Paying contractors and remote employees in Latin America

More topics If you’re running a business in the US, Europe or even in Latin America, there’s a good chance you’ll find yourself working with remote employees and/or contractors who are based in other Latin American countries. The region is popular among digital nomads, has a busy startup ecosystem, and it helps that the time…

If you’re running a business in the US, Europe or even in Latin America, there’s a good chance you’ll find yourself working with remote employees and/or contractors who are based in other Latin American countries. The region is popular among digital nomads, has a busy startup ecosystem, and it helps that the time zone is close to that of much of the US and among Latin American countries themselves.

But to make your partnership with remote employees or contractors in Latin America work smoothly, you need an easy and low-cost way to make business payments to countries in that region.

Cross-border business payments often come with high fees and poor transparency, making it hard to be confident if your payment has arrived. On top of that, your funds can take a long time to clear, which is frustrating for your workers or contractors who rely on your income.

Here are some of the preferred options to pay contractors and remote employees in Latin America.

Here is a summary of the different options you have.

Payment options

*Available for companies only

Overall description

How to pay contractors and employees in Latin America

SWIFT bank transfers

Like most countries in the world, banks in Latin America overall are part of the SWIFT international money transfer system. It’s reliable and secure, but it can be expensive and slow as well.

Depending on which bank you use, the fees can be as high as $40 or more per transfer. You won’t know how much it will cost until you make the payment order, so it’s hard to plan ahead if you’re the one paying the fees.

SWIFT transfers can take several days to clear, and there’s little transparency, so you can’t easily trace the payment if it doesn’t arrive as expected.

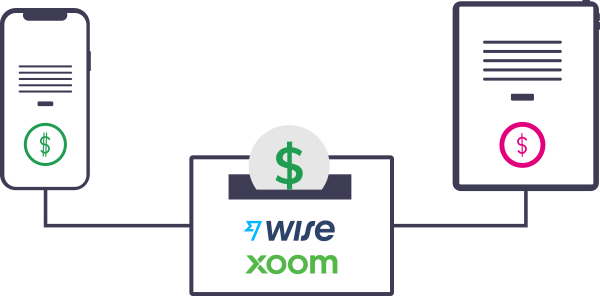

Money transfer services

Money transfer services are set up specifically to make cross-border foreign currency payments run more smoothly, so the fees are usually transparent and currency conversion costs are often lower.

A number of money transfer companies serve Latin America, including familiar names like Wise, Xoom (owned by PayPal), and business-focused payment solutions like Remitly. These companies offer a secure, direct payment service that handles currency conversion and deposits the money directly into the recipient’s bank account.

But you’ll still have to pay a sizable fee, plus the payment service might not support your local currency, so you’ll lose even more money on an extra currency conversion.

Integrated payroll services

Outsourcing to Latin America and working with freelancers and agencies overseas is so popular that there’s a whole range of companies offering integrated services to help make the whole experience smoother.

Platforms like help you prepare and sign contracts, guide you through local employment laws, calculate taxes, and streamline the payment process too. You’ll typically have to pay a monthly fee which varies according to how many contractors you manage, but it can be as high as $300-700 per contractor, per month, which is pretty steep when you’ve managed hiring.

However, because the platform addresses the whole process of hiring, onboarding, and managing compensation, it doesn’t offer many payment options. Usually it just connects with your business bank account, leaving you to pay high currency conversion fees. Also, you might also prefer to use the tax management tools that you’re familiar with, instead of having to learn new ones.

Digital wallets

Digital wallets are becoming more popular, especially among contractors and freelancers. Much of the population is unbanked and smartphone penetration is very high, so lots of people in the region use digital wallets and ewallets instead of a bank account.

Freelancers in Latin American can receive payments on international digital wallets like Apple Wallet and Google Pay.

While regional and local wallets such as PicPay, Nubank in Brazil, Rappi in Colombia, and MercadoPago in Argentina are growing fast, they still do not enable their users to receive international payments (although Nubank has a partnership with a local player, Remessa Online, to receive international funds, this is not available for B2B payments, only remittances).

Although digital wallets might be convenient for your partners and employees, they aren’t always so convenient for you. International wallets often have high fees and poor exchange rates, and local wallets might require you to convert your payment into local currency before using the platform.

Payoneer: A better way to pay partners in Latin America

Payoneer makes it easy and cost effective to pay your remote workers or contractors in Latin America from over countries worldwide. You can make payments directly from the balance in your Payoneer account, or connect your credit card or US or Canadian bank account for funds to be debited automatically.

Once you’ve authorized the payment, recipients can withdraw funds to their local bank account at low fees.

