Employee cost calculator for global hiring

Use our free employee cost calculator to estimate the true cost of employee around the world. Get country-specific breakdowns of salary, taxes, and employer contributions.

The true cost of employee: What employer costs really include

Hiring goes far beyond paying a salary. Employers also cover mandatory contributions, taxes, and benefits that vary by country, often adding 15–50% or more to total costs.

Typical employer costs include:

- Gross salary

- Social contributions

- Payroll taxes

- Employee benefits

- Compliance and administration

Managing all of this by yourself across multiple countries makes things complex.

That is where an Employer of Record (EOR) helps.

Why use an Employer of Record (EOR)

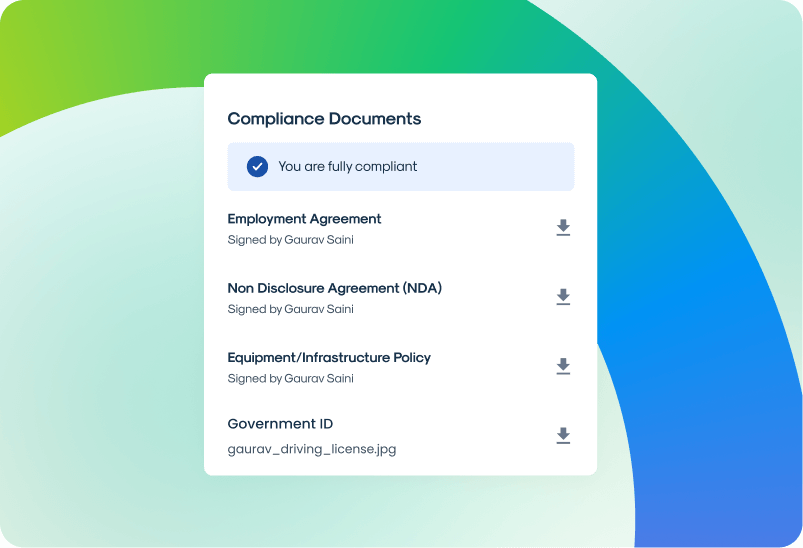

An Employer of Record (EOR) simplifies global hiring by supporting with payroll, taxes, benefits, and compliance so you can engage talent globally without setting up local entities.

An EOR helps you:

- Build, manage and pay teams in new markets quickly

- Stay compliant with local labor and tax laws

- Reduce overhead and admin work

An EOR offers support to make global hiring more cost-efficient.

Read our whitepaper to understand why an EOR wins over entity setup.

