9 Tips for Writing Better Invoices as a Freelancer

Editor’s note: This is a guest post by Connie Benton, professional blogger and writer. As a freelancer, it would be ideal to work with companies that provide a consistent stream of tasks and pay on time. For many, it’s not an option. You have to dedicate a significant portion of your time to find clients…

Editor’s note: This is a guest post by Connie Benton, professional blogger and writer.

As a freelancer, it would be ideal to work with companies that provide a consistent stream of tasks and pay on time.

For many, it’s not an option. You have to dedicate a significant portion of your time to find clients even with the perfect freelancer LinkedIn profile. If that’s not enough, you have to solicit payments from multiple clients. Writing and delivering invoices to send off to your client can become a constant pain for freelancers.

It doesn’t have to be this way as sending invoices is an art that you have to master. Here’s how to create and send an invoice like a pro!

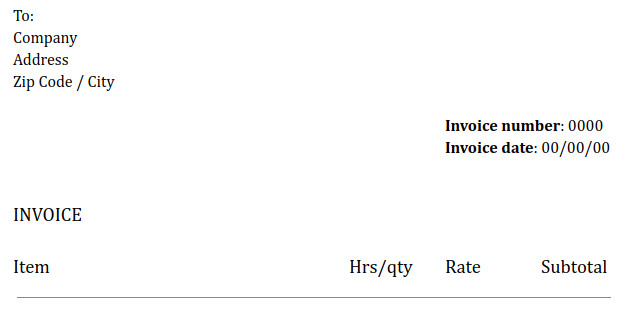

1. Fill in the basic fields correctly

Creating a professional invoice is the first step towards receiving a timely payment. No matter how you choose to go about sending it, it has to be filled in correctly and with the right format for invoices. Include the date of filling out the invoice as well as the date the payment is due as some companies will only pay on the last day. Double-check the date to be sure you’ll get the payment in time. Fill in the company information and include the company name, address, and zip code. You can also include the company email and URL as well.

2. Let the client know what they’re paying for

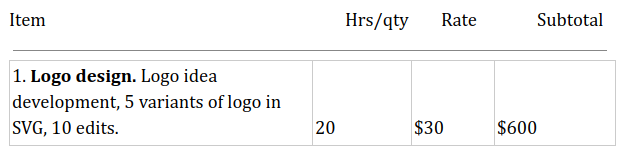

It can be frustrating to pay hundreds of dollars for something that looks insignificant. Many believe that freelancers can produce logos, designs, or articles in a moment’s notice, so paying them so much seems a bit unfair.

Let the client know about everything they’re paying for. Include the number of hours you’ve spent on the project, the hourly rate, and subtotal. If they understand what went into making the final product, and how many hours you spent on it, they’re more likely to pay on time.

Here’s how this item can look like for a logo design.

3. Include tax

Freelancers can pretty much work from anywhere, however, any dreamy workplace requires you to submit your fair share of taxes. Michael Faaron, CEO of Tax Defense Partners, states that a lot of freelancers that previously worked with his agency, were underpaid because they either forgot to include tax into invoices or miscalculated them.

It’s highly important to make sure that the client knows the tax is included in the payment.

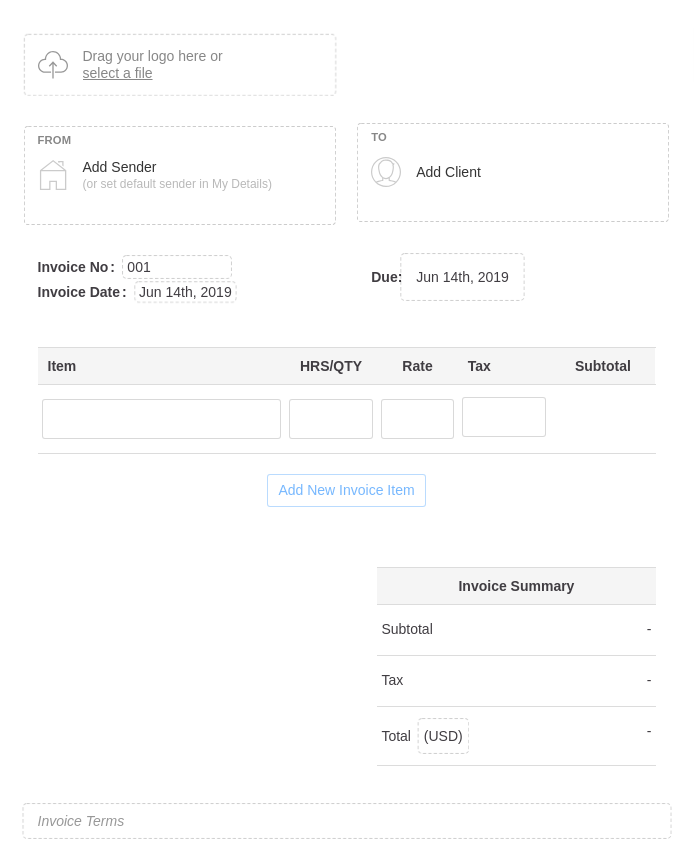

4. Customize your invoice

Make your invoice stand out from the others your client receives so they can instantly know it’s yours. Now, you can create an invoice in MS Word or PDF quite easily. If you make use of tables and work on customization, it will look simple yet professional.