It’s simple to use Payoneer to pay accounts in Latam. It only takes a few clicks to complete the payment order, and you can either initiate a payment or respond to a request. Payoneer also offers a batch payment function so you can pay multiple employees, freelancers, agencies, or suppliers with a single transaction order.

The benefits of using Payoneer to pay your partners and workers in Latin America

Payoneer lets you offer contractors and employees fast, secure payments straight into their Payoneer account. They’ll appreciate being able to withdraw income to their local bank account in USD or local currency in 190+ countries, at competitive conversion rates.

It’s also up to you to decide who pays the fees, but either way they won’t be high. Payoneer charges 1% for USD transfers, and transfers in any other currency are fee-free. In contrast, PayPal and similar alternative payment solutions charge fees of 3-5%. Currency conversion fees for contractors are just 2% in total, but a local bank would typically charge 4-6%.

Paying Latin America-based partners through Payoneer saves you time, too. With the batch payments feature you can authorize multiple payments at once, and there’s no need to spend time coordinating cash flow to ensure there’s enough money in your Payoneer account. Just link your local credit card, or your bank account if you’re in the US or Canada, and it will be debited automatically for each payment.

Finally, Payoneer transactions give you and your recipients the peace of mind of knowing that your payment is completely transparent. You can track its progress until it reaches its destination.

Of course, once you’ve been paid and the funds are in your contractor’s Payoneer account, you have multiple ways in which you can use your funds. From using them to spend online or in stores, wherever visa or Mastercard is accepted, to paying for your online advertising spends, it’s a simple and easy process.

Keeping your earnings and payments centralized from one location makes managing payments really straight forward and highly convenient. So too can contractors then also pay they other vendors directly to their Payoneer account (for free!) or to their external bank accounts. Plus, as Payoneer is integrated with Prex, Ligo, and Husly, you can make payments directly to these platforms from within Payoneer too.

Alternatively, you can always just withdraw your funds directly to your local bank account at a very low rate, thanks to Payoneer’s advanced banking infrastructure in over 150 countries.

A better way to send payments to Latin America

With Payoneer, you can send secure, traceable payments to your suppliers, contractors, employees, and partners in Latin America without paying high fees or waiting days for funds to clear. Save time on administration, stop worrying about cash flow, and keep your recipients happy when you streamline business payments to Argentina, Colombia, Brazil or other Latin American countries with Payoneer.

Related resources

Latest articles

-

Using an Employer of Record in Morocco

Looking for an Employer of Record in Morocco? See how Payoneer Workforce Management’s EOR services help simplify engaging talent in Morocco.

-

Using an Employer of Record in Jordan

Need an Employer of Record in Jordan? Here’s what you need to know about using an EOR in Jordan and how Payoneer Workforce Management can help you engage talent in Jordan.

-

Multi-currency Account: How It Helps Businesses Work With Customers Around the World

Optimize international payments for your IT, eCommerce, or SaaS business with a multicurrency account and easily receive funds from clients from abroad.

-

How to Open an Electronic Wallet: A Guide for Entrepreneurs and Businesses

How quickly and easily can you create an invoice with Payoneer? Learn how it helps businesses accept international payments, track them, and save time.

-

Wire Transfer in Ukraine: What Businesses Need to Know

Wire transfer in Ukraine for business, complete guide: how to make a transfer and receive an international Wire transfer on the account, terms and fees, tips, and examples.

-

Swift, ACH, or Wire: Which International Payment Method Should Businesses Choose?

SWIFT, ACH, or Wire for Ukrainian business: how they work, how they differ, which is cheaper and faster.

Disclaimer

The information in this article/on this page is intended for marketing and informational purposes only and does not constitute legal, financial, tax, or professional advice in any context. Payoneer and Payoneer Workforce Management are not liable for the accuracy, completeness or reliability of the information provided herein. Any opinions expressed are those of the individual author and may not reflect the views of Payoneer or Payoneer Workforce Management. All representations and warranties regarding the information presented are disclaimed. The information in this article/on this page reflects the details available at the time of publication. For the most up-to-date information, please consult a Payoneer and/or Payoneer Workforce Management representative or account executive.

Availability of cards and other products is subject to customer’s eligibility. Not all products are available in all jurisdictions in the same manner. Nothing herein should be understood as solicitation outside the jurisdiction where Payoneer Inc. or its affiliates is licensed to engage in payment services, unless permitted by applicable laws. Depending on or your eligibility, you may be offered the Corporate Purchasing Mastercard, issued by First Century Bank, N.A., under a license by Mastercard® and provided to you by Payoneer Inc., or the Payoneer Business Premium Debit Mastercard®, issued and provided from Ireland by Payoneer Europe Limited under a license by Mastercard®.

Skuad Pte Limited (a Payoneer group company) and its affiliates & subsidiaries provide EoR, AoR, and contractor management services.