Payoneer Now Integrated with Envoice

More topics When you’re working for yourself, successful time management is crucial. Wasting too much time on the lateral tasks and not on your actual work can make freelancing more complicated than it needs to be. The global freelance community is growing at a staggering rate, and technology is catching up. There are many tools at…

When you’re working for yourself, successful time management is crucial. Wasting too much time on the lateral tasks and not on your actual work can make freelancing more complicated than it needs to be.

The global freelance community is growing at a staggering rate, and technology is catching up. There are many tools at the freelancer’s disposal to make the tasks of client management, marketing and finances as seamless and pain-free as possible. Perhaps, no tool is more important to the freelancers than a tool that helps them bill clients and track payments.

Introducing: Envoice.

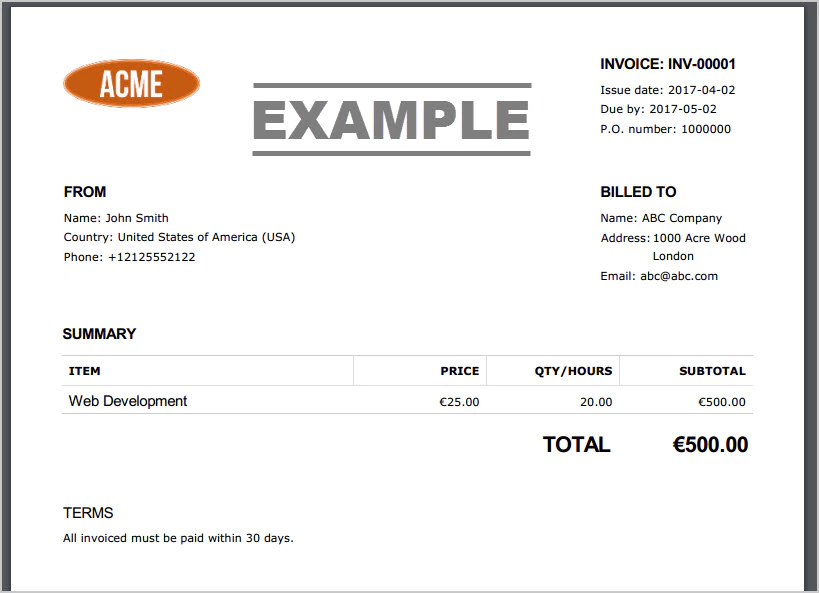

Envoice is a user-friendly invoicing platform that is designed specifically for freelancers. Powered by Emit Knowledge, Envoice is a powerful app that helps both freelancers and their clients manage payments. Invoices are easy to build and send, and the end result is a professional product.

Invoice example created with Envoice

In addition to the easy creation of the invoice, freelancers can:

- Know when clients interact with the invoice – via tracking issued invoices

- Set automatic email and text message reminder for both the sender and the clients for due invoices

- Attach logged hours, agreements or any additional files with the invoice, uploaded from Dropbox or Google Drive

- Enjoy predictive invoicing – Envoice will set client and invoice number based on previous invoices

- Apply discounts on the invoice, when relevant

- Use PO numbers when issuing invoices for big companies

- Grow with the community, thanks to the community articles submitted by other freelancers

How do I set up my Payoneer account in Envoice?

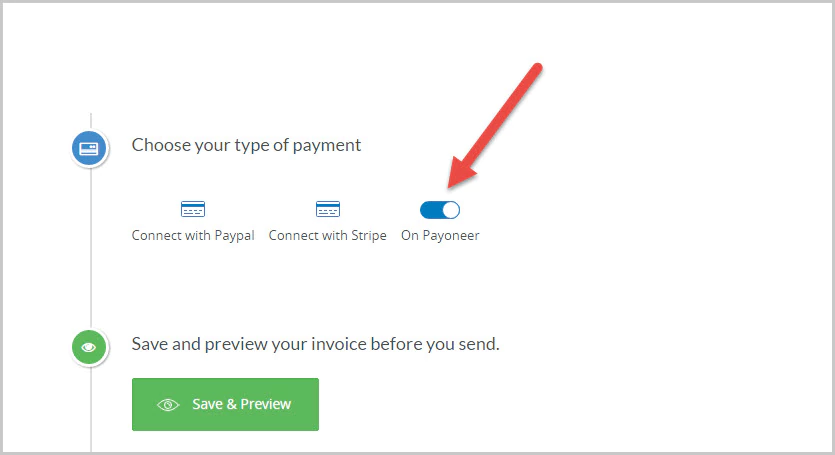

1. Log in to your Envoice account.2. In the Receive Payments menu, select Connect with Payoneer.

3. A new tab will open in your browser. Click on Connect.

4. You will now be redirected to a Payoneer sign-up page. If you already have a Payoneer account, click on the link to sign in. If not, complete the sign-up process by selecting your preferred withdrawal method and clicking on ‘SIGN UP’.5. Once your Payoneer account is paired, the icon in Receive Payments will become On Payoneer. Click on the slider to activate this pairing.

In addition, at the bottom of a created invoice, you will be able to choose Payoneer as your payment type.

Send your invoice to your client, and you’re good to go!