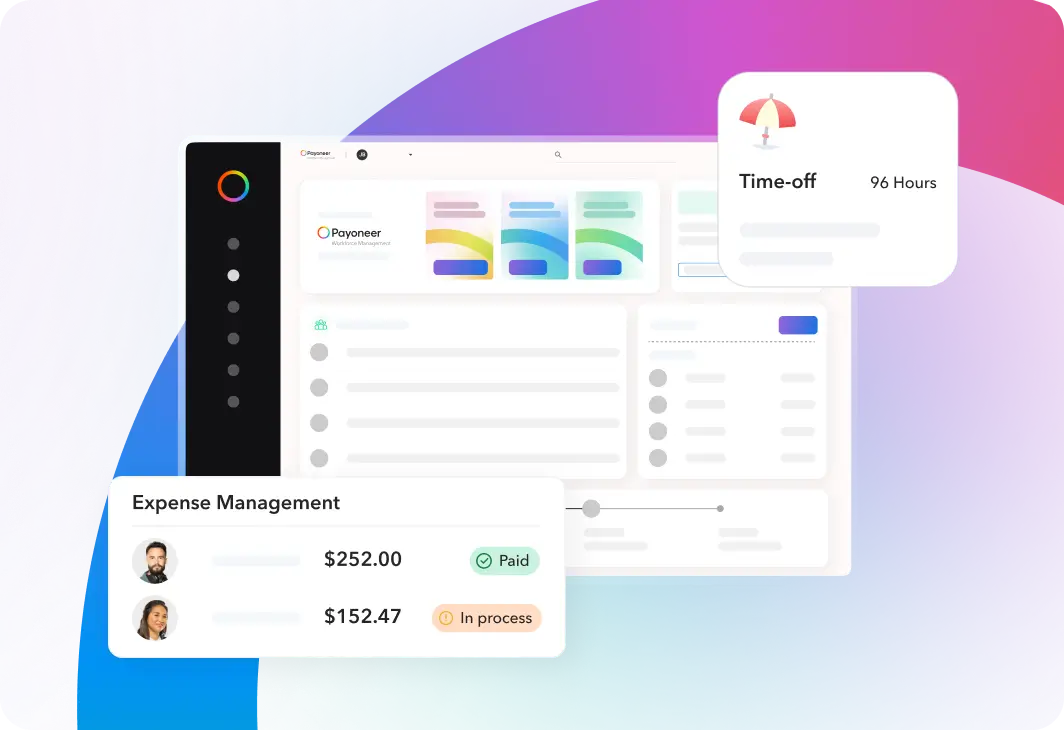

How Payoneer Workforce Management works

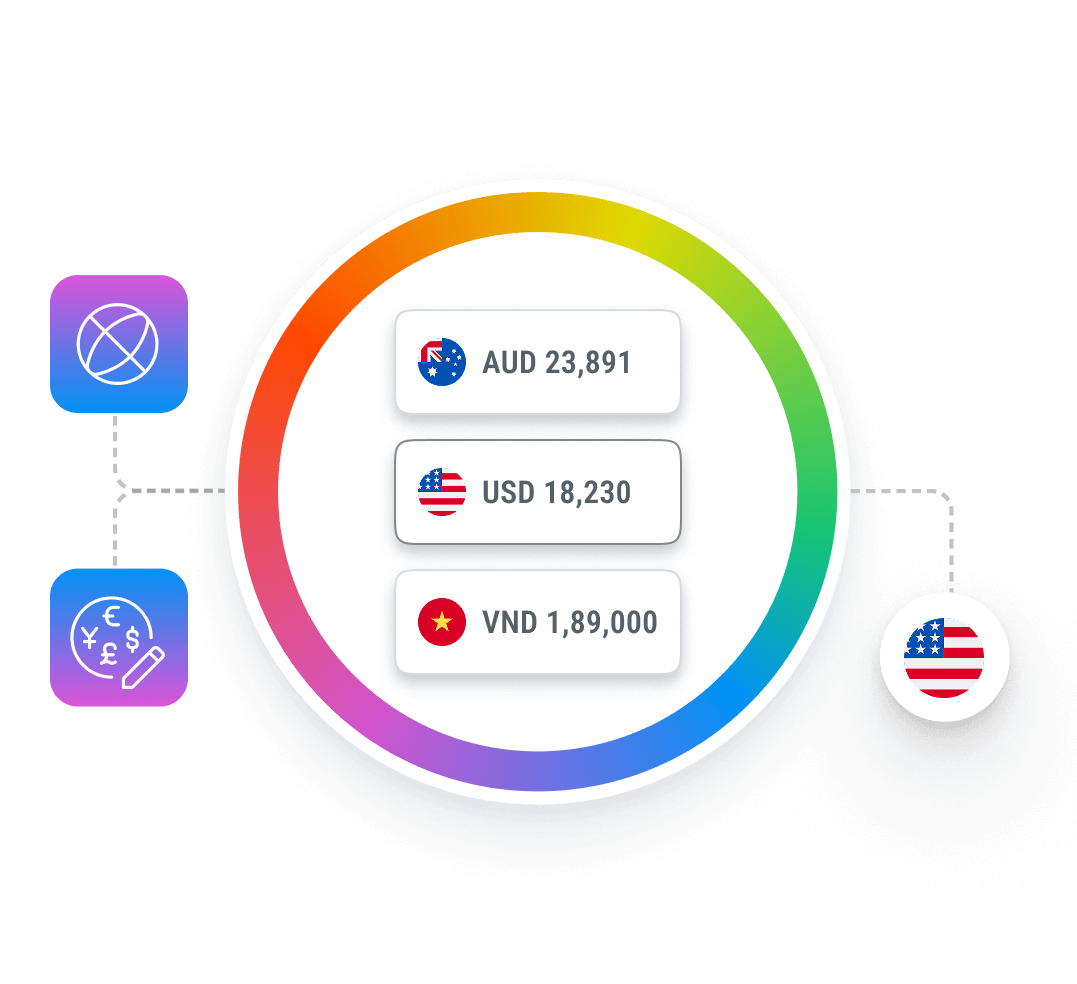

Our unified platform gives you a single dashboard to manage a global workforce.

