Alternative to opening a business bank account in Hong Kong

More topics For people who do business with partners, suppliers, or clients in Hong Kong, managing cross-border business payments without a local business bank account in Hong Kong Dollars (HKD) can be a real challenge. There’s often time-consuming, tedious paperwork that you have to complete every time. Currency conversion fees from your local currency can…

For people who do business with partners, suppliers, or clients in Hong Kong, managing cross-border business payments without a local business bank account in Hong Kong Dollars (HKD) can be a real challenge. There’s often time-consuming, tedious paperwork that you have to complete every time. Currency conversion fees from your local currency can be high, plus it’s not always easy to track your payments, and funds can take a long time to clear.

Hong Kong is one of South-East Asia’s main business hubs, so there are many reasons to do business there. Paying contractors and employees and receiving payments from clients and partners is much easier to organize and track when you have an HKD bank account. But opening a local business bank account in Hong Kong Dollars (HKD) is not always so easy.

How to open a business bank account in Hong Kong

According to Hong Kong laws, you can open a business bank account even if you’re not a citizen or a resident, and without registering your business in the country. But in practice, it’s rare for a bank to approve your application unless you’ve at least registered your business locally, which means more fees and more paperwork.

A number of local leading banks, including OCBC Wing Hang, the Bank of China (Hong Kong), and the Bank of East Asia offer multi-currency business bank accounts with online business banking. There are also some international banks, like HSBC, Citibank, and KBC Bank, which offer a business bank account in their branches in Hong Kong, but the application process is broadly similar, and they also expect you to register your business in Hong Kong first.

The Hong Kong financial system places a lot of emphasis on due diligence, so banks require a long list of supporting documents and can take a long time to investigate you and your business. It takes at least 2-4 weeks, and often several months, to get a response to your application. Most banks require all the signatories of the account to visit in person to verify their identity, even if they allow you to begin your application online. In some circumstances, some banks will “meet online” via Skype or Zoom, but only on a case by case basis.

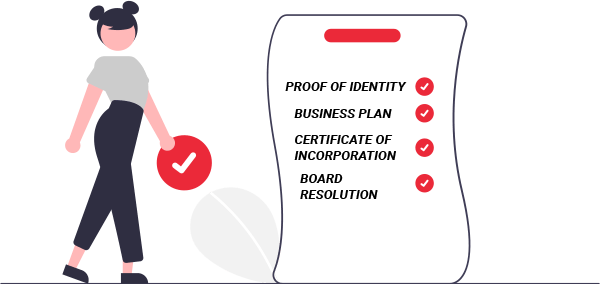

Here are some of the documents you can expect to have to bring to open a HKD business bank account. Some of them might need to be certified by a lawyer or local notary.

- Proof of identity for all the business’ directors and beneficiaries.

- Proof of residential address for all the directors and beneficiaries.

- A business plan.

- Evidence of trading history in Hong Kong and/or South-East Asia.

- A resolution by the board of directors giving approval to open the account.

- Certificates of incorporation and registration of the company. For a Hong Kong company, that includes the certificate of incorporation, a valid business registration certificate, and the articles of association. Offshore companies need to show a Certificate of Incumbency and Certificate of Good Standing.

- A chart showing the structure of the company and all its ultimate beneficiaries.

- Specimen signatures for each signatory.

Different banks often have different requirements for opening a business bank account, so before you begin your application, you’ll need to find out if the bank you’re applying to accepts applications from non-citizens and exactly which documents it requires.

Even if you provide all these documents, your application might still be accepted. Hong Kong banks usually reject businesses they consider high risk, and those that do business with anyone on a sanctions list. If the bank thinks you don’t have enough business history with entities in Hong Kong or South-East Asia, you’re also likely to have your application denied, which is a problem if you’re waiting to have a local bank account before expanding into the region.

Opening a local HKD business bank account can also cost a lot of money and tie up your capital. You’ll usually need to make an initial deposit of anything from HKD10,000 up to HKD 200,000, plus some banks charge an application fee of HKD400-HKD10,000. You can also expect to have to keep a minimum monthly balance in the account, and/or pay a monthly maintenance fee.

Some banks, like Hang Seng Bank, offer online-only HKD business banking, where the entire process including verifying your identity is carried out online, some fees are waived or delayed, and you usually get a faster response. However, fees and deposit requirements are often still high, and you’ll still need to go through the same complex application process.

There are some internet banks which offer an online-only HKD business account, like Neat or Statrys, for low fees and with a simpler application process, but only Hong Kong-registered businesses are eligible.

The Alternative: A Payoneer local HKD receiving account

Payoneer helps you receive payments from Hong Kong-based customers and clients, manage currencies, and pay contractors, or suppliers in Hong Kong. Instead of jumping through hoops to open a business account in a local Hong Kong bank, you could use Payoneer instead.

