How to manage currencies to simplify your global payments

More topics Editor’s note: This service is currently not available in India and Korea. When doing business internationally, you need easy access to funds in major foreign currencies at all times. At Payoneer, you can easily manage your currencies to ensure that you have the currency you need for your payments. Simply transfer between your…

Editor’s note: This service is currently not available in India and Korea.

When doing business internationally, you need easy access to funds in major foreign currencies at all times.

At Payoneer, you can easily manage your currencies to ensure that you have the currency you need for your payments. Simply transfer between your different Payoneer currency balances to get the currency you need, and then make your payment.

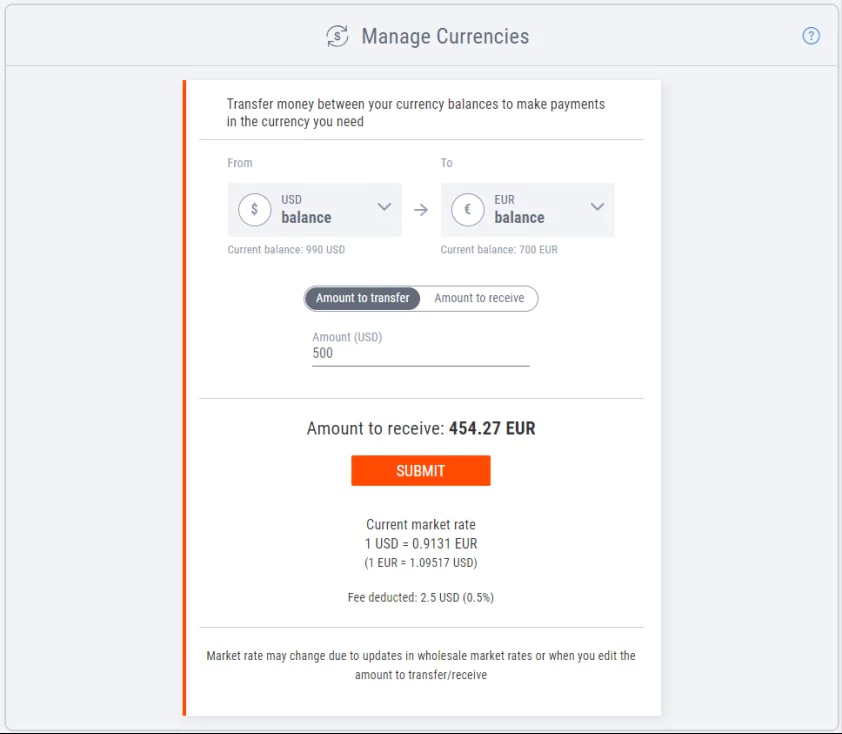

And, managing currencies is affordable! We use the current market rate and our low fee of 0.5% of the amount to transfer is automatically deducted so you’ll always know exactly how much money you’re going to receive.

Why Would I Want to Manage Currencies by Transferring Funds Between My Currency Balances?

Transferring between balances enables you to have funds available in a specific currency to:

- Make payments to your suppliers, contractors and business partners, whether they have a Payoneer account or not.

- Make VAT payments.

- Access funds in a specific currency you’re being billed in, if your service provider uses the Pay with Payoneer API to debit your account.

How it Works

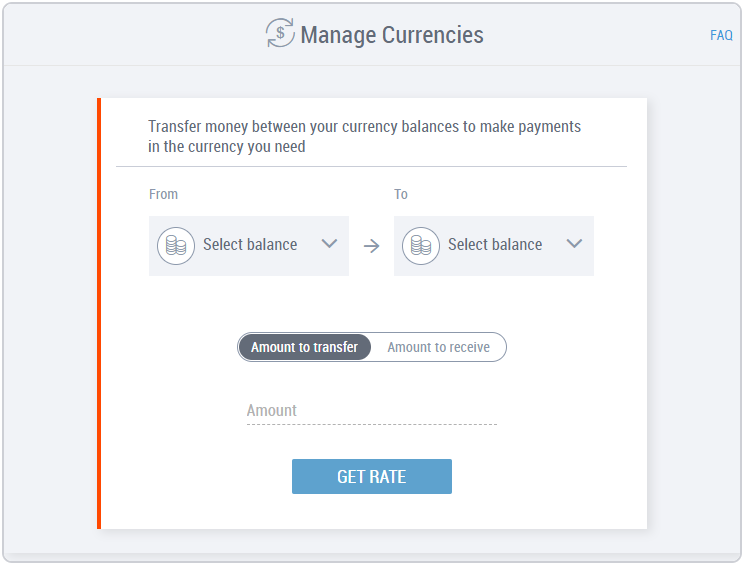

- Sign in to your Payoneer account and click Activity > Manage Currencies. The Manage Currencies page opens.

