10 compliance checks for independent contractors

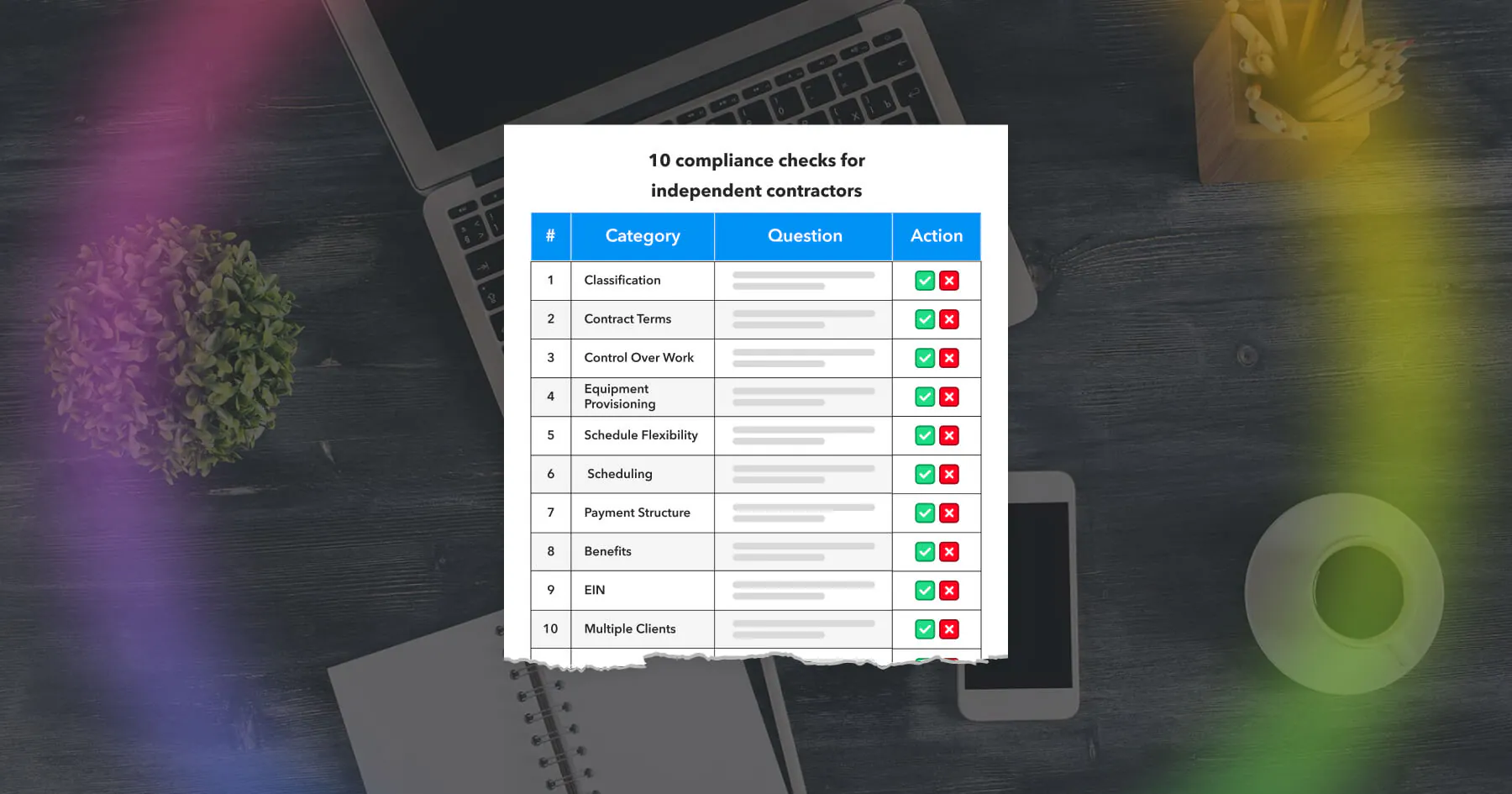

Looking for a faster way to determine the proper worker classification? Here’s 10 compliance checks for independent contractors made easy.

Business owners considering the prospect of hiring an independent contractor have more than likely viewed official compliance documents like the “IRS 20-Point Checklist” to ensure compliance. While those documents are useful, the legalese involved may make them less useful on the grounds of user-friendliness. In addition, employers wanting to double-check on the status of existing contractors may get more use out of a condensed list.

With that in mind, the following list of 10 compliance checks for independent contractors distills the most important aspects of the 20-Point Checklist to help business owners reduce contractor misclassification mistakes.

