Your Guide to Amazon CA Seller Central

More topics Getting paid from Amazon CA Seller Central As the eCommerce market in Canada rapidly expands, Amazon CA seller central is an essential platform for eSellers. With revenue projected to reach US$62.12bn in 2023 and an annual growth rate (CAGR 2023-2027) of 10.95%, Amazon CA seller central can help eSellers tap into this growing…

Getting paid from Amazon CA Seller Central

As the eCommerce market in Canada rapidly expands, Amazon CA seller central is an essential platform for eSellers. With revenue projected to reach US$62.12bn in 2023 and an annual growth rate (CAGR 2023-2027) of 10.95%, Amazon CA seller central can help eSellers tap into this growing market.

Although China currently generates the most revenue, Amazon CA seller central provides a great opportunity for eSellers in Canada, where the number of users is expected to reach 31.7 million by 2027.

Standalone retailers struggle to find their unique selling proposition (USP) as marketplaces like Amazon and AliExpress flourish. By leveraging Amazon CA seller central, eSellers can increase their brand engagement through community building, loyalty programs, and a seamless mobile and desktop user experience.

As Chinese eCommerce giants like Alibaba Group, JD, and Pinduoduo continue to push technology forward and diversify into every sphere of online retail, Amazon CA seller central can help eSellers stay competitive and succeed in the rapidly evolving eCommerce landscape.

By the numbers: ecommerce growth in Canada

Setting up your Amazon CA seller central account is just the beginning of your eCommerce journey. As you embark on the exciting path of selling your products online, you’ll want to ensure that receiving payments from your sales is seamless and hassle-free. Enter Payoneer – the ultimate solution for eCommerce entrepreneurs who want to make the most of their online sales.

With Payoneer’s local receiving accounts in CAD, USD, EUR, AUD, GBP, and many other currencies, receiving disbursements has never been easier. The Payoneer Global Payment Service (GPS) provides eSellers with a flexible and convenient way to manage their funds from anywhere in the world.

With a Payoneer account, you can use your Payoneer Prepaid Mastercard to purchase in online stores or in person and withdraw cash from ATMs worldwide.

In addition to its user-friendly platform, Payoneer offers competitive exchange rates for converting Amazon disbursements in CAD into your local currency. This means you can receive your payments quickly and safely without worrying about fluctuating exchange rates or hidden fees. It’s a convenient and cost-effective option to the many volatile alternatives.

But that’s not all – Payoneer offers a suite of powerful tools and features to help eSellers streamline their eCommerce business. From automated VAT invoicing to multi-currency billing, Payoneer has everything you need to manage your online sales with ease.

Take your eCommerce business to the next level. Don’t just take our word for it – the 2023 Stats on eCommerce in Canada chart and the comparable estimates for eCommerce (Canada) graphics speak for themselves. These valuable resources paint a clear picture of the rapidly growing eCommerce market in Canada and the potential for eSellers to thrive.

With Payoneer’s user-friendly platform, competitive exchange rates, and powerful tools and features, you can maximize your eCommerce potential and capitalize on the tremendous growth opportunities that lie ahead. Take advantage of Payoneer’s innovative payment solutions and unlock the full potential of your eCommerce business today.

Payoneer makes it easy for ecommerce sellers like you to get paid from top marketplaces worldwide, so you can focus on what you do best – growing your business.

The step-by-step guide to getting paid through Payoneer

If you’re an eCommerce entrepreneur looking to expand your business into Maple Country, Amazon Seller Central Canada is an excellent platform to sell your products in a large and growing eCommerce market. But once you start making sales, you’ll need a reliable way to receive disbursements.

That’s where Payoneer comes in – a flexible payment solution that enables eSellers to receive payments from Amazon in their local currency. In this step-by-step guide, we’ll walk you through the process of receiving disbursements through Payoneer from your Amazon Seller Central Canada account.

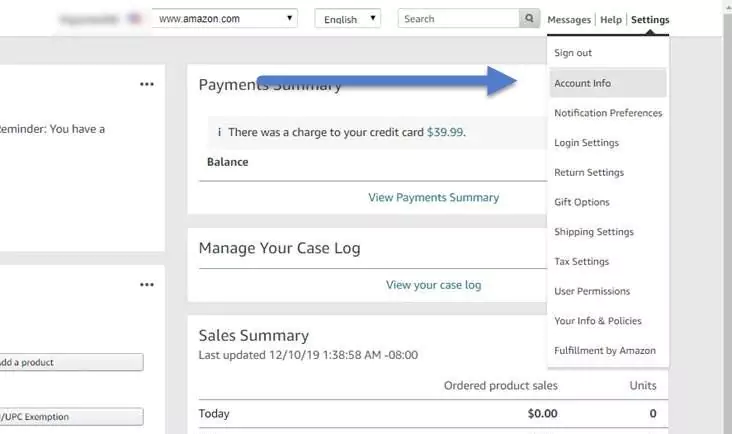

Step 1: Log in to your Amazon Seller Central account

To begin the process of receiving disbursements through Payoneer, log in to your Amazon CA Seller Central account. Once you’re logged in, select ‘Settings’ from the menu, then click on ‘Account Info’ in the drop-down menu.