- Select a balance for the currency you want to transfer.

- Select a balance for the currency you want to receive.

- Enter an amount. You can select whether to enter amount to transfer or amount to receive.

- Click Get Rate and review the amount, rate, and fee. The rate will be held for a short time period.

- Click SUBMIT to submit the request and transfer the money between your balances.

That’s it! You’ll receive your requested currency in just minutes.*

Keep in Mind

- From the moment the request is submitted, funds are generally transferred to the receiving balance within minutes.*

- Periods of unavailability and periodic limits may sometimes be in effect for certain currencies. In such cases, we’ll let you know before completing the request.

- We currently support the following currencies: USD, EUR, GBP, CAD, AUD and JPY. The list of supported currencies may change from time to time and differ from region to region.

- You need at least two supported currencies to manage currencies. If you need additional currencies, contact us.

For more information check out our FAQ page.

Editor’s Note: The original post was updated on 17.12.19 for accuracy and comprehensiveness.

*In some cases, it may take several hours for funds to appear in your balance.

**Services are subject to limitations and eligibility requirements.

Related resources

Latest articles

-

Using an Employer of Record in Morocco

Looking for an Employer of Record in Morocco? See how Payoneer Workforce Management’s EOR services help simplify engaging talent in Morocco.

-

Using an Employer of Record in Jordan

Need an Employer of Record in Jordan? Here’s what you need to know about using an EOR in Jordan and how Payoneer Workforce Management can help you engage talent in Jordan.

-

Multi-currency Account: How It Helps Businesses Work With Customers Around the World

Optimize international payments for your IT, eCommerce, or SaaS business with a multicurrency account and easily receive funds from clients from abroad.

-

How to Open an Electronic Wallet: A Guide for Entrepreneurs and Businesses

How quickly and easily can you create an invoice with Payoneer? Learn how it helps businesses accept international payments, track them, and save time.

-

Wire Transfer in Ukraine: What Businesses Need to Know

Wire transfer in Ukraine for business, complete guide: how to make a transfer and receive an international Wire transfer on the account, terms and fees, tips, and examples.

-

Swift, ACH, or Wire: Which International Payment Method Should Businesses Choose?

SWIFT, ACH, or Wire for Ukrainian business: how they work, how they differ, which is cheaper and faster.

Disclaimer

The information in this article/on this page is intended for marketing and informational purposes only and does not constitute legal, financial, tax, or professional advice in any context. Payoneer and Payoneer Workforce Management are not liable for the accuracy, completeness or reliability of the information provided herein. Any opinions expressed are those of the individual author and may not reflect the views of Payoneer or Payoneer Workforce Management. All representations and warranties regarding the information presented are disclaimed. The information in this article/on this page reflects the details available at the time of publication. For the most up-to-date information, please consult a Payoneer and/or Payoneer Workforce Management representative or account executive.

Availability of cards and other products is subject to customer’s eligibility. Not all products are available in all jurisdictions in the same manner. Nothing herein should be understood as solicitation outside the jurisdiction where Payoneer Inc. or its affiliates is licensed to engage in payment services, unless permitted by applicable laws. Depending on or your eligibility, you may be offered the Corporate Purchasing Mastercard, issued by First Century Bank, N.A., under a license by Mastercard® and provided to you by Payoneer Inc., or the Payoneer Business Premium Debit Mastercard®, issued and provided from Ireland by Payoneer Europe Limited under a license by Mastercard®.

Skuad Pte Limited (a Payoneer group company) and its affiliates & subsidiaries provide EoR, AoR, and contractor management services.