Why choose Payoneer Workforce Management?

Managing a global team shouldn’t mean dealing with complex systems, hidden costs, or compliance risks. We make global employment simple, transparent, and scalable.

160+

Countries

covered

100%

Transparency in

fee structure

70

Currencies

for payroll

24×5

Dedicated

support

Frequently asked questions

Learn more about employee and employment costs.

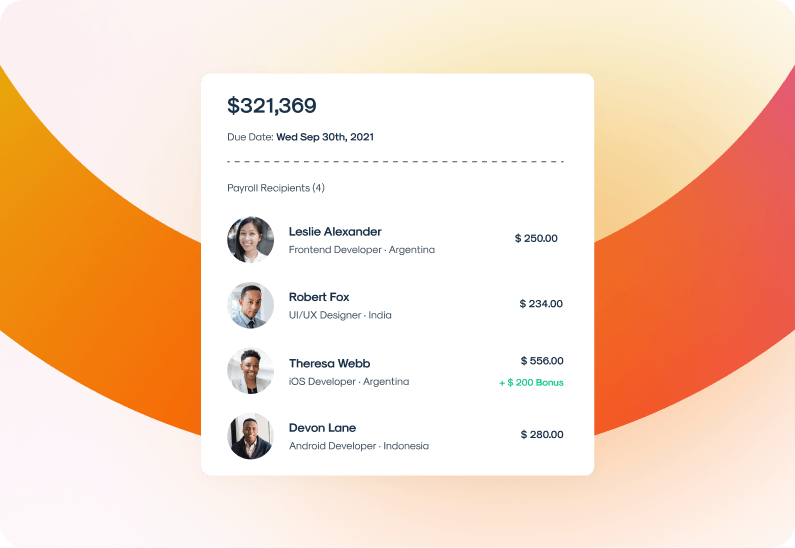

To calculate employee cost, start with the gross annual salary and add all employer-paid expenses such as taxes, benefits, and social contributions.

Formula: Total Employee Cost = Gross Salary + Employer Taxes + Benefits + Other Expenses

This gives you an estimate of the true cost of employee, usually 15–50% higher than base salary.

Employee costs differ due to local tax laws, labor regulations, mandatory benefits, and social security rates.

Knowing the cost of hiring an employee helps you budget accurately, set salaries competitively, and plan sustainable growth. It also allows companies to compare hiring costs globally and decide where to expand or build teams efficiently.

Gross salary is the amount an employee earns before deductions. Total employment cost includes the employer’s additional expenses like taxes, insurance, benefits, and compliance fees.

In most cases, the total cost is 1.2–1.5 times the gross salary.

An EOR offers support with managing payroll, taxes, benefits, and compliance on your behalf. This allows you to engage talent globally without opening local entities or handling complex local regulations, helping control costs and reduce administrative effort.

Need clarity on global employee costs? We can help.

Disclaimer

The information in this article/on this page is intended for marketing and informational purposes only and does not constitute legal, financial, tax, or professional advice in any context. Payoneer and Payoneer Workforce Management are not liable for the accuracy, completeness or reliability of the information provided herein. Any opinions expressed are those of the individual author and may not reflect the views of Payoneer or Payoneer Workforce Management. All representations and warranties regarding the information presented are disclaimed. The information in this article/on this page reflects the details available at the time of publication. For the most up-to-date information, please consult a Payoneer and/or Payoneer Workforce Management representative or account executive.

Availability of cards and other products is subject to customer’s eligibility. Not all products are available in all jurisdictions in the same manner. Nothing herein should be understood as solicitation outside the jurisdiction where Payoneer Inc. or its affiliates is licensed to engage in payment services, unless permitted by applicable laws. Depending on or your eligibility, you may be offered the Corporate Purchasing Mastercard, issued by First Century Bank, N.A., under a license by Mastercard® and provided to you by Payoneer Inc., or the Payoneer Business Premium Debit Mastercard®, issued and provided from Ireland by Payoneer Europe Limited under a license by Mastercard®.

Skuad Pte Limited (a Payoneer group company) and its affiliates & subsidiaries provide EoR, AoR, and contractor management services.