Payoneer’s Guide to Amazon Advertising Billing

More topics Now it’s much easier to pay your Amazon advertising invoices It’s time to pay your Amazon Business invoice, but what options are available to you?Before we share the GREAT NEWS, you can use Automated Clearing House (ACH) debit, ACH payment, wire transfer, check, or credit memo.ACH debit is Amazon’s preferred option, and you…

Now it’s much easier to pay your Amazon advertising invoices

It’s time to pay your Amazon Business invoice, but what options are available to you?

Before we share the GREAT NEWS, you can use Automated Clearing House (ACH) debit, ACH payment, wire transfer, check, or credit memo.

ACH debit is Amazon’s preferred option, and you can start the payment by visiting the Your Invoices for Pay by Invoice page. ACH CCD and ACH CTX are two ACH formats that transfer funds between US corporate entities.

If you exceed the addendum record limitations, send the remittance information to the email address on the invoice.

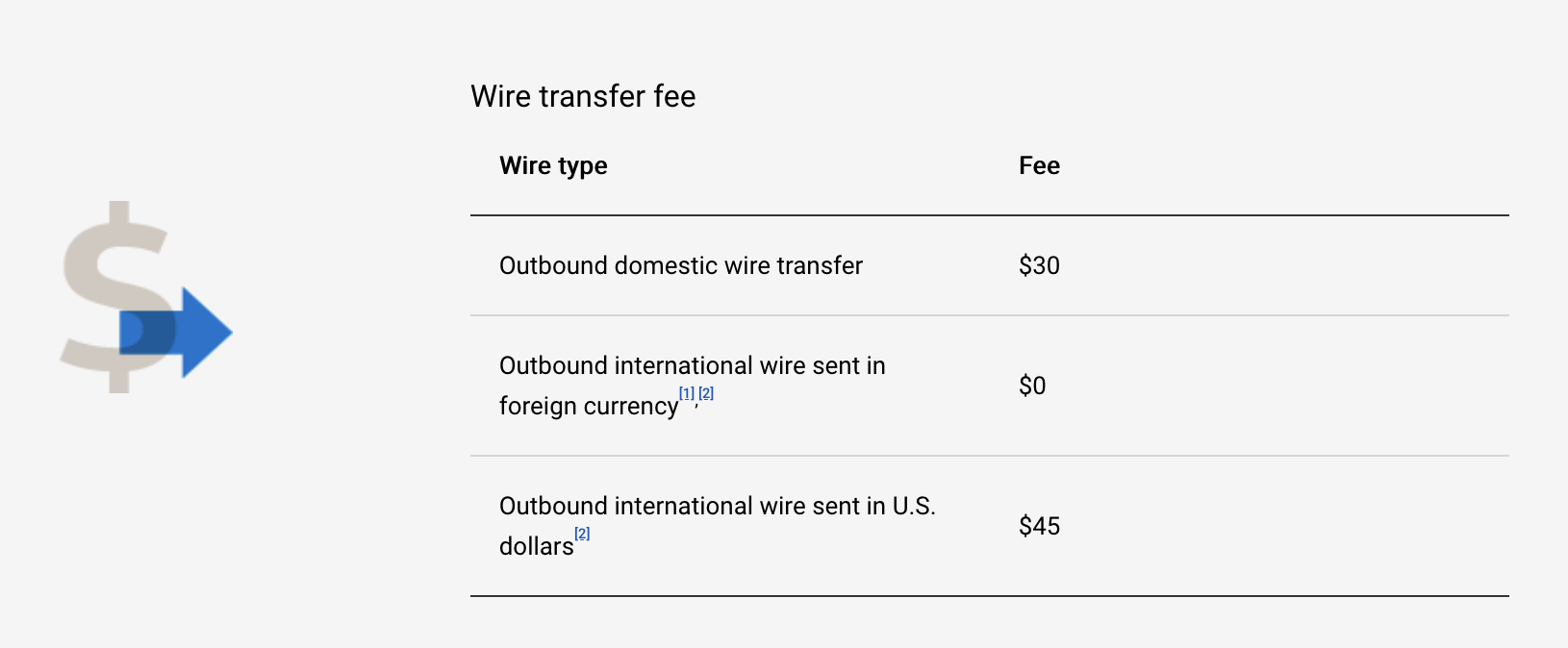

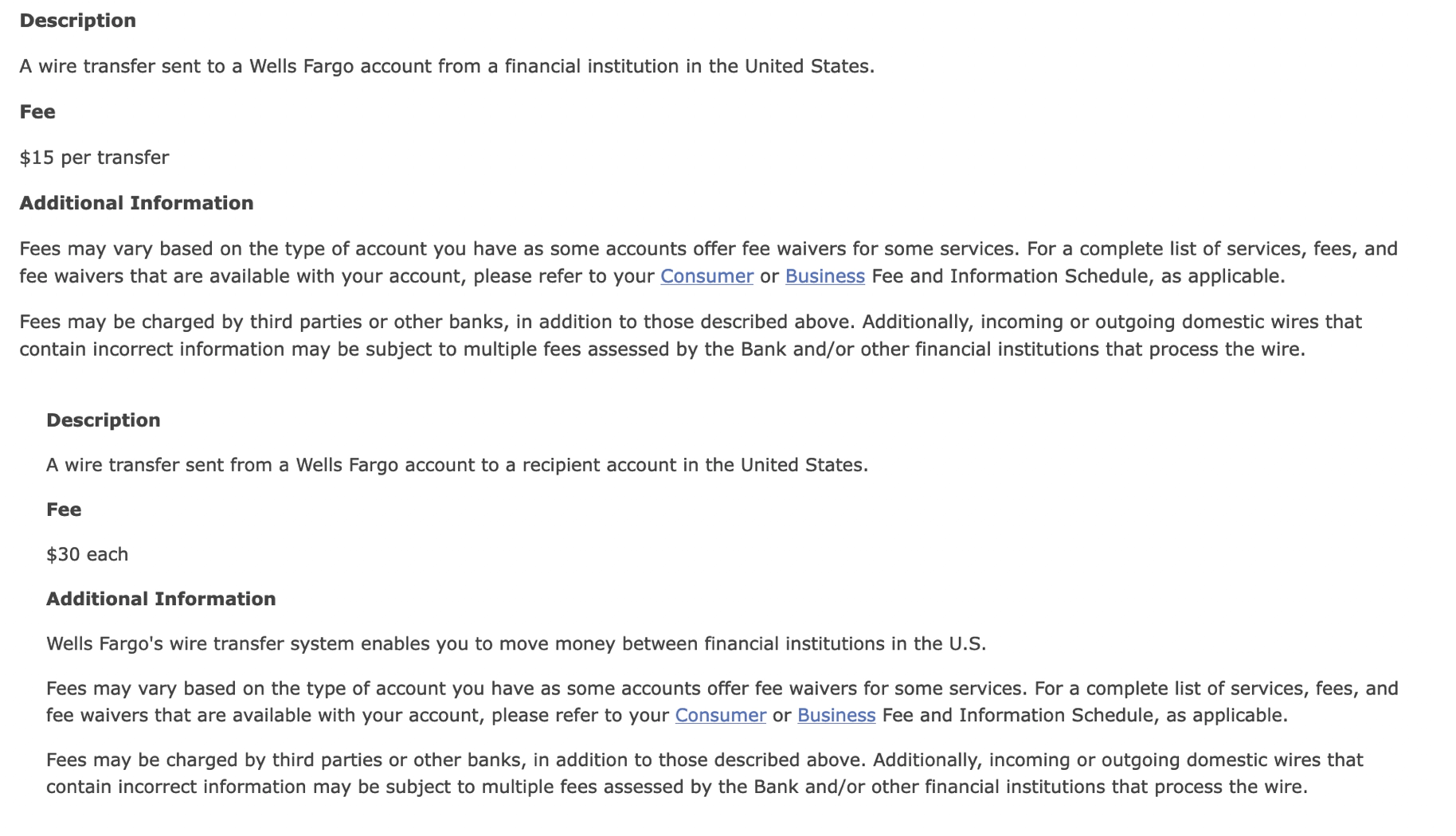

Wire transfer and check payments require you to include invoice details on the remittance. You can also apply open credit memos to your invoices, but currently, you cannot use a credit card or a gift card to pay your invoices.

When paying by wire transfer, check, or credit memo, it’s important to provide remittance information to ensure that payments are applied correctly to your invoices.

The required details for your remittance information include your account number, remittance date, total remitted amount (including cash & credit memos), invoice numbers, credit memo numbers (if necessary), and the amount of payment you’d like to apply to each outstanding invoice.

To submit your remittance instructions, send a .csv file with the information in the specified format.

Sounds quite complicated, right? Luckily, there’s exciting news on the payments front.

Now you can pay your Amazon Advertising & Amazon Transparency invoices direct from your Payoneer account!

That’s right folks, Payoneer’s all-in-one payments platform makes it really easy to take care of your Amazon advertising billing.

The Payoneer payment service simplifies all aspects of your Amazon store, allowing you to quickly & easily pay your invoices and get back to growing your business.

[cta-button text=”I’m ready for easy payment for Amazon Advertising!” url=”https://www.payoneer.com/solutions/make-a-payment/” color=”#FF4800″ type=”referral”]

Paying your Amazon advertising billing invoices

To start paying your Amazon advertising billing invoices from your Payoneer account, follow the steps outlined below:

- On the Make a Payment page in your Payoneer account, click on Pay an Amazon Advertising Invoice.

- You have the option to either manually enter your invoice details or upload them to the system.