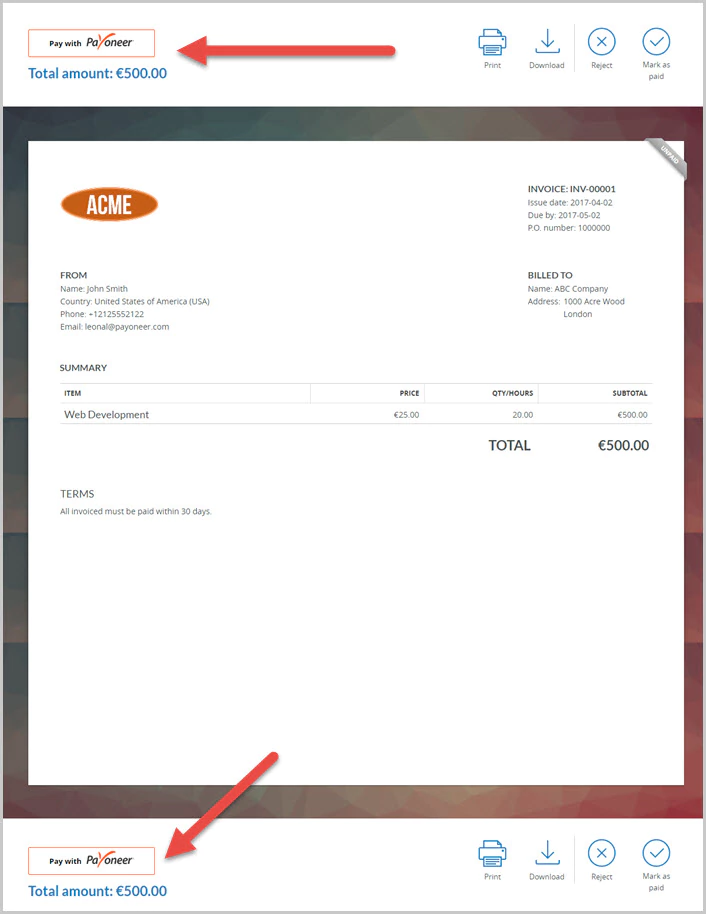

How will it look for my client?

When you send your client the invoice, they will be prompted to Pay with Payoneer, right from the invoice.

Once your client clicks on Pay with Payoneer, they will then have several options for payment. Once payment is complete, the funds will be received directly into your linked Payoneer account.

To get detailed info on linking your accounts, check out Envoice’s full guide here.

[cta-button text=”Log in to your Envoice account ” url=”https://www.envoice.in/invoice/new” color=”#428BCA” type=”referral”]

Related resources

Latest articles

-

Using an Employer of Record in Morocco

Looking for an Employer of Record in Morocco? See how Payoneer Workforce Management’s EOR services help simplify engaging talent in Morocco.

-

Using an Employer of Record in Jordan

Need an Employer of Record in Jordan? Here’s what you need to know about using an EOR in Jordan and how Payoneer Workforce Management can help you engage talent in Jordan.

-

Multi-currency Account: How It Helps Businesses Work With Customers Around the World

Optimize international payments for your IT, eCommerce, or SaaS business with a multicurrency account and easily receive funds from clients from abroad.

-

How to Open an Electronic Wallet: A Guide for Entrepreneurs and Businesses

How quickly and easily can you create an invoice with Payoneer? Learn how it helps businesses accept international payments, track them, and save time.

-

Wire Transfer in Ukraine: What Businesses Need to Know

Wire transfer in Ukraine for business, complete guide: how to make a transfer and receive an international Wire transfer on the account, terms and fees, tips, and examples.

-

Swift, ACH, or Wire: Which International Payment Method Should Businesses Choose?

SWIFT, ACH, or Wire for Ukrainian business: how they work, how they differ, which is cheaper and faster.

Disclaimer

The information in this article/on this page is intended for marketing and informational purposes only and does not constitute legal, financial, tax, or professional advice in any context. Payoneer and Payoneer Workforce Management are not liable for the accuracy, completeness or reliability of the information provided herein. Any opinions expressed are those of the individual author and may not reflect the views of Payoneer or Payoneer Workforce Management. All representations and warranties regarding the information presented are disclaimed. The information in this article/on this page reflects the details available at the time of publication. For the most up-to-date information, please consult a Payoneer and/or Payoneer Workforce Management representative or account executive.

Availability of cards and other products is subject to customer’s eligibility. Not all products are available in all jurisdictions in the same manner. Nothing herein should be understood as solicitation outside the jurisdiction where Payoneer Inc. or its affiliates is licensed to engage in payment services, unless permitted by applicable laws. Depending on or your eligibility, you may be offered the Corporate Purchasing Mastercard, issued by First Century Bank, N.A., under a license by Mastercard® and provided to you by Payoneer Inc., or the Payoneer Business Premium Debit Mastercard®, issued and provided from Ireland by Payoneer Europe Limited under a license by Mastercard®.

Skuad Pte Limited (a Payoneer group company) and its affiliates & subsidiaries provide EoR, AoR, and contractor management services.