Alternative to opening a business bank account in the US

More topics The USA is home to 325 million people, making up the world’s largest single consumer market, with a GDP of $20 trillion, which is very attractive for businesses around the world. Plus, many business owners and entrepreneurs want to work with American suppliers, freelancers, consultants, artisans, and other US small businesses. If you’re…

The USA is home to 325 million people, making up the world’s largest single consumer market, with a GDP of $20 trillion, which is very attractive for businesses around the world. Plus, many business owners and entrepreneurs want to work with American suppliers, freelancers, consultants, artisans, and other US small businesses.

If you’re doing business with partners or suppliers who are based in the USA, or you have a sizable addressable market in that country, you’ve probably already found that it can be awkward to manage cross-border payments. You need to pay for products you’ve ordered, request payments from customers, and pay tax and other official obligations.

A local business bank account could make life much simpler, but it’s not always that easy to get it.

How do you open a business bank account in the US?

You don’t have to be a US citizen or permanent resident to open a US business bank account. But it is a complicated, and often long and expensive, process. First, you need to register your business in the US as an LLC and get an Employer Identification Number (EIN) from the Inland Revenue Service (IRS).

Once you have an EIN, you can open an account. Although there are some new online banks which let you open a business account online, you mostly have to visit the bank in person to open an account. You also need to choose a bank in the same state where your business is registered.

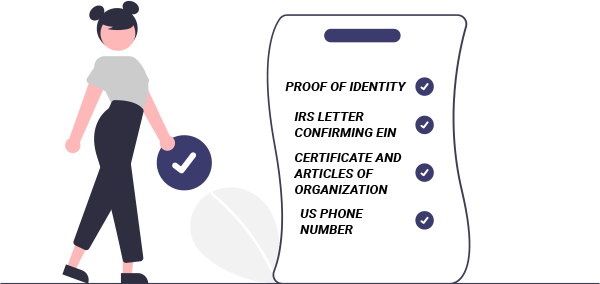

These are the documents that you’ll probably have to bring with you to open the account, but it’s best to check with the bank first just in case they request something more:

- Your business’ Certificate and Articles of Organization, proof of address, and LLC operating Agreement

- A letter from the IRS confirming your EIN

- 2 types of ID

- A US phone number

However, it can be difficult to register a business in the US if you aren’t already a citizen or permanent resident.

The Alternative: A Payoneer local USD receiving account

Payoneer helps you receive payments from US customers and clients, manage currencies, and pay contractors, suppliers, or remote employees in the US. Instead of jumping through hoops to open a business account in a local US bank, you could use Payoneer receiving account instead.

Payoneer offers a local receiving account, so you can accept payments in USD. Anyone with a US bank account can use the same domestic ACH network to make a convenient local bank transfer to your Payoneer USD receiving account.

It’s easy to set up your USD business account with Payoneer. Just register with Payoneer and choose which local receiving accounts you need — in GBP, EUR, CAD, HKD, SGD, or USD. You’ll soon be able to view your account details and share them with clients on your invoices, through email, or over WhatsApp.

You can withdraw funds in over 150 different countries and currencies for a low, transparent fee, or you can hold them in your Payoneer account in USD and use the funds to pay local taxes or global contractors to their US receiving bank accounts.

Enjoy the benefits of having a business bank account in the US

There are a lot of good reasons to open a US receiving business bank account. For a start, you’ll be able to save money on foreign currency conversions. Instead of converting USD into your local currency and paying fees every time, you’ll be able to receive payments in USD and either use the funds to pay local expenses or wait until you have a larger amount and make fewer, bigger currency conversions.

Having a local receiving business bank account in USD also makes it much easier to manage payments if you’re getting paid through a US-based platform like Amazon, eBay, Upwork, or Fiverr. You’ll save on currency conversion bills but also save yourself the hassle of linking an account that’s in a different currency.

What’s more, a US receiving bank account can help you close deals and build trust. American clients naturally prefer to work with a partner or vendor who has a local receiving bank account. People often worry that payments might get lost if they send them through a foreign bank transfer like SWIFT, and they don’t want to have to pay high fees for making a cross-border credit cards payment.

An easier way to get a local US business bank account

Payoneer’s low cost, fast international payments platforms, transparent and inexpensive foreign currency conversions, and convenient local receiving bank account in USD makes it much easier to manage payments between your company and contractors, employees, suppliers, and customers in the US, no matter where you or your business are located.

Related resources

Latest articles

-

Using an Employer of Record in Morocco

Looking for an Employer of Record in Morocco? See how Payoneer Workforce Management’s EOR services help simplify engaging talent in Morocco.

-

Using an Employer of Record in Jordan

Need an Employer of Record in Jordan? Here’s what you need to know about using an EOR in Jordan and how Payoneer Workforce Management can help you engage talent in Jordan.

-

Multi-currency Account: How It Helps Businesses Work With Customers Around the World

Optimize international payments for your IT, eCommerce, or SaaS business with a multicurrency account and easily receive funds from clients from abroad.

-

How to Open an Electronic Wallet: A Guide for Entrepreneurs and Businesses

How quickly and easily can you create an invoice with Payoneer? Learn how it helps businesses accept international payments, track them, and save time.

-

Wire Transfer in Ukraine: What Businesses Need to Know

Wire transfer in Ukraine for business, complete guide: how to make a transfer and receive an international Wire transfer on the account, terms and fees, tips, and examples.

-

Swift, ACH, or Wire: Which International Payment Method Should Businesses Choose?

SWIFT, ACH, or Wire for Ukrainian business: how they work, how they differ, which is cheaper and faster.

Disclaimer

The information in this article/on this page is intended for marketing and informational purposes only and does not constitute legal, financial, tax, or professional advice in any context. Payoneer and Payoneer Workforce Management are not liable for the accuracy, completeness or reliability of the information provided herein. Any opinions expressed are those of the individual author and may not reflect the views of Payoneer or Payoneer Workforce Management. All representations and warranties regarding the information presented are disclaimed. The information in this article/on this page reflects the details available at the time of publication. For the most up-to-date information, please consult a Payoneer and/or Payoneer Workforce Management representative or account executive.

Availability of cards and other products is subject to customer’s eligibility. Not all products are available in all jurisdictions in the same manner. Nothing herein should be understood as solicitation outside the jurisdiction where Payoneer Inc. or its affiliates is licensed to engage in payment services, unless permitted by applicable laws. Depending on or your eligibility, you may be offered the Corporate Purchasing Mastercard, issued by First Century Bank, N.A., under a license by Mastercard® and provided to you by Payoneer Inc., or the Payoneer Business Premium Debit Mastercard®, issued and provided from Ireland by Payoneer Europe Limited under a license by Mastercard®.

Skuad Pte Limited (a Payoneer group company) and its affiliates & subsidiaries provide EoR, AoR, and contractor management services.