing efficiency, reduce transaction costs, improve approvals, and gain actionable insights.

-

Payment Confirmation Guide: How to Know Your Money Arrived Safely

Learn how to confirm your payment was received, track its status, and understand typical processing times with Payoneer’s international payment tools.

-

Using an Employer of Record in Taiwan

Learn how an Employer of Record in Taiwan helps you onboard, pay, and manage talent without a local entity. This blog also covers essential information on Taiwanese payroll, labor laws, leave policies, and more.

-

Using an employer of record in Sri Lanka

Explore key Sri Lankan legal regulations and employment nuances that you need to keep track of. Learn how you can utilize an EOR in Sri Lanka to support local team expansion, including onboarding, payroll, benefits, and more.

Disclaimer

The information in this article/on this page is intended for marketing and informational purposes only and does not constitute legal, financial, tax, or professional advice in any context. Payoneer and Payoneer Workforce Management are not liable for the accuracy, completeness or reliability of the information provided herein. Any opinions expressed are those of the individual author and may not reflect the views of Payoneer or Payoneer Workforce Management. All representations and warranties regarding the information presented are disclaimed. The information in this article/on this page reflects the details available at the time of publication. For the most up-to-date information, please consult a Payoneer and/or Payoneer Workforce Management representative or account executive.

Availability of cards and other products is subject to customer’s eligibility. Not all products are available in all jurisdictions in the same manner. Nothing herein should be understood as solicitation outside the jurisdiction where Payoneer Inc. or its affiliates is licensed to engage in payment services, unless permitted by applicable laws. Depending on or your eligibility, you may be offered the Corporate Purchasing Mastercard, issued by First Century Bank, N.A., under a license by Mastercard® and provided to you by Payoneer Inc., or the Payoneer Business Premium Debit Mastercard®, issued and provided from Ireland by Payoneer Europe Limited under a license by Mastercard®.

Skuad Pte Limited (a Payoneer group company) and its affiliates & subsidiaries provide EoR, AoR, and contractor management services.