You can also use an online invoice generator software like the Free Invoice Builder Web-App which can help save you time since you can fill out an invoice in a couple of minutes and copy the document to send it .

5. Include a logo

Do you have a logo? You have to include it on every invoice. It’s a very simple and efficient way to signal to the customer who they’re paying. With an easily discernable logo, they don’t even need to read the description, they’ll remember you instantly.

6. Keep track of invoices

It can be easy to remember everything your clients owe you if you only have a handful of them. Start keeping track of your finances early on to avoid confusion. This allows you to make sure you’ve sent the invoice and remind the company to pay you if they’ve missed the payment date.

7. Know the client

In an ideal world, every client would pay as soon as you send them the invoice, but in reality, it’s a bit more complicated. Some clients are oblivious and can forget to pay if not reminded many times and larger companies can sometimes only pay on certain days of the month. Others have one person contact you and another makes a payment. If you know the person, address them by name in invoice terms and in private message to make the payment personal, not official or dry.

8. Make it easy to pay

Once you know your client, it’s easy to offer them the right payment method. Some companies can only use several methods due to company policy, yet private clients need to be taught on how to pay with a certain system. When you contact the client personally to request a payment, provide a convenient payment link so they can pay quicker.

Payoneer, a cross-border payments platform, offers freelancers simple payment methods options to get paid by global companies and marketplaces.

9. Reach out the right way

The way you reach out to a customer with an invoice and the payment link may be even more important than the invoice itself. Start with the email topic and mention who you are, and why are you writing. “Website Design Invoice from Jerry” can be a simple and effective way to make yourself heard.

Once you’re at it, start with mentioning the addressee by name. It’s an old psychological trick, but it works. Add all the important information at the beginning of your email and be as brief as possible and explain everything the client has to know about making a payment. Leverage the sense of urgency by putting a deadline. “You have three days to pay” is not a good way to do that as it sounds menacing. Try simply stating the due date.

Connie is a professional blogger and writer. She is interested in self-development, psychology, and marketing. She is also the content advisor at Whenipost.com.

Related resources

Latest articles

-

Using an Employer of Record in Morocco

Looking for an Employer of Record in Morocco? See how Payoneer Workforce Management’s EOR services help simplify engaging talent in Morocco.

-

Using an Employer of Record in Jordan

Need an Employer of Record in Jordan? Here’s what you need to know about using an EOR in Jordan and how Payoneer Workforce Management can help you engage talent in Jordan.

-

Multi-currency Account: How It Helps Businesses Work With Customers Around the World

Optimize international payments for your IT, eCommerce, or SaaS business with a multicurrency account and easily receive funds from clients from abroad.

-

How to Open an Electronic Wallet: A Guide for Entrepreneurs and Businesses

How quickly and easily can you create an invoice with Payoneer? Learn how it helps businesses accept international payments, track them, and save time.

-

Wire Transfer in Ukraine: What Businesses Need to Know

Wire transfer in Ukraine for business, complete guide: how to make a transfer and receive an international Wire transfer on the account, terms and fees, tips, and examples.

-

Swift, ACH, or Wire: Which International Payment Method Should Businesses Choose?

SWIFT, ACH, or Wire for Ukrainian business: how they work, how they differ, which is cheaper and faster.

Disclaimer

The information in this article/on this page is intended for marketing and informational purposes only and does not constitute legal, financial, tax, or professional advice in any context. Payoneer and Payoneer Workforce Management are not liable for the accuracy, completeness or reliability of the information provided herein. Any opinions expressed are those of the individual author and may not reflect the views of Payoneer or Payoneer Workforce Management. All representations and warranties regarding the information presented are disclaimed. The information in this article/on this page reflects the details available at the time of publication. For the most up-to-date information, please consult a Payoneer and/or Payoneer Workforce Management representative or account executive.

Availability of cards and other products is subject to customer’s eligibility. Not all products are available in all jurisdictions in the same manner. Nothing herein should be understood as solicitation outside the jurisdiction where Payoneer Inc. or its affiliates is licensed to engage in payment services, unless permitted by applicable laws. Depending on or your eligibility, you may be offered the Corporate Purchasing Mastercard, issued by First Century Bank, N.A., under a license by Mastercard® and provided to you by Payoneer Inc., or the Payoneer Business Premium Debit Mastercard®, issued and provided from Ireland by Payoneer Europe Limited under a license by Mastercard®.

Skuad Pte Limited (a Payoneer group company) and its affiliates & subsidiaries provide EoR, AoR, and contractor management services.