The State of Freelancing During COVID-19: 3 Takeaways from our Report

As COVID-19 continues to spread around the world, the remote workforce has become the new norm for the first time in modern history. Many freelancers and gig-workers share the same concerns for job security and financial stability, leaving them to wonder – what’s in store for the future of freelancing? Will the future of work…

As COVID-19 continues to spread around the world, the remote workforce has become the new norm for the first time in modern history.

Many freelancers and gig-workers share the same concerns for job security and financial stability, leaving them to wonder – what’s in store for the future of freelancing? Will the future of work shift to be entirely remote now that we see work can be done at a high level remotely and result in more outsourcing, or will businesses need to cut costs and reduce the amount of outsourced work?

To better understand how the current pandemic has affected the freelance economy, Payoneer surveyed over 1,000 freelancers from 100+ countries, asking them to share how COVID-19 has impacted the demand for their services, their hourly rates and what opportunities and risks they expect will arise from the crisis. Survey respondents provided us with unique insights into what they believe is the future of freelancing and how they expect the workforce to bounce back once the outbreak is under control.

Let’s take a deeper look into three takeaways from our report and see what freelancers had to say.

1. Demand for Freelancers Has Dropped in the Short-Term

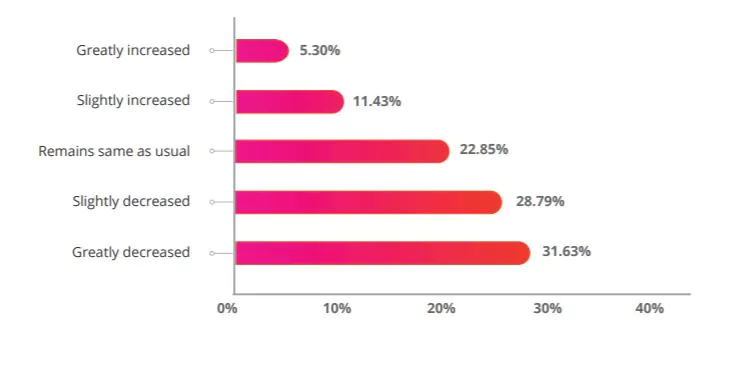

We asked freelancers if over the past three months, they’ve seen a change in demand for their freelance services. Close to 32% of the freelancers surveyed mentioned that demand has decreased greatly, suggesting that businesses and companies have cut freelancing costs and have halted any new projects or contracts. However, there is a bright side as 23% of freelancers reported that business has remained as usual with an additional 17% saying that demand has actually increased during this period.

*Total numbers may fall slightly below 100% in cases where some survey respondents skipped the specific question.

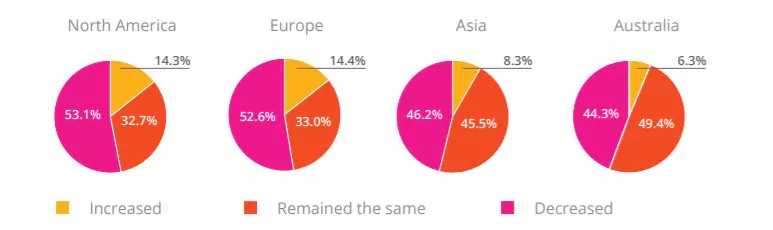

Furthermore, freelancers who work with international clients based in North America and Europe saw the highest slowdown in demand. Those with clients based in Asia and Australia – regions which first experienced the outbreak, have seen less of a decrease in demand for freelancers. This suggests that as certain regions slowly recover from the outbreak, the demand for freelancers will rebound.

2. Freelance Hourly Rates Remain Stable

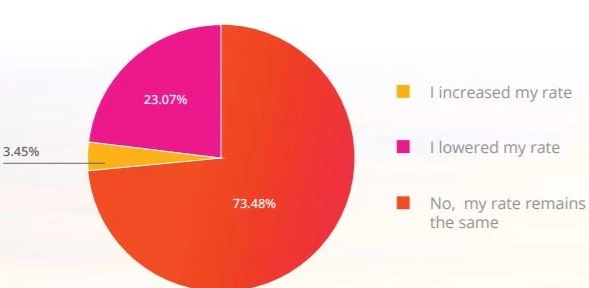

Despite the fact that for some freelancers, demand has decreased, hourly rates seem to have remained solid for a large majority. Close to 74% of survey respondents reported that their rates have remained the same, while 23% mentioned that they’ve lowered their rates due to the pandemic. Perhaps freelancers are in general, pretty confident that their rates offer great value and even with new freelancers jumping on the bandwagon, there’s no urgent need to change their fees.

