Attach invoices, contracts and more when you request a payment

More topics Whether your clients are around the corner or 5 time-zones away, billing them and receiving payments has never been easier. Payoneer’s Request a Payment enables freelancers, contractors and professionals to send out payment requests for work completed. The clients can then choose to pay via payment options, including credit/debit card, ACH bank debit and local bank transfer…

Whether your clients are around the corner or 5 time-zones away, billing them and receiving payments has never been easier. Payoneer’s Request a Payment enables freelancers, contractors and professionals to send out payment requests for work completed. The clients can then choose to pay via payment options, including credit/debit card, ACH bank debit and local bank transfer (via the Global Payment Service). It’s a great solution for all parties.

We’re excited to announce some new features that are now available for Payoneer users using Request a Payment! We aim to make this service as easy and functional as possible for both users and their clients, and are constantly working to improve the experience for everyone.

Attachments

You can now add an attachment to your request for payment. Here are some examples of files you might want to attach:

- All professionals: invoices, contracts, timesheets, product photos, shipping details, etc

- Designers: design files pertaining to the payment request

- Translators/writers: documents you have created for the project

And many more! Here’s how to attach a file to your payment request:

1. Log in to My Account to Request a Payment.

Before you can start sending payment requests, you will be asked to provide information that verifies your identity and line of business. This is necessary to verify that your business is supported under our terms of service and to prevent fraud or identity theft. If any additional information is needed, we will contact you by email.

2. The Request a Payment window will open, where you will need to fill out the details. You’ll notice a new field under Payment Details, which allows you to upload files. Click on it and a file navigator will load.

You can add a description to the file, to let the receiver know what the file contains.

NOTE: You can attach up to 5 files to send with your payment request, with a max file size of 10MB. Supported file formats: PDF, DOC, DOCX, JPEG, JPG, PNG, TIFF, BMP, XLS, XLSX.

If you need to create your invoice first, then you can create invoices in PDF format for free with this online invoice generation tool: freeinvoicebuilder.com

And how does it look on the client’s side?

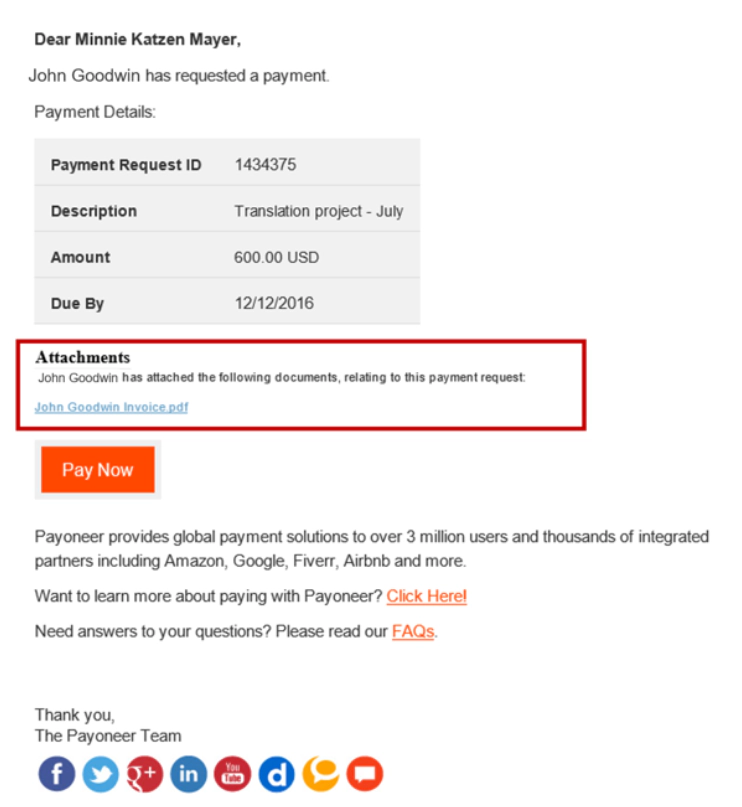

The client receives the payment request as usual, with the attached files available for download:

