Alternative to WISE’s international multi-currency business accounts

More topics Wise (formerly Transferwise) offers a multi-currency international account which is popular among travel-lovers, digital nomads, and people who want to regularly send money to family back home. Users appreciate Wise’s easy to use interface, low transfer fees, and integration with e-wallets and small business tools. But many businesses need more than that to…

Wise (formerly Transferwise) offers a multi-currency international account which is popular among travel-lovers, digital nomads, and people who want to regularly send money to family back home.

Users appreciate Wise’s easy to use interface, low transfer fees, and integration with e-wallets and small business tools. But many businesses need more than that to make global payments run smoothly.

For businesses that need to receive payments globally and send cross-border payments to remote service providers, employees or suppliers, Payoneer offers a business multi-currency local receiving accounts service.

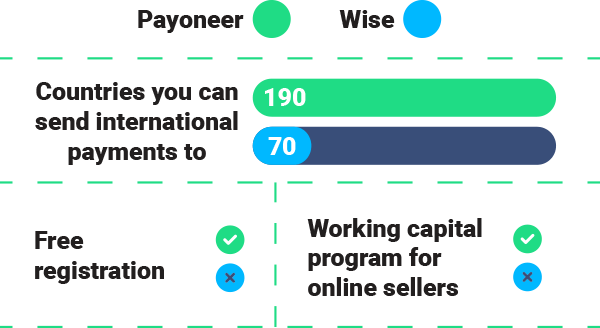

| Features | Payoneer | Wise |

| Send international payments to | 190 countries[1] | 70 countries[2] |

| Free registration | Yes, completely free. | Not free worldwide. In some countries fees are required (e.g. in the UK, registration costs £45)[3] |

| Working capital program for eligible online sellers and other SMBs | Yes, in certain countries | No |

Payoneer is the digital international payment solution for cross-border businesses. It brings benefits such as:

- Free signup and registration

- Easy Payoneer Account to Payoneer Account payments

- Broad geographic coverage for 190+ countries

- Simple billing solution for international payment management

- Personal account management services for larger customers

- A large ecosystem of users, including freelancers and suppliers

So, if you’re trying to decide which platform to use for your global business payments, read our in-depth comparison between Wise and Payoneer as a multi-currency banking alternative.

An in-depth international multi-currency business account comparison: Wise vs. Payoneer

Countries and currencies supported

For global businesses, it’s important to choose a payment platform that supports transactions in as many countries as possible. Otherwise, you might not be able to easily expand your business to clients in a new geography.

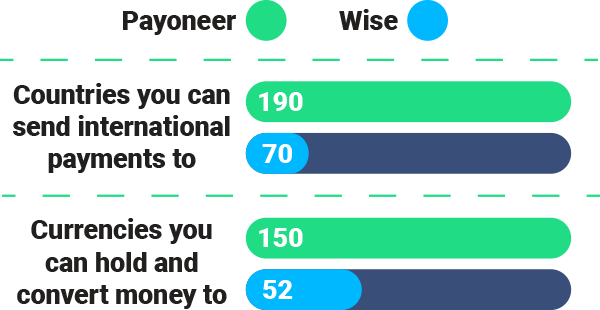

| Payoneer | Wise | |

| Number of Countries to which you can send international payments | 190 | 70 |

| Number of supported currencies | 150 | 52 |

Disclaimer: the provision of Payoneer services is subject to the user’s eligibility and subject to Payoneer’s policies and procedures in place from time to time. Payoneer services may vary depending on territory.

Wise lets you send payments to recipients in 70 countries, and hold and convert money between 52 currencies2. With Payoneer, you can send money to people in 190 countries and 150 currencies.

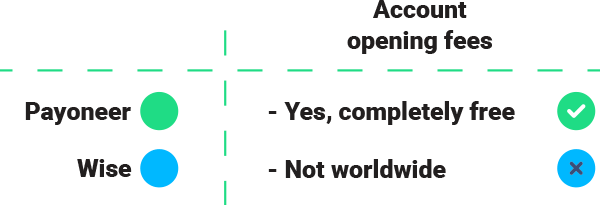

Account opening fee

Wise signup Fees vs Payoneer registration fees

| Payoneer | Wise | |

| Account opening fees[4] | Yes, completely free | Not free worldwide. In some countries fees are required (e.g. in the UK, registration costs £45) |

The bottom line is always important when you’re running a business, so you don’t want to have to pay too much to set up your global payments solution. Payoneer won’t charge you anything to open an account, no matter where you are located or what size your balance is. With Wise, it’s free to open an account in some countries, but in other areas you’ll have to pay a sizable fee. For example, in the UK you’ll pay as much as £45 just to open your account.

Access to Working Capital

Payoneer is more than just an international payments platform. It also has competitive working capital offerings to help ecommerce business owners expand their business and increase their revenue. We have also started offering these working capital offerings to a broader range of SMBs. Wise doesn’t offer these extra services.

Advantages to a Payoneer business account

To summarize, the benefits to opening a Payoneer international multi-currency business account are:

- Zero cost to sign up and get started

- Broader global coverage across 190 countries and 150+ currencies

- Working capital offerings for eligible online sellers and other SMBs.

