The difference between an estimate and an invoice

More topics When it comes to accounting and paperwork, small businesses and freelancers have a lot to keep track of. Fortunately, business software like Free Invoice Builder helps streamline the process and keeps all your documents organized. Two important business documents you’ll need to know are estimates and invoices. While there are similarities between the…

When it comes to accounting and paperwork, small businesses and freelancers have a lot to keep track of. Fortunately, business software like Free Invoice Builder helps streamline the process and keeps all your documents organized.

Two important business documents you’ll need to know are estimates and invoices. While there are similarities between the two, they provide very different purposes.

What is an estimate?

An estimate is a general price for a project that a business proposes to a client to offer an idea of what a service might cost. An estimate is used at the very beginning of a transaction before both parties have discussed project details. Providing a client an estimate does not mean any money is owed.

When is an estimate used?

An estimate is proposed by a business before a contract has been signed to provide a customer an approximate idea of what they can expect to pay. Estimates are not meant to provide a fixed cost for a service.

For example, a business hiring a freelancer to do an SEO audit of their website may inquire about pricing from several freelancers. Each business will provide an estimate of what they charge for services and what they think the job will cost based on previous work. At this point in the transaction, the freelancers will not have concrete details of what the job entails, but instead, a general idea. Therefore, the final cost of the job might be different than the initial estimate.

What information is included on an estimate?

Include the following details in your estimate:

- Description of the job

- Projected timeline

- List of prices for line items and total cost

- Payment terms

- Your company’s logo and contact information

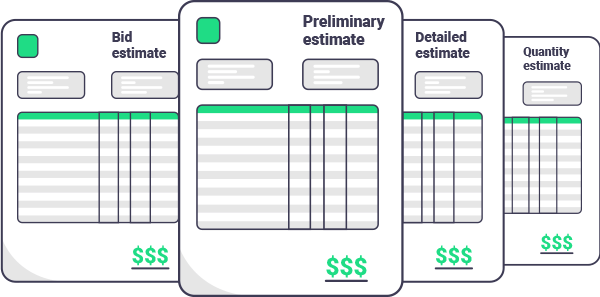

Types of estimates

There are four primary types of estimates:

1. Preliminary estimate

This is the most basic type of estimate and provides a general idea about how much a project will cost. It is given to a client at the beginning of a project when only limited information is available.

2. Detailed estimate

If a more detailed description of the project is given to the service provider, they can provide a more concise estimate of the cost.

3. Quantity estimate

Quantity estimates are used for jobs that require physical materials. They include details of materials required to complete the project.

4. Bid estimate

A business submits a bid estimate to a potential client in hopes of winning a project.

What is an invoice?

An invoice is a legal document a business sends a client formally requesting payment for a service. Invoices also provide a financial record when a job is completed and will be used for tax and accounting purposes.

What details are included in an invoice

Invoices are more detailed than estimates and can be created with a free invoice builder. They should include:

- Customer’s contact information

- Official due date and amount due

- Business contact information

- Invoice number or ID

- Invoice date

- Payment terms

- Complete list of services

- The currency in which the invoice should be paid

- If working on an hourly basis, indicate the total number of hours worked

- Country of origin

- Any taxes that apply

When are invoices used?

Any business that needs to request payment from a client must submit an invoice to do so. For example, a freelance web designer must invoice every client they create a new website for to keep track of transactions and request payment. While invoicing can seem complicated, online software allows businesses to send and file invoices online, increasing efficiency and eliminating the need for paper documents.

Types of invoices

These are five of the primary types of invoices you should know:

1. Standard invoice

This is the most common type of invoice and should include all the basic details outlined above.

2. Commercial invoice

Commercial invoices are used for internationally sold products and are required to determine customs duties. In addition to basic details, commercial invoices must include the total value of the product, description, the parties involved in the sale, country of origin and destination, and weight.

3. Final invoice

Final invoices are used to collect payment for large projects that have a longer timeline and multiple components.

4. Interim invoice

Interim invoices are also used to collect payment for longer, multi-stage projects. However, interim invoicing implies a business will collect payment throughout the project as stages are completed as opposed to one payout at the end.

5. Recurring invoice

Recurring invoices are similar to interim invoices, but you can schedule recurring invoices ahead of time for ongoing work.

Tips & best practices for providing estimates and invoices

1. Maximize on simplicity: find a system that works and stick to it. Take advantage of user-friendly online software to provide templates and complete all your paperwork. Consolidating all information in one place reduces human error. Additionally, all information you include on your documents should be logical and easy to read to avoid confusion.

2. Personalize your invoices. This not only helps identify which documents are meant for you, but helps create a more personal connection with clients. Thank them for the business and even use the first name of the person you worked with on the project.

3. Use your estimates and invoices to strengthen brand identity. Any aspect of your business should work to enhance your brand. To do so, make sure to include your logo on both estimates and invoices to differentiate them from others.

4. Make sure your work description is clear. Include a short but detailed description of your work so it’s clear what exactly the client is paying for.

Related resources

Latest articles

-

Employment laws in Vietnam

Explore the ins and outs of employment laws in Vietnam, an info-rich guide to employees’ rights, employer obligations, and the labor code

-

Looking for an Employer of Record in Bosnia and Herzegovina? Here’s what you need to know

Learn how a workforce management platform can help you manage international teams, including onboarding, payroll, benefits, and more.

-

Using an Employer of Record in Jamaica

Looking for an employer of record in Jamaica? Learn about Jamaica’s payroll, minimum wage, leave policy, employment contracts, and how to stay compliant when engaging local talent.

-

Employment laws in Argentina

Explore how labor laws in Argentina govern employment and what it means for your organization. Also, discover how Payoneer Workforce Management can help you manage local teams in Argentina.

-

Your guide to payroll in Argentina

Manage Argentina payroll processing with ease. Learn how to pay employees in Argentina, handle employer taxes, and ensure full payroll compliance.

-

Planning to hire employees in Argentina? Here’s a quick guide

Learn how Payoneer Workforce Management helps you streamline the hiring process in Argentina, including onboarding, tax compliance, and employment regulations.

Disclaimer

The information in this article/on this page is intended for marketing and informational purposes only and does not constitute legal, financial, tax, or professional advice in any context. Payoneer and Payoneer Workforce Management are not liable for the accuracy, completeness or reliability of the information provided herein. Any opinions expressed are those of the individual author and may not reflect the views of Payoneer or Payoneer Workforce Management. All representations and warranties regarding the information presented are disclaimed. The information in this article/on this page reflects the details available at the time of publication. For the most up-to-date information, please consult a Payoneer and/or Payoneer Workforce Management representative or account executive.

Availability of cards and other products is subject to customer’s eligibility. Not all products are available in all jurisdictions in the same manner. Nothing herein should be understood as solicitation outside the jurisdiction where Payoneer Inc. or its affiliates is licensed to engage in payment services, unless permitted by applicable laws. Depending on or your eligibility, you may be offered the Corporate Purchasing Mastercard, issued by First Century Bank, N.A., under a license by Mastercard® and provided to you by Payoneer Inc., or the Payoneer Business Premium Debit Mastercard®, issued and provided from Ireland by Payoneer Europe Limited under a license by Mastercard®.

Skuad Pte Limited (a Payoneer group company) and its affiliates & subsidiaries provide EoR, AoR, and contractor management services.