Firing a contractor? Take the right steps

Firing a contractor is never an easy decision to make, but it’s important to have the right tools at your side if/when the time comes. This guide tells you everything you need to know when it does

The following article details the steps of firing a contractor when a relationship has run its course. The sections below include specifics when working with U.S.-based contractors and international cases, but first, let’s discuss the core steps required.

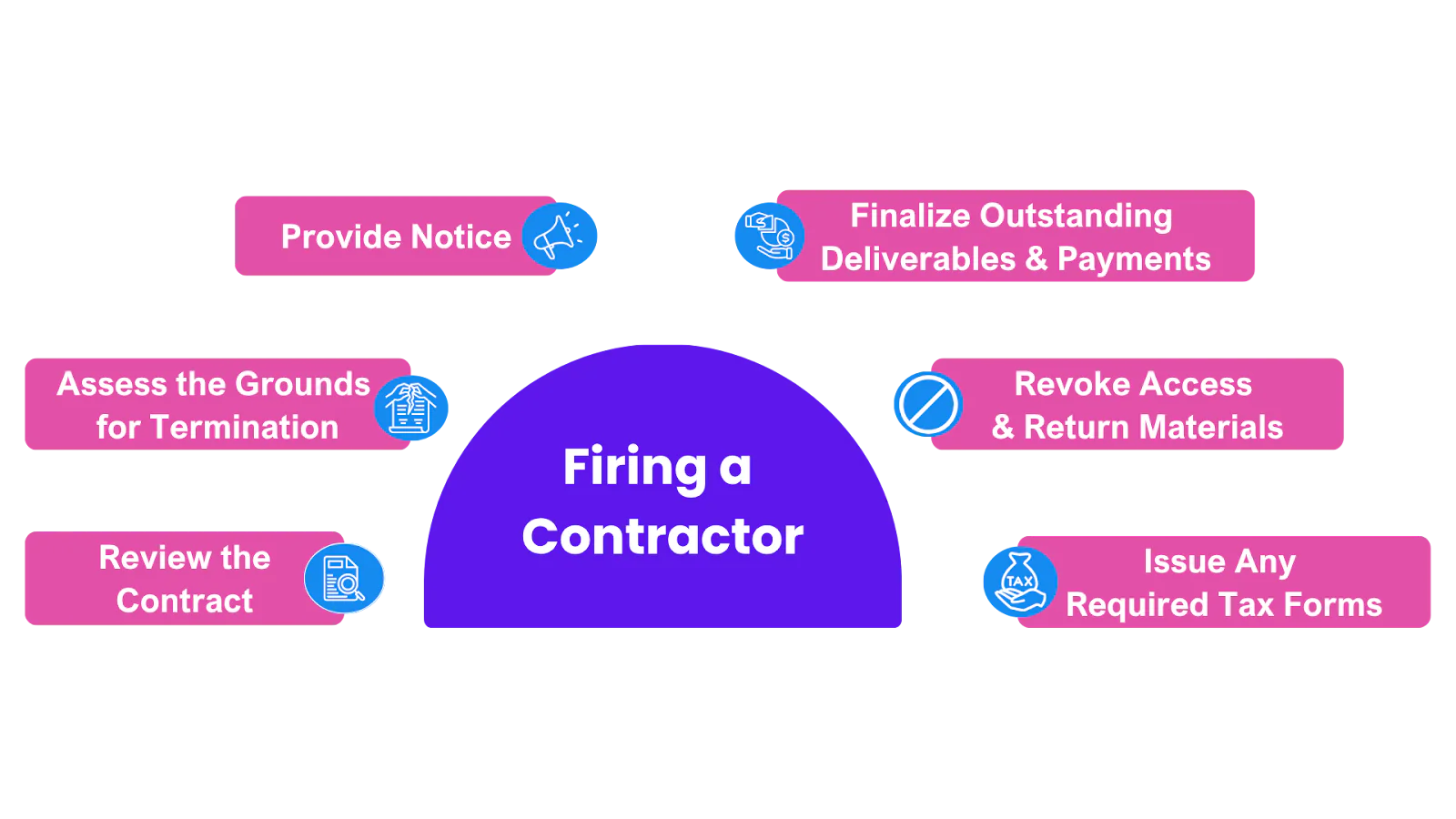

Firing a contractor: The core steps

Regardless of where the contractor operates out of, firing a contractor has a few elements that are going to remain the same:

- Review the contract

- Assess the grounds for termination

- Provide notice

- Finalize outstanding deliverables & payments

- Revoke access & return materials

- Issue any required tax forms

1. Review the contract

Often, the most difficult aspect of firing a contractor is that they are protected by their contract for the entirety of its duration.

This means that your first step when letting them go is to evaluate the language in the termination clause of their contract.

The termination clause should contain information regarding:

- How much notice the employer is required to give

- The grounds for termination

- Details for any specific procedures (e.g., written notice, “cure” periods that offer the contractor the opportunity to fix the breach) that must take place before the contractor can be let go.