3. The Future of Freelancing Post-COVID-19 Looks Bright

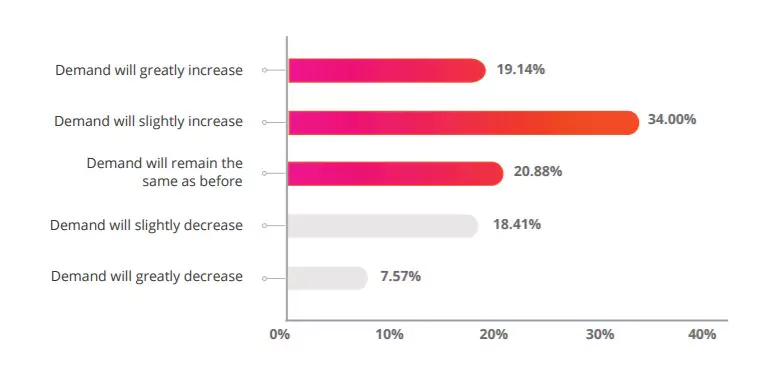

As the global economy faces one of the toughest times in history, freelancers and gig-workers are asking themselves, what’s next and will the economy prevail? We asked freelancers whether they believe demand for their services will change once the outbreak is under control. Based on our results, a total of 53% expect that demand will increase, while a total of 21% think that demand will remain the same prior to the pandemic.

Summary

Overall, our survey shows that while demand for freelancers appears to have slowed in the short-term, many are optimistic about the future and believe that it’s just a matter of time until businesses get back on their feet and return to outsourcing. As more businesses around the world adapt to working online, it’s clear that remote work may be here to stay.

Download our report today to learn more about how freelancers have been impacted by the COVID-19 pandemic.

Related resources

Latest articles

-

Employment laws in Sweden

Explore the employment laws in Sweden, a comprehensive guide to employees’ rights, employer obligations, and fair labor practices.

-

Employment laws in Poland

Explore the ins and outs of employment laws in Poland, an info-rich guide to employees’ rights, employer obligations, and fair labor practices that shape the future.

-

Employment laws in Indonesia

Find out more about Indonesia labor laws that dictate how employees should be contracted, managed, and paid, both on a national and state/territory level.

-

Employment laws in France

Learn about France’s labor laws dictating minimum wage, benefits, and more. Plus, discover the consequences of non-compliance with employment laws in France.

-

Employment laws in Spain

Find out more about Spain’s labor laws, from contracts and benefits to termination rules.

-

Employment laws in Australia

Find out more about the employment laws in Australia that dictate how employees should be contracted, managed, and paid, both on a national and state/territory level.

Disclaimer

The information in this article/on this page is intended for marketing and informational purposes only and does not constitute legal, financial, tax, or professional advice in any context. Payoneer and Payoneer Workforce Management are not liable for the accuracy, completeness or reliability of the information provided herein. Any opinions expressed are those of the individual author and may not reflect the views of Payoneer or Payoneer Workforce Management. All representations and warranties regarding the information presented are disclaimed. The information in this article/on this page reflects the details available at the time of publication. For the most up-to-date information, please consult a Payoneer and/or Payoneer Workforce Management representative or account executive.

Availability of cards and other products is subject to customer’s eligibility. Not all products are available in all jurisdictions in the same manner. Nothing herein should be understood as solicitation outside the jurisdiction where Payoneer Inc. or its affiliates is licensed to engage in payment services, unless permitted by applicable laws. Depending on or your eligibility, you may be offered the Corporate Purchasing Mastercard, issued by First Century Bank, N.A., under a license by Mastercard® and provided to you by Payoneer Inc., or the Payoneer Business Premium Debit Mastercard®, issued and provided from Ireland by Payoneer Europe Limited under a license by Mastercard®.

Skuad Pte Limited (a Payoneer group company) and its affiliates & subsidiaries provide EoR, AoR, and contractor management services.