Payoneer and Meezan Bank Transform International Payment Withdrawals in Pakistan with New Partnership

Payoneer and Meezan Bank Transform International Payment Withdrawals in Pakistan with New Partnership In a big step for global financial transactions in Pakistan, Payoneer has partnered with Meezan Bank, the premier Islamic bank in the region, to make international payment withdrawals seamless for businesses and freelancers. This collaboration introduces a real-time withdrawal feature on the…

Payoneer and Meezan Bank Transform International Payment Withdrawals in Pakistan with New Partnership

In a big step for global financial transactions in Pakistan, Payoneer has partnered with Meezan Bank, the premier Islamic bank in the region, to make international payment withdrawals seamless for businesses and freelancers.

This collaboration introduces a real-time withdrawal feature on the Meezan Bank mobile app, offering unmatched convenience and speed.

The Story Behind this Payoneer and Meezan Bank News

Payoneer and Meezan Bank have both recognized that Pakistani freelancers and businesses, especially small-to-medium sized businesses (SMBs), meet with too many costly and time-consuming obstacles whilst trying to conduct international withdrawals. This is why they have partnered to introduce a real-time withdrawal feature for cross-border payments; one that streamlines financial transactions for Pakistani SMBs, entrepreneurs, and freelancers.

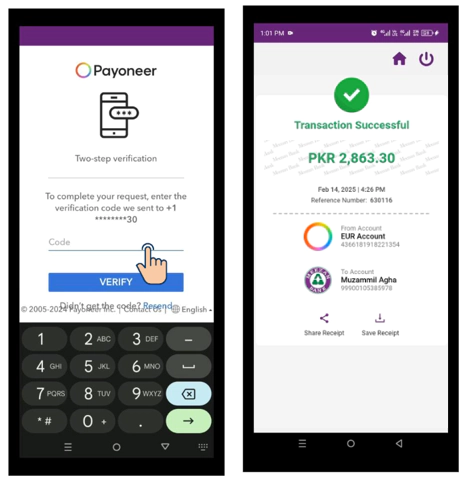

Through the Meezan Bank App, customers can now link their Payoneer accounts in a few clicks or taps, and transfer funds seamlessly, from USD to PKR. This is a game-changer for businesses in the region, opening a whole new avenue for unparalleled speed, security, and convenience. Notifications provide transparency and updates at every step, while the entire process is designed to remove unwanted delays and allow customers to focus on scaling their operations.

Ultimately, this Payoneer and Meezan Bank news represents a shared commitment to empower Pakistan’s growing digital economy and support its growing international business sector.

How Payoneer Streamlines Withdrawals and International Payments for SMBs in Pakistan

Payoneer is a leading global payment platform, offering comprehensive solutions tailored to the needs of businesses in Pakistan, especially those that do not have an endless supply of resources or a bottomless budget. With Payoneer, SMBs and freelancers can access multi-currency accounts, allowing them to receive payments in USD, EUR, GBP, and other major world currencies. This is particularly beneficial when it comes to receiving or withdrawing international payments for SMBs in Pakistan.

One of Payoneer’s standout features is its low transaction fees and competitive exchange rates, making it a cost-effective solution for cross-border transactions. Additionally, funds can be withdrawn directly to local Pakistani bank accounts in PKR – such as Meezan Bank – for an extra layer of localized convenience.

In addition, when the customer withdraws money to their MBL (Meezan Bank Limited) account they will also get PRC (Proceed Realisation Certificate) in the email.

With advanced security protocols, fast processing times, and compliance with international regulations, Payoneer provides a reliable, capable, and intuitive platform that empowers Pakistani businesses to thrive on a global scale.

Using Payoneer and the Meezan Bank Mobile App for International Withdrawals in Pakistan

As Pakistan’s leading Islamic bank, Meezan Bank offers a range of financial solutions tailored to meet the needs of SMBs. Known for its customer-centric approach, the bank provides businesses with dedicated support, innovative digital banking features, and competitive services for managing finances.

With the Meezan Bank Mobile App, accessing international payments has become easier than ever thanks to the integration with Payoneer. Here’s how to get started:

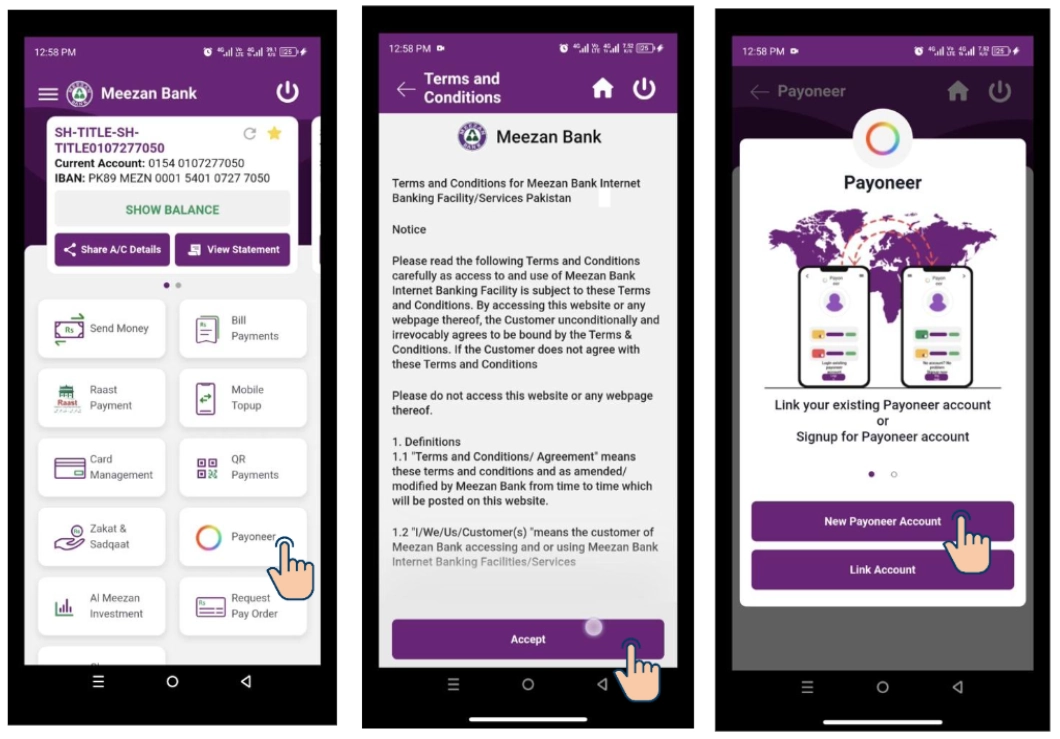

- Log In to the Meezan Bank Mobile App: Make sure the app is installed and up to date, then log in with your credentials. Click the Payoneer icon on the home page and follow the steps.

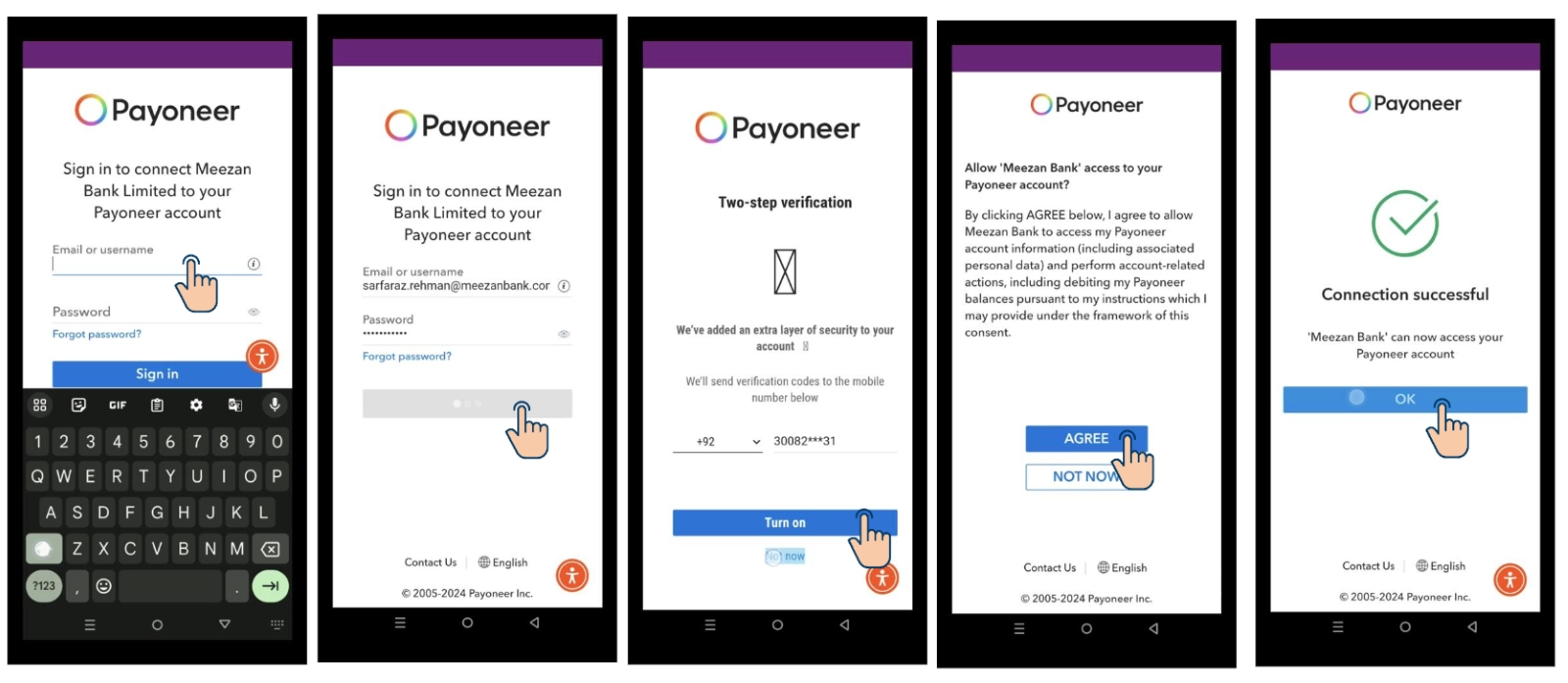

- Link Your Payoneer Account: Choose whether you wish to open a new Payoneer account or link an existing one. Enter your Payoneer login details and verify your identity using secured SMS-based authentication.