This step is more about planning for the future ones; during your review of the contract, you should be getting a core idea of what firing a contractor will look like, which should make the following steps easier when you get to them.

2. Assess the grounds for termination

Grounds for termination typically fall under two categories:

Grounds for termination when firing a contractor

| For-Cause | No-Fault |

|---|---|

| The contractor is being terminated due to a failure to perform the responsibilities of the job (e.g., breach of confidentiality, failure to deliver, interpersonal misconduct) | The contractor is being terminated, regardless of their ability or inability to perform the required tasks. *Sometimes referred to as “at-will” termination |

It should be noted that no-fault termination applies only in specific circumstances where such conditions are explicitly permitted in the contract; if not specified, employers must have appropriate cause in order to terminate employment.

This leads us to a couple of follow-up questions

- What actions constitute “For-Cause” termination?

- These actions vary depending on where you are hiring, but examples include failure to deliver, breach of confidentiality, repeated missed deadlines, actions that cause data loss or reputational harm, fraud, IP theft, or working for a direct competitor.

- What happens if the contractor doesn’t meet the specific grounds for termination, but they aren’t performing satisfactorily?

- Some contracts may include a “termination for convenience” clause that allows at-will termination with a 30-day notice. Otherwise, employers will need to find a way to amend the contract or suffer the consequences should they find themselves in violation of it.

3. Provide notice

Your notice is effectively the letter of termination, letting the contractor know that their services will no longer be necessary with the company. There is no specification as to the length of the notice, but an example notice might look like this:

Dear [Contractor Name]: Pursuant to Section [X.X] (“Termination for Cause”) of our Master Services Agreement (the “Agreement”) dated [Agreement Date], we hereby terminate your services effective as of [Effective Date of Termination]. As outlined in Section [X.X], the following constitutes “Cause” for termination: • [e.g., “Repeated failure to meet project milestones as specified in Exhibit A.”] • [e.g., “Unauthorized disclosure of confidential information.”] Optional: If they have a cure provisionPursuant to the cure provision, we provided written notice on [Date of Cure Notice], but you have not remedied the breach within the [10-day] cure period. Accordingly, all work performed after [Effective Date] is unauthorized, and you must: 1. Immediately cease all services. 2. Return all Company-owned materials, data, and equipment by [Return Date]. 3. Submit any outstanding invoices for work performed through [Last Authorized Date]. We will remit payment for all undisputed invoice amounts within 30 days of receipt. Please direct any questions to [Contact Name, Email, Phone]. Sincerely, [Your Name] [Title] [Company Name] |

Employers must ensure that the notice is sent both within the timeline specified under the contract, typically 7, 14, or 30 days, as well as through the specified means of communication stipulated in the contract.

For example, you should not send an email notice to the contractor if their preferred method of contact is via the employee portal messaging system. Failure to do so may result in further legal difficulty down the road.

4. Finalize outstanding deliverables & payments

When firing a contractor, the best thing to do is to cut ties legally and as quickly as allowed. This means that any outstanding balances should be delivered to the contractor. Conversely, the contractor should submit any remaining deliverables they are responsible for.

Any significant deliberation or argument regarding deliverables/payment owed should be referred to your legal representative to ensure that everything remains above board. If you work through an agent-of-record (AOR) or contractor management tools, they may provide you with resources to manage this depending on their level of coverage.

5. Revoke access & return materials

This step is all about ensuring that the contractor is no longer included or notified of anything happening in the company. There are a few steps to keep in mind here:

- Remove their access to any company-provided resources (e.g., company portal, databases, intellectual property)

- Remove them from any mailing lists or ongoing email correspondence

- Make any necessary documentation in their file with HR

In addition, employers should manage the return of any equipment issued to the contractor to facilitate the performance of their responsibilities. Instances like these are generally rarer since contractors typically provide their own equipment, but it’s important to be aware of them.

6. Issue any required tax forms

Finally, employers should keep all financial and personnel records on file in order to issue the appropriate tax filing forms. These forms vary depending on the location of the contractor, but generally break down as follows:

Tax forms for contractors: U.S. vs International

| U.S.-Based | International | |

|---|---|---|

| Receive from Contractor | W9 | W-8BEN |

| Send to Contractor | 1099-NEC | 1042-S |

| Send to IRS | 1096 (if filing physically) | 1042 |

We should note that these forms are not set in stone; for example, Form 1099 has several variants that may apply to a contractor depending on the nature of their payment.

Similarly, foreign contractors working under an agency or business may require Form W-8BEN-E as opposed to the standard form. Consult legal counsel or your AOR to check if you are sending the correct form.

Sending out the tax form should be the final interaction between the employer and the contractor. Afterwards, it is still important that you keep a copy of their records on file for future reference or in the event of an IRS audit.

The following sections detail specific aspects of firing a contractor according to location; because it is impossible to discuss the specifics for every international location, we have divided them into two categories: U.S.-based contractors and international contractors.