10 compliance checks for independent contractors

| # | Category | Question | Answer | ||

| Contractor(Yes) | Employee(No) | Unclear | |||

| 1 | Classification | Does the worker meet the classification standards found in official tests? | |||

| 2 | Contract Terms | Is the job offered outlined in a contract? | |||

| 3 | Control Over Work | Does the worker control the nature of how work is done? | |||

| 4 | Equipment Provisioning | Does the worker provide their own equipment/training? | |||

| 5 | Schedule Flexibility | Does the worker control their schedule? | |||

| 6 | Scheduling | Is the schedule project-based? | |||

| 7 | Payment Structure | Is the worker paid by the project? | |||

| 8 | Benefits | Is the worker exempt from benefits, PTO, etc? | |||

| 9 | EIN | Are the contractors operating under their own business/EINs? | |||

| 10 | Multiple Clients | Can the worker work for multiple clients at a time? | |||

| The total number of checked answers | |||||

These checks are intended as a general guide and do not replace official compliance standards.

The following sections outline each of the considerations in the table above so that readers can answer the provided questions.

1) Proper worker classification

The fastest way to determine whether you are adhering to federal and state regulations in terms of contractor classification is to check the regulations themselves. There are three official tests that companies can/should use to determine contractor status:

| Agency | Test |

|---|---|

| Internal Revenue Service (IRS) | 20-Point Checklist, Common Law Test |

| Dept. of Labor (DOL) | Economic Realities Test |

| State-Level | ABC Test |

Using these formal tests may not be the fastest method of ensuring that you stay within compliance, but they are certainly accurate, as they will take you more in-depth than any other tests.

2) Written independent contractor agreement

Contractors typically operate within the bounds of a written contract that is agreed upon by both parties before any work is done. These contracts stipulate the terms of work, including:

- Scope: What work is the contractor responsible for?

- Timeline: When must they complete the work?

- Payment: How much is the contractor paid and through what means?

- Team Integration: How much will the contractor interact with in-house teams?

- Hours: The regular schedule of the contractor, if necessary (contractors often set their own hours)

- Termination: Under what terms can the contractor/employer end the relationship?

For business owners evaluating the status of an existing contractor, it’s important to revisit the contract and verify that the terms laid out within are being met. Have your legal team or an agent-of-record (AOR) review these terms and look for any discrepancies or irregularities that need to be corrected.

3) Control over work

Contractors are hired to do a job; how that job is completed is entirely up to them, at least in most cases. By comparison, employees must perform a job exactly as the employer instructs them to.

Consider the level of control that you have as an employer over how the work gets done. Anything beyond the scope of work determined in the contract could pose a potential violation.

4) Provision of tools & equipment

Unlike employees who have equipment and tools provided by their employer, contractors are expected to supply their own equipment when taking on job responsibilities. This includes but is not limited to:

- Computers

- Phones

- Tools

- Transportation

- Insurance

The only exceptions to this rule are highly specialized equipment for niche tasks.

If you have a contractor who is using company-provided equipment, it may constitute a potential misclassification error. Have your legal team revisit the topic to determine the best course of action.

5) Work schedule flexibility

Contractors are often determined by the level of control they hold over their daily work schedule and how work is generally performed. When compared with employees, it breaks down something like this:

| Contractor | Employee |

|---|---|

| Typically, a contractor is restricted only by the deadline under which work needs to be completed. This leaves them free to determine everything else, including daily schedule and preferred means of communication. | Employees are under a significantly higher level of control by the employer than contractors. They must adhere to regular business hours and perform work according to the guidelines set out by the employer. |

This is not to say that contractors always determine their own schedule: for example, a contractor working in a highly specialized field (e.g., full-stack web development, financial consultant) may need to adhere to stricter communication methods when reaching out to the in-house team. Similarly, physically involved work may require more regular hours to accommodate the overall project scale.

Review the terms in your contract to determine where on this scale a contractor should be. Make adjustments, if necessary.

6) Project-based or Time-bound work

Because contractors are bound by the scope of work laid out in the contract, they are tied to finite deadlines and deliverables. By contrast, an employee is subject to indefinite work in which these deadlines mark an event in their working relationship with the employer rather than the end of it.

As an employer, consider whether your contractor is operating on a project-based level or not. The latter may suggest potential complications unless otherwise specified within your contract.