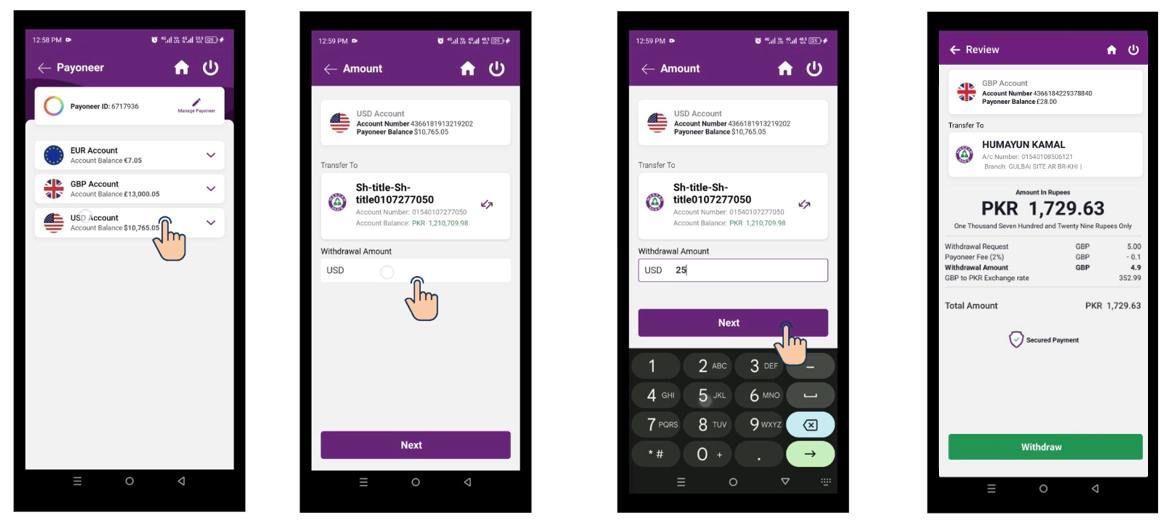

- View Your Balance: Check your available Payoneer USD balance directly in the app.

- Initiate the Transfer: Confirm the displayed exchange rate, enter the withdrawal amount, and approve the transaction.

Visit this Payment Withdrawals link for more information on withdrawing payments through Payoneer.

Experience a New Way to Conduct International Payments for SMBs in Pakistan Today

Meezan Bank customers can explore the new Payoneer integration by logging into the Meezan Bank App today.

Whether you’re a freelancer looking to manage global payments efficiently or an SMB scaling operations internationally, this innovative solution is tailored to meet your needs. Experience the convenience of real-time transactions and simplify your financial management with this innovative feature designed to empower your business growth.

Frequently Asked Questions (FAQs)

What are the different methods of making international payments in Pakistan?

In Pakistan, there are several ways to send or receive international payments:

- Bank Transfers (Wire Transfers): Secure but often costly, suitable for larger transactions.

- Online Payment Gateways: Platforms like Payoneer provide cost-effective and user-friendly options for freelancers and businesses. Especially through partnerships like the one with Meezan Bank.

- Money Transfer Services: Services such as Western Union and MoneyGram are ideal for personal remittances but may not be suitable for business needs.

Each method has its own pros and cons, so it’s important to do the necessary research before you make your choice.

Are there any restrictions on international payments in Pakistan?

Yes, the State Bank of Pakistan (SBP) keeps a close regulatory eye on cross-border payments. For individuals, there are limits under the Foreign Exchange Manual for the amount of money that can be sent or received.

Businesses, on the other hand, must comply with additional documentation and reporting requirements, such as providing invoices or contracts for payment justification. These restrictions aim to ensure proper currency flow and prevent misuse.

How can I receive international payments in Pakistan?

Receiving international payments in Pakistan include a few steps:

- Choosing a Service: Platforms like Payoneer offer efficient solutions, while most Pakistani banks support SWIFT transfers.

- Providing Documentation: Banks may require proof of identification, purpose of payment, and tax details (e.g., NTN).

- Understanding and Accepting Fees: Be aware of currency conversion rates and transaction fees that may apply.

- Verifying Processing Times: SWIFT transfers can take several days, while services like Payoneer offer faster alternatives.

How secure are international payments in Pakistan?

Security is of utmost importance when handling international payments. Banks and platforms like Meezan Bank and Payoneer use advanced encryption, two-factor authentication, and fraud detection systems to protect transactions. Additionally, the State Bank of Pakistan (SBP) follows stringent regulatory measures to ensure compliance and security.

Here are a few tips on how to safeguard your transactions:

- Use trusted platforms and banks like Payoneer and Meezan Bank.

- Avoid sharing sensitive information over unsecured networks.

- Frequently monitor transactions to identify and report suspicious activity promptly.

Visit this Payment Withdrawals link for more information on withdrawing payments with Payoneer.