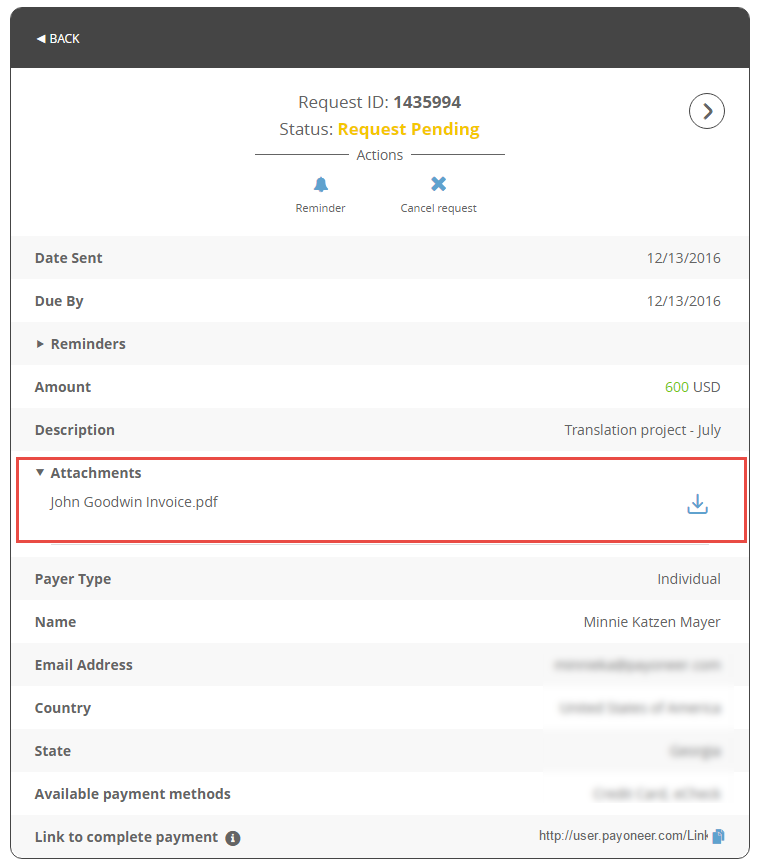

Can I access the attachment later?

Of course. On the Activity Menu, select Payment Requests Sent. Then, select the specific Payment Request you’d like to view.

Click on Attachments, and you’ll see what was included in the Payment Request. You can even download the attachments from here.

Direct links to payment requests

Would you rather send your clients a direct link to the payment request? This feature is also available now. If you have an established personal relationship with your client and would prefer to send them the request yourself, all you have to do is copy it and send it via email, message or text to allow them to directly access the payment request.

After sending the request, the following window will appear

Click on “a direct link to complete this payment”.

The direct link appears at the bottom, and you can copy and paste it to send to your contact.

Making payments easier for your clients

As always, your clients will enjoy multiple payment options for fulfilling your payment requests: via credit card, ACH bank debit or bank transfer. What’s more, the ACH bank debit limit has been raised to $10,000 – making it easier for payers to close out large invoices at once.

To read more about the service and requirements for eligibility, please see our full FAQ. Some transactions, such as selling goods directly to a consumer, are prohibited. Please see our Terms & Conditions for the full list of prohibited services.

Stay tuned for more updates!

Related resources

Latest articles

-

Using an Employer of Record in Morocco

Looking for an Employer of Record in Morocco? See how Payoneer Workforce Management’s EOR services help simplify engaging talent in Morocco.

-

Using an Employer of Record in Jordan

Need an Employer of Record in Jordan? Here’s what you need to know about using an EOR in Jordan and how Payoneer Workforce Management can help you engage talent in Jordan.

-

Multi-currency Account: How It Helps Businesses Work With Customers Around the World

Optimize international payments for your IT, eCommerce, or SaaS business with a multicurrency account and easily receive funds from clients from abroad.

-

How to Open an Electronic Wallet: A Guide for Entrepreneurs and Businesses

How quickly and easily can you create an invoice with Payoneer? Learn how it helps businesses accept international payments, track them, and save time.

-

Wire Transfer in Ukraine: What Businesses Need to Know

Wire transfer in Ukraine for business, complete guide: how to make a transfer and receive an international Wire transfer on the account, terms and fees, tips, and examples.

-

Swift, ACH, or Wire: Which International Payment Method Should Businesses Choose?

SWIFT, ACH, or Wire for Ukrainian business: how they work, how they differ, which is cheaper and faster.

Disclaimer

The information in this article/on this page is intended for marketing and informational purposes only and does not constitute legal, financial, tax, or professional advice in any context. Payoneer and Payoneer Workforce Management are not liable for the accuracy, completeness or reliability of the information provided herein. Any opinions expressed are those of the individual author and may not reflect the views of Payoneer or Payoneer Workforce Management. All representations and warranties regarding the information presented are disclaimed. The information in this article/on this page reflects the details available at the time of publication. For the most up-to-date information, please consult a Payoneer and/or Payoneer Workforce Management representative or account executive.

Availability of cards and other products is subject to customer’s eligibility. Not all products are available in all jurisdictions in the same manner. Nothing herein should be understood as solicitation outside the jurisdiction where Payoneer Inc. or its affiliates is licensed to engage in payment services, unless permitted by applicable laws. Depending on or your eligibility, you may be offered the Corporate Purchasing Mastercard, issued by First Century Bank, N.A., under a license by Mastercard® and provided to you by Payoneer Inc., or the Payoneer Business Premium Debit Mastercard®, issued and provided from Ireland by Payoneer Europe Limited under a license by Mastercard®.

Skuad Pte Limited (a Payoneer group company) and its affiliates & subsidiaries provide EoR, AoR, and contractor management services.