An alternative to opening a business bank account in the European Union

More topics With 27 member states, including 19 that use the Euro single currency, the European Union is an important market for any business. But if your business is based outside of the Single Euro Payments Area (SEPA), it can be difficult for you to manage cross-border payments in Euros. You need to pay your…

With 27 member states, including 19 that use the Euro single currency, the European Union is an important market for any business. But if your business is based outside of the Single Euro Payments Area (SEPA), it can be difficult for you to manage cross-border payments in Euros.

You need to pay your suppliers, receive payments from clients and customers, and share funds with partners in Euros, but without a local Euro business bank account, you end up paying high currency conversion fees every time. It can take an annoyingly long time for funds to clear from a foreign currency transfer, each transaction involves extra paperwork, and the transaction isn’t always easy to trace if something goes wrong.

It would be so much easier to pay local taxes, receive funds, and pay for shipments if you had a local business bank account in Euros. But opening a business bank account in the European single currency area can be tough.

How to open a business bank account in the EU

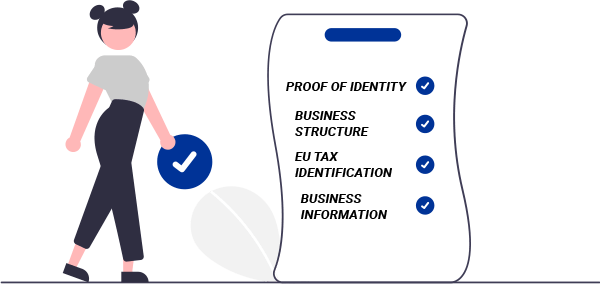

Most countries in the EU allow non-residents to open a business bank account, but it’s not simple. You can expect to be asked for a lot of documents, including:

- Proof of your identity

- An explanation of your business structure

- Proof of your business location

- An EU tax identification number

- A physical business address in that country

- A local business phone number

Most banks want you to open an account in person, and they’ll also require you to register your business in that country, or open a subsidiary business, which means more paperwork and more fees before you even get started. Sometimes you’ll be asked to prove your transaction volume or why you need a business bank account in that country.

What’s more, there can be different requirements depending on which type of business you have, and different countries in the EU have different rules about opening a business bank account. These rules can change quickly. It’s so complicated that many businesses hire an expert consultant to manage the process.

For example, in Ireland you’ll need to show 2 forms of identification and a large stack of other documents. In Germany, you’ll have to prove your credit history, which is difficult if you are just setting up your business there.

That’s not all. To open a business account in most EU banks as a non-resident, you’ll need to make a sizable deposit before opening the account. You won’t be able to draw on it until your account has been approved, so that capital will be tied up for a while. And in some countries, individual bankers have a lot of authority. If you catch someone on a bad day, you could fail through no fault of your own.

One option is to become an e-resident of Estonia. Estonia offers e-residency to much of the world, and once you’re an e-resident, you can open a local business bank account, vote in elections, and easily set up a business in that country.

You can also open an account with an online-only bank which offers a digital business bank account. These banks usually have simpler requirements, and check your identity through a smartphone app.

For example, Genome offers accounts in EUR, USD, and GBP and bank transfers through SEPA payment services for Eurozone members, like SWIFT gpi and SCT Inst. Bunq offers physical and virtual credit cards and multi-currency transactions for a fixed monthly or annual fee, and N26 provides online transactions and free payments, but both require you to be resident in the EU. Revolut gives users a debit card and a mobile banking app that supports 28 currencies, but you need to register your business in the EEA or Switzerland.

Payoneer’s local EUR receiving account

Payoneer helps you receive payments from customers and clients anywhere in the eurozone, manage currencies, and pay contractors, or suppliers in EU member states. Instead of jumping through hoops to open a business account in a local EU bank, you could use Payoneer instead.

Payoneer offers a local receiving account that works just like a local EU bank account, so you can accept payments in EUR. Anyone you work with who has an EU bank account can use the same domestic, SEPA, or SWIFT bank transfer network to make a convenient bank transfer to your Payoneer EUR receiving account.

It’s easy to set up your EUR receiving account with Payoneer. Just register with Payoneer and choose which local receiving accounts you need[1] — in GBP, EUR, CAD, HKD, SGD, or USD. You’ll soon be able to view your account details and share them with clients on your invoices, through email, or over WhatsApp.

