How to make an invoice: a step-by-step guide

Learn what an invoice is, what it must include, and the difference between templates and invoice generators. This guide covers common mistakes, helpful tips, and how Payoneer makes creating and sending invoices faster and easier.

Table of Contents

Invoicing is vital to maintain order in today’s business world when it comes to paying and getting paid for goods and services, because invoices ensure that you get paid on time and maintain a clear set of financial records. Regardless of the structure or size of your business, knowing how to make an invoice streamlines your payment process and helps you keep things professional.

Making an invoice shouldn’t be complicated. With tools provided by Payoneer, you can generate invoices in just a few clicks, which makes life easier when you receive payments from clients, wherever they may be.

This guide will take you through the key features of writing an invoice and explain how Payoneer simplifies invoicing with an invoice generator tool.

What is an invoice?

An invoice is a legally binding form issued by a seller to a buyer, detailing the products or services provided and the total amount owed. It’s a document that serves as both a payment request and a legal record of the transaction. Invoices are essential for tracking revenue, maintaining an orderly flow of cash, and ensuring everything is above regulatory board.

As opposed to a receipt, which confirms a payment has been made, an invoice is issued before payment in the form of a request. A standard invoice includes key information on the seller and buyer such as banking and address specifics, a detailed list of services or products, the total amount due, and any specific payment terms.

Using an invoice generator tool like the one used by Payoneer clients, ensures that all the important elements are included, all while making the creation process more convenient.

Payoneer allows you to create invoices that align with global standards, making it easy to send professional, customizable documents to clients worldwide.

Key components of an invoice

Creating an ironclad invoice means including all the essentials to make sure it’s crystal clear, professional, and compliant.

Here are the details every invoice should have:

Follow the steps below if you want to write a professional invoice:

- Your business details

Include the name of your business , your logo, address, phone number, and work email.

- Client information

Clearly state the client’s name, business name (if applicable), and address. Accurate client details ensure proper record-keeping.

- Invoice number and date

Assign a unique number to your invoice for tracking and reference purposes, and make sure you include the date the invoice was issued. - Description of goods or services rendered

List each product or service provided with a brief but clear description. Include quantities, rates, and subtotals for transparency.

- Payment terms

Outline due dates, methods of payment you accept, and notes about any potential penalties for late payments.

- Total amount due

The obvious one. Make sure the total amount owed is calculated correctly, and be sure to include applicable taxes, VAT, discounts, or additional charges.

- Payment instructions

Specify how and where the client should send payments. If you’re using Payoneer, include links or details to avoid unnecessary details with transactions.

Step-by-step guide on how to write an invoice

- Choose a template or invoice generator

Select an invoice template or use an invoice generator like the one offered by Payoneer. The latter saves time and ensures compliance with global standards. - Enter your business information

Personalize your invoice according to the information mentioned above. - Assign a unique identifier and date

Use a sequential numbering system to keep invoices organized. - Fill in the buyer’s details

Include your client’s name, address, contact information and any other important billing details. - List the products and/or services

Itemize the goods or services provided, making sure descriptions, quantities, and prices are all clear. - Include any special terms of payment

Clearly state the payment due date, accepted methods (e.g., Payoneer), and any notes on late payment fees. - Review and send

Double-check the invoice for errors before sending it. With Payoneer, you can email invoices directly to clients and monitor their status

Following these steps will ensure that your invoices are professional, accurate, and easy for clients to process. Using Payoneer to receive payments streamlines the entire workflow, saving time and ensuring frictionless transactions.

The difference between an invoice template and an invoice generator

When it comes to creating invoices, you have two main options: invoice templates or invoice generators. If you’re a freelancer or a small startup that’s not familiar with invoices, it’s easy to get the two confused.

Each has its benefits, but one may be better suited for your needs. Let’s take a closer look.

Invoice templates

Templates, often available in Word, Excel, or PDF formats, are perfect for those who prefer more of a hands-on approach. You can download a free invoice template, add your details, and save it so that you can usecan you use it again in the future.

Keep in mind that templates require manual input, which can be more time-consuming and prone to errors compared to invoice generators, especially for businesses handling multiple clients.