- Streamlined billing solution

- Multiple payment methods

- Instant free payments between Payoneer accounts for eligible customers

- Single dashboard to manage multiple online stores and payments

- Business account management for large customers

- Fee-free balance holding5 for eligible customers.

Advantages to a Wise business account

Holding a Wise business account also has its benefits. Here are some of the benefits of a Wise international account:

- Low transfer fees

- Personal and business accounts

- Option to hold and convert funds in 50+ currencies

Why use Payoneer for your international multi-currency business account?

Payoneer gives you more than just competitive international payments. With a Payoneer account, you can easily receive payments through multiple payment options, Receive payments in multiple currencies via local bank transfers and track transactions every step of the way.

Payoneer makes it easy for you to manage your funds by converting them to different currencies whenever you like, and to withdraw to your bank, through an ATM, or using it for online payments. You can set your own withdrawal schedule, and automate invoicing and billing.

Handling your own payments is easier with Payoneer, too. Payoneer helps you to send payment requests through a number of different payment methods, including the option to get paid by credit and debit card, and manage free payments to other Payoneer accounts.

Payoneer is your alternative to a Wise international business account

Wise’s multi-currency account is a great, low-fee way to send and receive payments around the world, and it integrates well with key accounting software. However, for businesses and individuals looking for more than simple international currency transfers, Payoneer stands out. Plus it’s free to sign up to Payoneer but with Wise it will cost you up to £45 depending on your location just to get started.

With Payoneer, business owners can access a larger geographic coverage for sending and receiving payments, attentive account management, automated billing, invoicing, and withdrawal solutions, and free payments between Payoneer accounts. Payoneer also presides over a wider network of suppliers and freelancers, making it a better international multi-currency business account alternative to Wise for people to do business online globally.

With Payoneer, business owners can access a larger geographic coverage for sending and receiving payments, attentive account management, automated billing, invoicing, and withdrawal solutions, and free payments between Payoneer accounts. Payoneer also presides over a wide network of suppliers and freelancers, making it a better international multi-currency business account alternative to Wise for people to do business online.

So, if you’re looking for an easy, low-cost and secure way to pay and get paid from international businesses, make sure to open a Payoneer account today.

Sources:

https://wise.com/us/pricing/business

[1]https://www.payoneer.com/solutions/pay_service_provider/

[2]https://wise.com/

[3]https://wise.com/gb/pricing/business

[4] If you don’t make a single transaction within 12 months, an inactivity fee of 29.95$ will be deducted from your account balance

Related resources

Latest articles

-

Using an Employer of Record in Morocco

Looking for an Employer of Record in Morocco? See how Payoneer Workforce Management’s EOR services help simplify engaging talent in Morocco.

-

Using an Employer of Record in Jordan

Need an Employer of Record in Jordan? Here’s what you need to know about using an EOR in Jordan and how Payoneer Workforce Management can help you engage talent in Jordan.

-

Multi-currency Account: How It Helps Businesses Work With Customers Around the World

Optimize international payments for your IT, eCommerce, or SaaS business with a multicurrency account and easily receive funds from clients from abroad.

-

How to Open an Electronic Wallet: A Guide for Entrepreneurs and Businesses

How quickly and easily can you create an invoice with Payoneer? Learn how it helps businesses accept international payments, track them, and save time.

-

Wire Transfer in Ukraine: What Businesses Need to Know

Wire transfer in Ukraine for business, complete guide: how to make a transfer and receive an international Wire transfer on the account, terms and fees, tips, and examples.

-

Swift, ACH, or Wire: Which International Payment Method Should Businesses Choose?

SWIFT, ACH, or Wire for Ukrainian business: how they work, how they differ, which is cheaper and faster.

Disclaimer

The information in this article/on this page is intended for marketing and informational purposes only and does not constitute legal, financial, tax, or professional advice in any context. Payoneer and Payoneer Workforce Management are not liable for the accuracy, completeness or reliability of the information provided herein. Any opinions expressed are those of the individual author and may not reflect the views of Payoneer or Payoneer Workforce Management. All representations and warranties regarding the information presented are disclaimed. The information in this article/on this page reflects the details available at the time of publication. For the most up-to-date information, please consult a Payoneer and/or Payoneer Workforce Management representative or account executive.

Availability of cards and other products is subject to customer’s eligibility. Not all products are available in all jurisdictions in the same manner. Nothing herein should be understood as solicitation outside the jurisdiction where Payoneer Inc. or its affiliates is licensed to engage in payment services, unless permitted by applicable laws. Depending on or your eligibility, you may be offered the Corporate Purchasing Mastercard, issued by First Century Bank, N.A., under a license by Mastercard® and provided to you by Payoneer Inc., or the Payoneer Business Premium Debit Mastercard®, issued and provided from Ireland by Payoneer Europe Limited under a license by Mastercard®.

Skuad Pte Limited (a Payoneer group company) and its affiliates & subsidiaries provide EoR, AoR, and contractor management services.