We’ve partnered with bKash to streamline Bangladeshi cross-border payments

More topics Great news for Bangladeshi gig workers and entrepreneurs! Payoneer has teamed up with bKash, Bangladesh’s largest Mobile Financial Services (MFS) provider to streamline your payments and ensure that you’re able to access your funds whenever you want, wherever you want. With bKash, users can take advantage of: Connecting your Payoneer and bKash accounts…

Great news for Bangladeshi gig workers and entrepreneurs! Payoneer has teamed up with bKash, Bangladesh’s largest Mobile Financial Services (MFS) provider to streamline your payments and ensure that you’re able to access your funds whenever you want, wherever you want. With bKash, users can take advantage of:

- 24/7 real-time withdrawals

- Minimum withdrawal of only 1,000 BDT

- Notifications for every successful and failed transaction

- Zero additional paperwork

Connecting your Payoneer and bKash accounts

Linking your Payoneer and bKash accounts is a simple process that can be broken down in the following steps:

1. Log into bKash app and select remittance. Then select Payoneer and Link my Payoneer Account:

2. Enter in your email and Payoneer password and proceed with the Payoneer and bKash verification process:

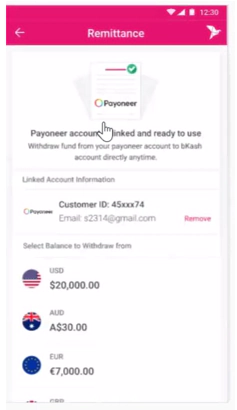

3. After you complete the process, you’ll be notified that your Payoneer account has been linked:

That’s it! Once your Payoneer account is active, you’ll be able to instantly withdraw funds straight to your bKash account.

Withdrawing from Payoneer to your bKash account

To withdraw funds from your Payoneer account to your bKash account, simply follow the steps outlined below:

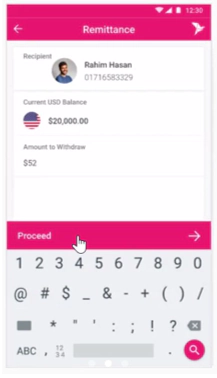

1. In your bKash app, select the foreign currency you’d like to withdraw:

2. Input the withdrawal amount and click “proceed”:

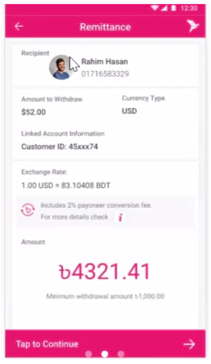

3. You’ll then be able to see the converted BDT amount. When you’re ready, click “Tap to Continue”:

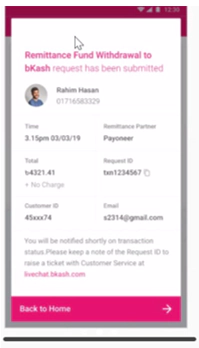

4. You’ll then see a notification that your withdrawal request has been submitted:

5. This will be followed by a confirmation notification that your withdrawal has indeed been processed:

Still waiting to connect your bKash and Payoneer accounts? Now’s the time so you can start getting paid globally and withdrawing locally.

Related resources

Latest articles

-

Employment laws in Sweden

Explore the employment laws in Sweden, a comprehensive guide to employees’ rights, employer obligations, and fair labor practices.

-

Employment laws in Poland

Explore the ins and outs of employment laws in Poland, an info-rich guide to employees’ rights, employer obligations, and fair labor practices that shape the future.

-

Employment laws in Indonesia

Find out more about Indonesia labor laws that dictate how employees should be contracted, managed, and paid, both on a national and state/territory level.

-

Employment laws in France

Learn about France’s labor laws dictating minimum wage, benefits, and more. Plus, discover the consequences of non-compliance with employment laws in France.

-

Employment laws in Spain

Find out more about Spain’s labor laws, from contracts and benefits to termination rules.

-

Employment laws in Australia

Find out more about the employment laws in Australia that dictate how employees should be contracted, managed, and paid, both on a national and state/territory level.

Disclaimer

The information in this article/on this page is intended for marketing and informational purposes only and does not constitute legal, financial, tax, or professional advice in any context. Payoneer and Payoneer Workforce Management are not liable for the accuracy, completeness or reliability of the information provided herein. Any opinions expressed are those of the individual author and may not reflect the views of Payoneer or Payoneer Workforce Management. All representations and warranties regarding the information presented are disclaimed. The information in this article/on this page reflects the details available at the time of publication. For the most up-to-date information, please consult a Payoneer and/or Payoneer Workforce Management representative or account executive.

Availability of cards and other products is subject to customer’s eligibility. Not all products are available in all jurisdictions in the same manner. Nothing herein should be understood as solicitation outside the jurisdiction where Payoneer Inc. or its affiliates is licensed to engage in payment services, unless permitted by applicable laws. Depending on or your eligibility, you may be offered the Corporate Purchasing Mastercard, issued by First Century Bank, N.A., under a license by Mastercard® and provided to you by Payoneer Inc., or the Payoneer Business Premium Debit Mastercard®, issued and provided from Ireland by Payoneer Europe Limited under a license by Mastercard®.

Skuad Pte Limited (a Payoneer group company) and its affiliates & subsidiaries provide EoR, AoR, and contractor management services.