You can withdraw funds in over 150 different countries and currencies for a low, transparent fee, or you can hold them in your Payoneer account in EUR and use the funds to pay local taxes or global contractors either to their EU bank accounts.

Enjoy the benefits of a local EUR business account

A local EUR account takes away the hassle of making and receiving payments across the single euro payments area. You can save time and money on administration costs for cross-border transactions, and the funds clear faster too to help improve your cash flow. Bookkeeping tools that automatically calculate your income and expenses and pay your taxes can usually only connect with a local currency account.

With an EU account, you can use local, trusted cross-border payment transfer networks like SWIFT gpi, the faster and more secure European version of SWIFT, and SEPA streamlined payments services like the SEPA Instant Credit Transfer scheme (SCT Inst), RT1, or the TARGET Instant Payments Service (TIPS).

When you have a local EU account, you make it easier for everyone else to work with you. Your suppliers, customers, and partners can make a local payment with their existing credit or debit card, or through the secure local payments network that they already know and trust. They don’t like the extra cost and hassle of currency conversion any more than you do. People are also concerned about the risk of identity fraud or lost payments through foreign payment networks. They’re more likely to do business with you when they can use their trusted payment methods.

A number of platforms like eBay, Amazon, and Fiverr prefer to pay to accounts in the local currency. When you link to their local EU platform, you’ll get paid faster, have lower fees, and save money that gets lost in foreign currency conversions. A local EUR account also helps protect you from losing money when exchange rates fluctuate, as well as saving you from high currency conversion fees and unfavorable exchange rates.

A simpler way to get a local EUR business bank account

With Payoneer, you can enjoy the advantages of having a local EUR account, but without the expense and difficulties of opening one with a local or online bank. When you use Payoneer to send and receive payments in EUR, make low-cost foreign currency conversions, and complete quick international payments, it’s far easier and less expensive to work with clients, employees, contractors, and suppliers anywhere in the EU, no matter when you or your business can be found.

[1] According to eligibility and current Payoneer offering

Related resources

Latest articles

-

Using an Employer of Record in Morocco

Looking for an Employer of Record in Morocco? See how Payoneer Workforce Management’s EOR services help simplify engaging talent in Morocco.

-

Using an Employer of Record in Jordan

Need an Employer of Record in Jordan? Here’s what you need to know about using an EOR in Jordan and how Payoneer Workforce Management can help you engage talent in Jordan.

-

Multi-currency Account: How It Helps Businesses Work With Customers Around the World

Optimize international payments for your IT, eCommerce, or SaaS business with a multicurrency account and easily receive funds from clients from abroad.

-

How to Open an Electronic Wallet: A Guide for Entrepreneurs and Businesses

How quickly and easily can you create an invoice with Payoneer? Learn how it helps businesses accept international payments, track them, and save time.

-

Wire Transfer in Ukraine: What Businesses Need to Know

Wire transfer in Ukraine for business, complete guide: how to make a transfer and receive an international Wire transfer on the account, terms and fees, tips, and examples.

-

Swift, ACH, or Wire: Which International Payment Method Should Businesses Choose?

SWIFT, ACH, or Wire for Ukrainian business: how they work, how they differ, which is cheaper and faster.

Disclaimer

The information in this article/on this page is intended for marketing and informational purposes only and does not constitute legal, financial, tax, or professional advice in any context. Payoneer and Payoneer Workforce Management are not liable for the accuracy, completeness or reliability of the information provided herein. Any opinions expressed are those of the individual author and may not reflect the views of Payoneer or Payoneer Workforce Management. All representations and warranties regarding the information presented are disclaimed. The information in this article/on this page reflects the details available at the time of publication. For the most up-to-date information, please consult a Payoneer and/or Payoneer Workforce Management representative or account executive.

Availability of cards and other products is subject to customer’s eligibility. Not all products are available in all jurisdictions in the same manner. Nothing herein should be understood as solicitation outside the jurisdiction where Payoneer Inc. or its affiliates is licensed to engage in payment services, unless permitted by applicable laws. Depending on or your eligibility, you may be offered the Corporate Purchasing Mastercard, issued by First Century Bank, N.A., under a license by Mastercard® and provided to you by Payoneer Inc., or the Payoneer Business Premium Debit Mastercard®, issued and provided from Ireland by Payoneer Europe Limited under a license by Mastercard®.

Skuad Pte Limited (a Payoneer group company) and its affiliates & subsidiaries provide EoR, AoR, and contractor management services.