7) Payment structure

The project-based nature of the contractor relationship is reflected in the payment structure; contractors are typically paid by deliverable or by project, unless otherwise stated in the contract. Similarly, these payments are typically paid via invoice, as opposed to an employee’s paycheck.

Perhaps even more important are the tax considerations that a contractor comes with; contractors are responsible for their own taxes, meaning that employers should NOT be withholding their amount when issuing their payment.

8) No benefits or reimbursements

Contractors are responsible for bringing their own equipment to perform the work required, and among that equipment is the proper insurance. In addition to contractors insurance, this includes health insurance benefits, as well as car insurance if they perform job responsibilities that involve a great deal of travel.

Similarly, contractors are not covered under other benefits typically available to an employee, such as PTO or vacation time. Offering these benefits to a contractor may result in misclassification fines and penalties.

9) Use of business entity or EIN

Contractors may operate through either:

- Through their own business (typically an LLC)

- As an individual, by using an employer identification number (EIN)

- Both

Often, contractors with an LLC will nonetheless have an EIN if they manage an operation that hires employees themselves. As a result, it is possible to run into both. Whatever they can provide should be kept in your records in the event that the IRS requests it.

If a contractor does not provide an EIN, use their Social Security number (SSN). If they provide neither, you must:

- Still file Form 1099-NEC for their taxes if you paid >$600

- Begin backup withholding of 24% from their payments

10) Multiple clients

Because contractors operate their own business, they may serve multiple clients. By contrast, most employees are typically thought of as only working for a single employer.

It’s probably obvious why this element is at the bottom of this list: a contractor could potentially have just one large account that they work with, declining to take on additional clients due to the size of the project. Similarly, an employee may work multiple jobs despite still having an “employee” designation.

While it’s rarely the first thing that an employer would look at when determining the status of a worker, it can nonetheless help tip the scales one way or the other when looking at it along with the rest of the items in concert.

Managing contractors with Payoneer Workforce Management

Whether you need to onboard a new contractor quickly or you are just doing your due diligence, mitigating misclassification penalties is equally as important as it is tricky. Labor laws are constantly shifting, and employers expanding internationally will require local experts to align their business as per the foreign labor laws.

That’s why working with a contractor management solution like Payoneer Workforce Management is useful. Our solution provides your teams with tools to streamline contractor management. In addition, our agent-of-record (AOR) services can offer support with worker classification.

Book a demo today to understand how we can support.

Related resources

Latest articles

-

Employment laws in Sweden

Explore the employment laws in Sweden, a comprehensive guide to employees’ rights, employer obligations, and fair labor practices.

-

Employment laws in Poland

Explore the ins and outs of employment laws in Poland, an info-rich guide to employees’ rights, employer obligations, and fair labor practices that shape the future.

-

Employment laws in Indonesia

Find out more about Indonesia labor laws that dictate how employees should be contracted, managed, and paid, both on a national and state/territory level.

-

Employment laws in France

Learn about France’s labor laws dictating minimum wage, benefits, and more. Plus, discover the consequences of non-compliance with employment laws in France.

-

Employment laws in Spain

Find out more about Spain’s labor laws, from contracts and benefits to termination rules.

-

Employment laws in Australia

Find out more about the employment laws in Australia that dictate how employees should be contracted, managed, and paid, both on a national and state/territory level.

Disclaimer

The information in this article/on this page is intended for marketing and informational purposes only and does not constitute legal, financial, tax, or professional advice in any context. Payoneer and Payoneer Workforce Management are not liable for the accuracy, completeness or reliability of the information provided herein. Any opinions expressed are those of the individual author and may not reflect the views of Payoneer or Payoneer Workforce Management. All representations and warranties regarding the information presented are disclaimed. The information in this article/on this page reflects the details available at the time of publication. For the most up-to-date information, please consult a Payoneer and/or Payoneer Workforce Management representative or account executive.

Availability of cards and other products is subject to customer’s eligibility. Not all products are available in all jurisdictions in the same manner. Nothing herein should be understood as solicitation outside the jurisdiction where Payoneer Inc. or its affiliates is licensed to engage in payment services, unless permitted by applicable laws. Depending on or your eligibility, you may be offered the Corporate Purchasing Mastercard, issued by First Century Bank, N.A., under a license by Mastercard® and provided to you by Payoneer Inc., or the Payoneer Business Premium Debit Mastercard®, issued and provided from Ireland by Payoneer Europe Limited under a license by Mastercard®.

Skuad Pte Limited (a Payoneer group company) and its affiliates & subsidiaries provide EoR, AoR, and contractor management services.