Payoneer offers a local receiving account that works just like a local Hong Kong bank account, so you can accept payments in HKD. Anyone you work with who has a Hong Kong bank account can use the same domestic bank transfer network to make a convenient local bank transfer to your Payoneer HKD receiving account.

It’s easy to set up your HKD receiving account with Payoneer. Just register with Payoneer and choose which local receiving accounts you need[1] — in HKD, SGD, GBP, EUR, CAD, or USD. You’ll soon be able to view your account details and share them with clients on your invoices, through email, or over WhatsApp.

You can withdraw funds in over 150 different countries and currencies for a low, transparent fee, or you can hold them in your Payoneer account in HKD and use the funds to pay local taxes or global contractors either to their Hong Kong bank accounts, or free of charge to their Payoneer account.

Enjoy the benefits of a business account in Hong Kong

Once you have a local HKD business account, you’ll be able to enjoy faster cross-border payments that don’t require piles of administration and paperwork every time. Your transactions will be more transparent and easier to track, so there’s less risk of fraud or of payments getting lost on the way.

Having a local HKD account helps lower your business expenses and improve cash flow, because funds will clear more quickly and you won’t have to pay expensive currency conversion fees. Many freelancing and ecommerce platforms like Toptal, Amazon, and eBay pay out faster when you can link a local currency account, and you won’t leak money in the currency exchange rates.

Your local business account also helps you forge business connections. People usually prefer to work with entities that have a local account, because they trust familiar local payment systems and are nervous about the risk of fraud or data breaches from international money transfers.

Finally, a number of automated bookkeeping and accountancy tools are more effective when you can connect them to a local currency account. That way, they can automatically deduct taxes and pay other local fees.

An easier way to enjoy a local HKD business account

With Payoneer, you can access the benefits of a local HKD business bank account without the hassle, time, and expense of meeting the requirements of online or local banks. Use Payoneer’s low-cost foreign currency conversions, speedy international payment processing, and capability for sending and receiving payments in HKD to streamline your business transactions with contractors, clients, suppliers, and employees in Hong Kong, no matter where you or your business is located.

[1] According to eligibility and current Payoneer offering

Related resources

Latest articles

-

Using an Employer of Record in Morocco

Looking for an Employer of Record in Morocco? See how Payoneer Workforce Management’s EOR services help simplify engaging talent in Morocco.

-

Using an Employer of Record in Jordan

Need an Employer of Record in Jordan? Here’s what you need to know about using an EOR in Jordan and how Payoneer Workforce Management can help you engage talent in Jordan.

-

Multi-currency Account: How It Helps Businesses Work With Customers Around the World

Optimize international payments for your IT, eCommerce, or SaaS business with a multicurrency account and easily receive funds from clients from abroad.

-

How to Open an Electronic Wallet: A Guide for Entrepreneurs and Businesses

How quickly and easily can you create an invoice with Payoneer? Learn how it helps businesses accept international payments, track them, and save time.

-

Wire Transfer in Ukraine: What Businesses Need to Know

Wire transfer in Ukraine for business, complete guide: how to make a transfer and receive an international Wire transfer on the account, terms and fees, tips, and examples.

-

Swift, ACH, or Wire: Which International Payment Method Should Businesses Choose?

SWIFT, ACH, or Wire for Ukrainian business: how they work, how they differ, which is cheaper and faster.

Disclaimer

The information in this article/on this page is intended for marketing and informational purposes only and does not constitute legal, financial, tax, or professional advice in any context. Payoneer and Payoneer Workforce Management are not liable for the accuracy, completeness or reliability of the information provided herein. Any opinions expressed are those of the individual author and may not reflect the views of Payoneer or Payoneer Workforce Management. All representations and warranties regarding the information presented are disclaimed. The information in this article/on this page reflects the details available at the time of publication. For the most up-to-date information, please consult a Payoneer and/or Payoneer Workforce Management representative or account executive.

Availability of cards and other products is subject to customer’s eligibility. Not all products are available in all jurisdictions in the same manner. Nothing herein should be understood as solicitation outside the jurisdiction where Payoneer Inc. or its affiliates is licensed to engage in payment services, unless permitted by applicable laws. Depending on or your eligibility, you may be offered the Corporate Purchasing Mastercard, issued by First Century Bank, N.A., under a license by Mastercard® and provided to you by Payoneer Inc., or the Payoneer Business Premium Debit Mastercard®, issued and provided from Ireland by Payoneer Europe Limited under a license by Mastercard®.

Skuad Pte Limited (a Payoneer group company) and its affiliates & subsidiaries provide EoR, AoR, and contractor management services.