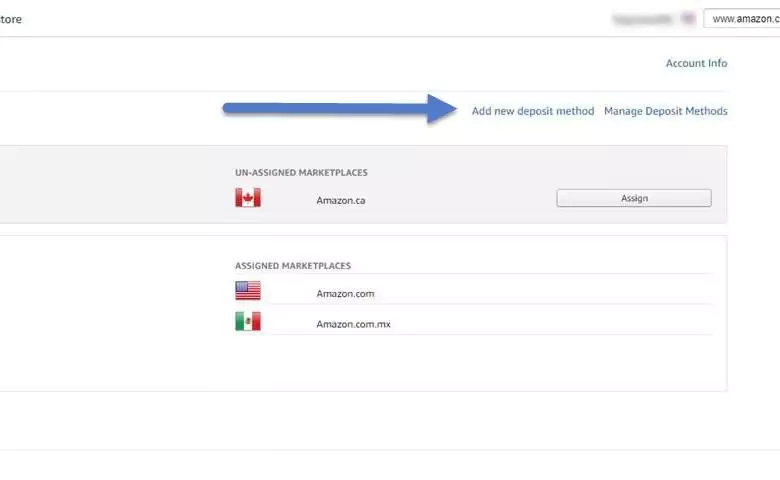

Step 2: Access ‘Deposit Methods’ in Payment Information

Once you’ve accessed your Amazon Seller Central account’s ‘Account Info’ page, look for the ‘Payment Information’ section. Here, you’ll find various settings related to your payment preferences.

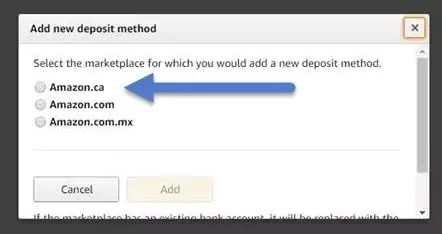

Step 3: Select ‘Add a deposit method’ to add Amazon.ca as a deposit option.

Notice the list of bullet points beneath ‘Add new deposit method.’ This menu allows you to select your preferred Amazon marketplace.

Highlight the appropriate deposit method – Amazon.ca – from the list.

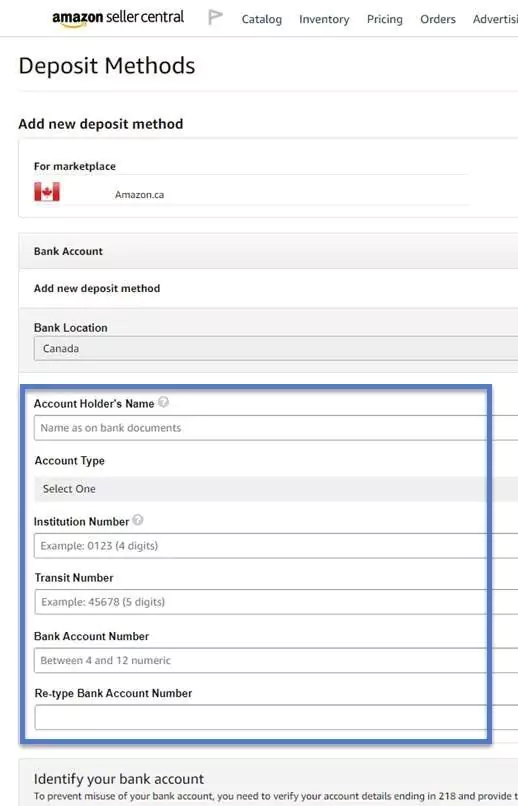

Step 4: Set Up Your Canadian Bank Account with Payoneer Global Payment Service

After verifying your Payoneer account and adding it as a deposit method to your Amazon Seller Central account, you can quickly set up your Canadian bank account through the ‘Payoneer Global Payment Service.

