Using JazzCash to receive payments with Payoneer just got even better!

If you’re a freelancer based in Pakistan, its quite possible you’re using the JazzCash app, right?And if you’re already a Payoneer customer, you may well have connected your JazzCash account to your Payoneer account to make managing your business payments easy. If so, you’ll be pleased to know that you can now use ‘Request a…

If you’re a freelancer based in Pakistan, its quite possible you’re using the JazzCash app, right?

And if you’re already a Payoneer customer, you may well have connected your JazzCash account to your Payoneer account to make managing your business payments easy.

If so, you’ll be pleased to know that you can now use ‘Request a Payment’ directly from within the Jazz Cash app!

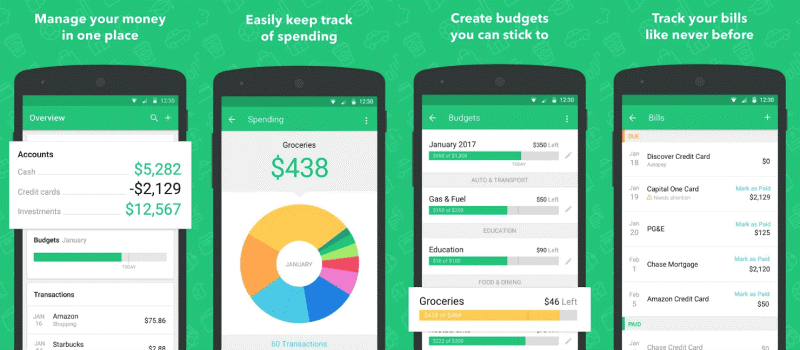

What is ‘Request a Payment’?

‘Request a Payment’ is a way to raise a payment request with your clients and helps freelancers grow their business as it gives your clients multple ways to pay you such as:

- Payment via credit card or debit card.

- Payment via local bank transfer or ACH debit at no cost to your client.

- Pay you via e-check

All your client needs to do is open the ‘request a payment’ link that you send them, enter their information to pay you, and that’s it!

Sounds exciting, right?

Opting in is easy. Here’s how:

- Open your Jazz Cash App and open Payoneer (make sure you have linked your Payoneer account with your Jazz Cash app)

- Select Request a Payment as shown below.

- You will then be shown the following screen. Click on ‘send email’ and immediately check your email for additional verification requirement. Submit those documents as soon as possible.

4. Select request a payment to initiate your first payment request. Congratulations, your business is now fully open to a world of opportunities!

5. Select Payer Type. You can bill either a company or an individual.

6. Congratulations, your first request has been successfully sent!

7. You can always track your payment status from the ‘Track Request’ tab, as shown below.

8. Once a payer has been set up, you will only be sending the invoice information, as shown below.

9. Pending requests can also be cancelled by clicking on the request and cancelling it. After completion of a successful payment request you can always view its receipt for record keeping purposes.

10. After completion of a successful payment request you can always view its receipt for record keeping purposes. The receipt will pop up and show the main details like Request ID, Date, amount and exchange rate applied.

11. You are now all set!

To learn more about how to use JazzCash with Payoneer, take a listen to the guru of freelancing, Hisham Sarwar, who will explain more about the process:

Frequently asked questions:

- Who is eligible to use this service?

Anyone with Jazz Cash and a Payoneer account is eligible to use this service. - What is the maximum amount I can request?

Credit Card: Max limit: 15K USD Per transaction and per day limit $50k.

ACH Debit: Per day limit 20K USD max limit $200K per day - When will the client amount reflect in my Payoneer account?

Credit Card: 2 Working Days

ACH Debit/local bank transfer: 5 Working Days - Are there any verification requirements?

Yes, you will be required to check your verification center to submit a business questionnaire. In your business questionnaire, share your business details/freelancer profile details as accurately and in detail as possible. Explain the services you provide, marketplaces you work on, the age of your freelancing profile, where your clients are based etc.

Make sure the website/profile you provide as evidence clearly shows the services you provide.

Related resources

Latest articles

-

Employment laws in Sweden

Explore the employment laws in Sweden, a comprehensive guide to employees’ rights, employer obligations, and fair labor practices.

-

Employment laws in Poland

Explore the ins and outs of employment laws in Poland, an info-rich guide to employees’ rights, employer obligations, and fair labor practices that shape the future.

-

Employment laws in Indonesia

Find out more about Indonesia labor laws that dictate how employees should be contracted, managed, and paid, both on a national and state/territory level.

-

Employment laws in France

Learn about France’s labor laws dictating minimum wage, benefits, and more. Plus, discover the consequences of non-compliance with employment laws in France.

-

Employment laws in Spain

Find out more about Spain’s labor laws, from contracts and benefits to termination rules.

-

Employment laws in Australia

Find out more about the employment laws in Australia that dictate how employees should be contracted, managed, and paid, both on a national and state/territory level.

Disclaimer

The information in this article/on this page is intended for marketing and informational purposes only and does not constitute legal, financial, tax, or professional advice in any context. Payoneer and Payoneer Workforce Management are not liable for the accuracy, completeness or reliability of the information provided herein. Any opinions expressed are those of the individual author and may not reflect the views of Payoneer or Payoneer Workforce Management. All representations and warranties regarding the information presented are disclaimed. The information in this article/on this page reflects the details available at the time of publication. For the most up-to-date information, please consult a Payoneer and/or Payoneer Workforce Management representative or account executive.

Availability of cards and other products is subject to customer’s eligibility. Not all products are available in all jurisdictions in the same manner. Nothing herein should be understood as solicitation outside the jurisdiction where Payoneer Inc. or its affiliates is licensed to engage in payment services, unless permitted by applicable laws. Depending on or your eligibility, you may be offered the Corporate Purchasing Mastercard, issued by First Century Bank, N.A., under a license by Mastercard® and provided to you by Payoneer Inc., or the Payoneer Business Premium Debit Mastercard®, issued and provided from Ireland by Payoneer Europe Limited under a license by Mastercard®.

Skuad Pte Limited (a Payoneer group company) and its affiliates & subsidiaries provide EoR, AoR, and contractor management services.