1. U.S.-Based Contractors

In the United States, contractors are not considered employees; this means that the “employment-at-will” doctrine does not apply to them the way that it does with employees, meaning that contractors can typically only be terminated under specific circumstances.

U.S.-based contracts may also have what’s known as a “cure provision” in them, which gives them a window in which they can fix the cause of termination (if applicable). These provisions are not applicable, however, in the event of extreme misconduct, such as criminal behavior or court-issued injunctions that prevent performance.

State laws often determine the timing of final payments and invoices. Refer to the state department of labor office for more information.

2. Firing an International Contractor

When working with international contractors, the process of termination can get significantly more complicated due to varying levels of worker protection from local governments.

One of the largest differences when looking at international examples is the presence of statutory notice periods; many countries require employers to give a minimum of 30 days’ notice when firing a contractor.

However, some countries have no statutory notice period, meaning that a contractor can be let go of immediately, assuming there is nothing stopping the employer in the contract.

What are the penalties for incorrectly firing a contractor?

Firing a contractor is something that the government tends to look at more on a case-by-case basis and rarely has a single penalty associated with it. There are, however, a few central trends that emerge when we look at the larger instances of termination:

Firing a contractor: U.S. & International Penalties

| Jurisdiction | Potential Penalties |

|---|---|

| U.S. | Breach of Contract Damages – fees for unperformed work |

| Misclassification Penalties – IRS back-taxes, unpaid payroll taxes, interest, penalties | |

| State Claims – wage-and-hour suits, unfair-practice investigations | |

| International | Contract Damages – typically lost profits or fees for the remaining term |

| Regulatory Fines – local labor board fines if “de facto employment” is found (Some regions may levy penalties for social-security under-payments) | |

| Reputational Risk – can impair the ability to source contractors locally |

What are the best practices when firing a contractor?

When firing a contractor, an essential piece of advice to adhere to at all times is “document everything”. Keep copies of notices, correspondences, invoices, and communications during and after termination, so that you have a solid paper trail documenting your actions in the event of attempted legal action.

Beyond that, however, a few additional pieces of advice to follow:

- Clearly define the terms of termination in the contract, including notice length and post-termination obligations

- Perform regular reviews to ensure both

- Early notice that a contractor may need to be let go

- The contractor still ‘fits” as a contractor, as per contract terminology

- Seek local advice when hiring international contractors to stay compliant with local laws, especially if you are not working through an AOR or a contractor management tool.

Final notes

Often, one of the best ways to manage this process is through the help of a contractor management platform or an agent-of-record (AOR) platform like Payoneer Workforce Management.

Our teams provide business owners with the tools to seamlessly manage the contractor lifecycle.

Book a demo to see how we can help.

Related resources

Latest articles

-

Employment laws in Sweden

Explore the employment laws in Sweden, a comprehensive guide to employees’ rights, employer obligations, and fair labor practices.

-

Employment laws in Poland

Explore the ins and outs of employment laws in Poland, an info-rich guide to employees’ rights, employer obligations, and fair labor practices that shape the future.

-

Employment laws in Indonesia

Find out more about Indonesia labor laws that dictate how employees should be contracted, managed, and paid, both on a national and state/territory level.

-

Employment laws in France

Learn about France’s labor laws dictating minimum wage, benefits, and more. Plus, discover the consequences of non-compliance with employment laws in France.

-

Employment laws in Spain

Find out more about Spain’s labor laws, from contracts and benefits to termination rules.

-

Employment laws in Australia

Find out more about the employment laws in Australia that dictate how employees should be contracted, managed, and paid, both on a national and state/territory level.

Disclaimer

The information in this article/on this page is intended for marketing and informational purposes only and does not constitute legal, financial, tax, or professional advice in any context. Payoneer and Payoneer Workforce Management are not liable for the accuracy, completeness or reliability of the information provided herein. Any opinions expressed are those of the individual author and may not reflect the views of Payoneer or Payoneer Workforce Management. All representations and warranties regarding the information presented are disclaimed. The information in this article/on this page reflects the details available at the time of publication. For the most up-to-date information, please consult a Payoneer and/or Payoneer Workforce Management representative or account executive.

Availability of cards and other products is subject to customer’s eligibility. Not all products are available in all jurisdictions in the same manner. Nothing herein should be understood as solicitation outside the jurisdiction where Payoneer Inc. or its affiliates is licensed to engage in payment services, unless permitted by applicable laws. Depending on or your eligibility, you may be offered the Corporate Purchasing Mastercard, issued by First Century Bank, N.A., under a license by Mastercard® and provided to you by Payoneer Inc., or the Payoneer Business Premium Debit Mastercard®, issued and provided from Ireland by Payoneer Europe Limited under a license by Mastercard®.

Skuad Pte Limited (a Payoneer group company) and its affiliates & subsidiaries provide EoR, AoR, and contractor management services.