- If you decide to manually enter your invoice details, you will need to indicate the Amazon marketplace where you are selling.

- After selecting the Amazon marketplace where you are selling, you can choose the currency balance you wish to pay from and enter the payment amount and corresponding invoice number.

- In case you uploaded your Amazon advertising billing invoice, selecting the currency balance to pay from is the only necessary action. If a currency conversion is required, Payoneer will display the corresponding charged amount.

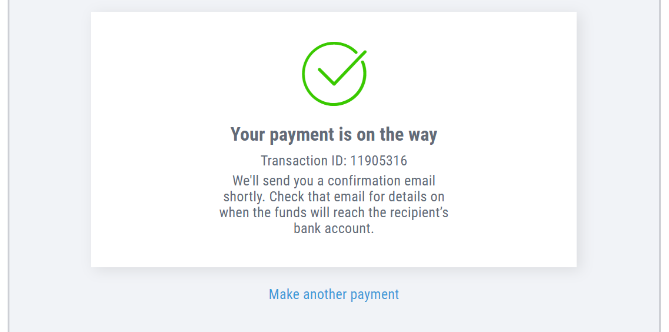

- Before submitting your payment, you have the option to review it. Once your payment is made, you will receive a confirmation message.

Quick Steps for Paying Amazon Transparency Invoices

To start paying your Amazon Transparency Invoices, follow these steps:

- To use your Payoneer account for Amazon transparency invoice payments, you need to add the bank details specified on your Amazon invoice to your Payoneer account. This can be done on the Bank Accounts page within your Payoneer account.

- To initiate a payment, click on the Pay button located at the top of your screen. Then, select the Make a Payment option from the dropdown menu and choose to pay to a recipient’s bank account.

- You can select the currency account you want to use for making the payment and the bank account listed on your Amazon advertising invoice. If the currencies for both accounts are the same, a fee will be displayed once you input the payment amount.

- In case the currencies for both accounts are different, the exchange rate will be displayed, along with the corresponding conversion fee.

- You can input the payment amount, either the exact amount you want to send or the amount your recipient is expecting to receive.

- After verifying your payment details, click on the Review button to proceed with the payment.

- Click on the Pay button. Afterwards, a confirmation screen will appear that shows your transaction ID.

[cta-button text=”I’m ready for easy payment for Amazon Advertising!” url=”https://www.payoneer.com/solutions/make-a-payment/” color=”#FF4800″ type=”referral”]

Related resources

Latest articles

-

Using an Employer of Record in Morocco

Looking for an Employer of Record in Morocco? See how Payoneer Workforce Management’s EOR services help simplify engaging talent in Morocco.

-

Using an Employer of Record in Jordan

Need an Employer of Record in Jordan? Here’s what you need to know about using an EOR in Jordan and how Payoneer Workforce Management can help you engage talent in Jordan.

-

Multi-currency Account: How It Helps Businesses Work With Customers Around the World

Optimize international payments for your IT, eCommerce, or SaaS business with a multicurrency account and easily receive funds from clients from abroad.

-

How to Open an Electronic Wallet: A Guide for Entrepreneurs and Businesses

How quickly and easily can you create an invoice with Payoneer? Learn how it helps businesses accept international payments, track them, and save time.

-

Wire Transfer in Ukraine: What Businesses Need to Know

Wire transfer in Ukraine for business, complete guide: how to make a transfer and receive an international Wire transfer on the account, terms and fees, tips, and examples.

-

Swift, ACH, or Wire: Which International Payment Method Should Businesses Choose?

SWIFT, ACH, or Wire for Ukrainian business: how they work, how they differ, which is cheaper and faster.

Disclaimer

The information in this article/on this page is intended for marketing and informational purposes only and does not constitute legal, financial, tax, or professional advice in any context. Payoneer and Payoneer Workforce Management are not liable for the accuracy, completeness or reliability of the information provided herein. Any opinions expressed are those of the individual author and may not reflect the views of Payoneer or Payoneer Workforce Management. All representations and warranties regarding the information presented are disclaimed. The information in this article/on this page reflects the details available at the time of publication. For the most up-to-date information, please consult a Payoneer and/or Payoneer Workforce Management representative or account executive.

Availability of cards and other products is subject to customer’s eligibility. Not all products are available in all jurisdictions in the same manner. Nothing herein should be understood as solicitation outside the jurisdiction where Payoneer Inc. or its affiliates is licensed to engage in payment services, unless permitted by applicable laws. Depending on or your eligibility, you may be offered the Corporate Purchasing Mastercard, issued by First Century Bank, N.A., under a license by Mastercard® and provided to you by Payoneer Inc., or the Payoneer Business Premium Debit Mastercard®, issued and provided from Ireland by Payoneer Europe Limited under a license by Mastercard®.

Skuad Pte Limited (a Payoneer group company) and its affiliates & subsidiaries provide EoR, AoR, and contractor management services.