Enter your Canadian bank account details into the Payoneer system, and your account will be created in the Seller Central system. With this simple process, you can ensure that your disbursements from Amazon are deposited directly into your Canadian bank account through Payoneer, making it quick and easy to manage your payments and grow your eCommerce business.

Once you have set up your Payoneer account and added it as a deposit method in your Amazon CA Seller Central account, you can easily set up your Canadian bank account through Payoneer Global Payment Service. Here’s how to do it:

- Choose Canada as your bank location to withdraw funds in Canadian dollars (CAD).

- Enter the relevant information in the remaining fields with your Institution Number, Transit Number, and Bank Account Number. If you are not sure where to find this information, you can access all of this from your Payoneer account. Navigate to your Payoneer account page, scroll to ‘Receive,’ select ‘Global Payment Service,’ and choose CAD. You will find all the necessary details listed.

- Verify your Bank Account Number and identify your bank account by completing the full account number again. Save the account details by clicking ‘Set Deposit Method.’

Presto! Amazon CA Seller Central will now provide your disbursements in CAD directly to your Payoneer account. To view the amounts of your disbursements, log in to your Payoneer account. Next, click on ‘Activity,’ then ‘Payment History.’ If you want to withdraw your funds, click ‘Withdraw’ on the main menu, then ‘To Bank Account.’

Alternatively, if you are in possession of a Payoneer Prepaid Mastercard®, you can easily load your Amazon earnings onto the Mastercard®. And if you need to pay your contractors or suppliers, you can send funds to anyone with an email address by clicking ‘Pay’ on the main menu and selecting ‘Make a Payment.’ Follow the on-screen instructions to complete the payment.

That’s how easy it is to get paid through Amazon CA Seller Central. By setting up your Canadian bank account through Payoneer Global Payment Service, you can receive your Amazon CA Seller Central disbursements in CAD and easily manage your payments.

Refer to this step-by-step guide to set up your Canadian bank account today and streamline your eCommerce business.

Payoneer makes it easy for ecommerce sellers like you to get paid from top marketplaces worldwide, so you can focus on what you do best – growing your business.

Related resources

Latest articles

-

Using an Employer of Record in Morocco

Looking for an Employer of Record in Morocco? See how Payoneer Workforce Management’s EOR services help simplify engaging talent in Morocco.

-

Using an Employer of Record in Jordan

Need an Employer of Record in Jordan? Here’s what you need to know about using an EOR in Jordan and how Payoneer Workforce Management can help you engage talent in Jordan.

-

Multi-currency Account: How It Helps Businesses Work With Customers Around the World

Optimize international payments for your IT, eCommerce, or SaaS business with a multicurrency account and easily receive funds from clients from abroad.

-

How to Open an Electronic Wallet: A Guide for Entrepreneurs and Businesses

How quickly and easily can you create an invoice with Payoneer? Learn how it helps businesses accept international payments, track them, and save time.

-

Wire Transfer in Ukraine: What Businesses Need to Know

Wire transfer in Ukraine for business, complete guide: how to make a transfer and receive an international Wire transfer on the account, terms and fees, tips, and examples.

-

Swift, ACH, or Wire: Which International Payment Method Should Businesses Choose?

SWIFT, ACH, or Wire for Ukrainian business: how they work, how they differ, which is cheaper and faster.

Disclaimer

The information in this article/on this page is intended for marketing and informational purposes only and does not constitute legal, financial, tax, or professional advice in any context. Payoneer and Payoneer Workforce Management are not liable for the accuracy, completeness or reliability of the information provided herein. Any opinions expressed are those of the individual author and may not reflect the views of Payoneer or Payoneer Workforce Management. All representations and warranties regarding the information presented are disclaimed. The information in this article/on this page reflects the details available at the time of publication. For the most up-to-date information, please consult a Payoneer and/or Payoneer Workforce Management representative or account executive.

Availability of cards and other products is subject to customer’s eligibility. Not all products are available in all jurisdictions in the same manner. Nothing herein should be understood as solicitation outside the jurisdiction where Payoneer Inc. or its affiliates is licensed to engage in payment services, unless permitted by applicable laws. Depending on or your eligibility, you may be offered the Corporate Purchasing Mastercard, issued by First Century Bank, N.A., under a license by Mastercard® and provided to you by Payoneer Inc., or the Payoneer Business Premium Debit Mastercard®, issued and provided from Ireland by Payoneer Europe Limited under a license by Mastercard®.

Skuad Pte Limited (a Payoneer group company) and its affiliates & subsidiaries provide EoR, AoR, and contractor management services.