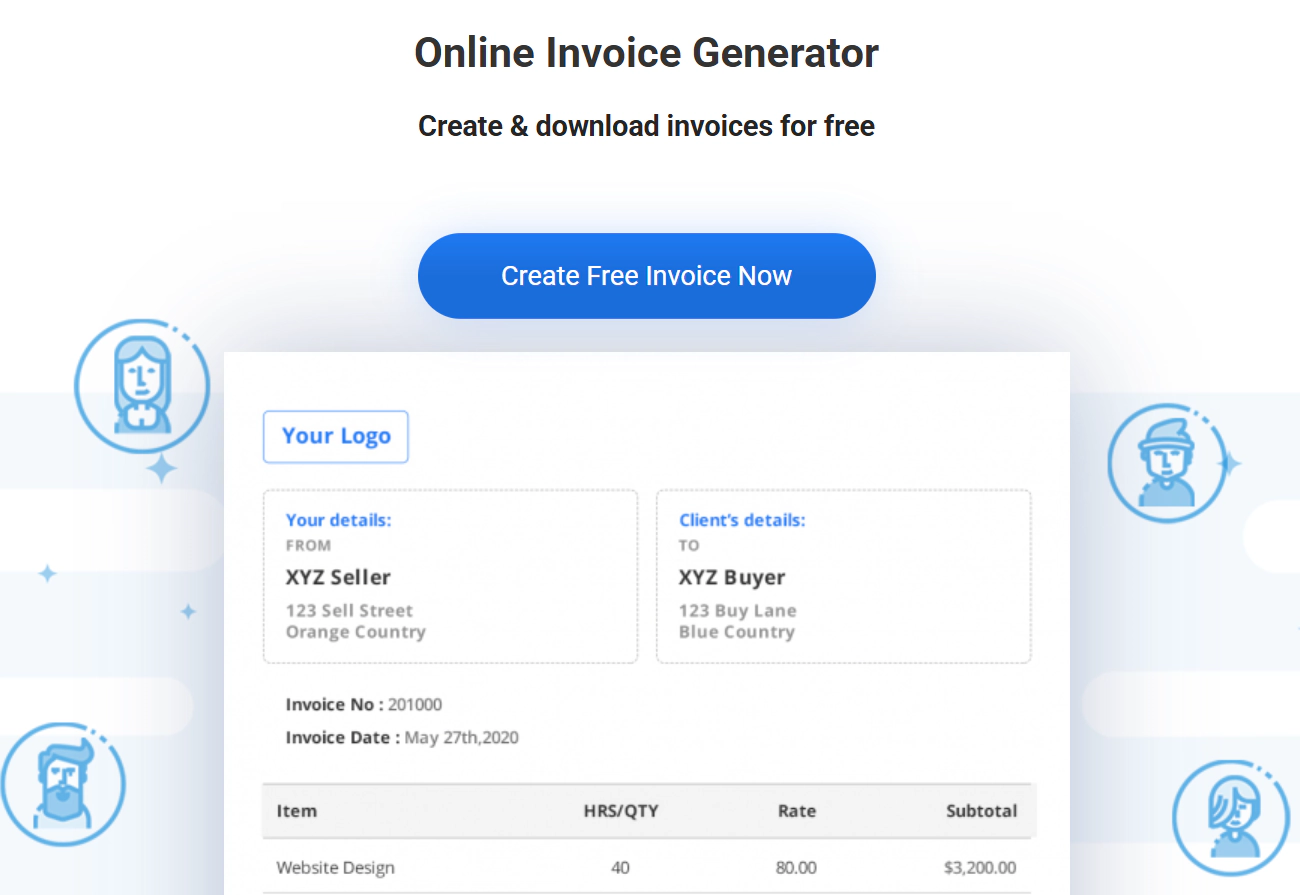

Invoice generators

Invoice generators automate the process more than templates, reducing the possibility for human error in the process. They allow you to create professional invoices quickly, with features like pre-filled client details, automated tax calculations, and built-in payment links. Payoneer’s generator integrates directly with your account, ensuring a seamless workflow from invoicing to receiving payments.

How Payoneer simplifies invoicing

Payoneer is more than just a payment platform or a digital wallet; it’s also a powerful tool for creating and managing invoices.

Here’s how it simplifies the invoicing process:

- Effortless invoice creation: Payoneer’s preferred invoice generator is user-friendly and intended to meet global invoicing standards. You can create an invoice within minutes, ensuring accuracy and professionalism.

- Multi-currency support: Whether your clients pay in USD, EUR, or GBP, Payoneer allows you to issue invoices in multiple currencies, making it perfect for international transactions. Learn more about getting paid by clients.

- Seamless payment integration: You can include payment links directly in your invoice, allowing your clients to pay with ease through credit cards, bank transfers, or other methods.

- Real-time tracking: Keep an eye on your invoices and payments in one centralized, intuitive dashboard that gives you full visibility over your operations.

Common mistakes to avoid when writing an invoice

Creating an invoice seems simple enough, but the smallest mistake can lead to the biggest delay or dispute. That’s why it’s so important to make sure the information is crystal clear and why businesses prefer to use pre-defined invoice templates or invoice generators.

Here are some of the most common mistakes people make with invoices which can end up being very costly in terms of both time and money:

- Missing payment terms

Always make sure you have a clear due date, a preferred payment method, and terms for late payment penalties (if applicable). Any ambiguity in these areas can mislead clients and cause delays. - Incorrect calculations

Double check your math, especially when applying taxes, discounts, or additional fees. Errors are not a good look and may cause unnecessary back-and-forth with clients. - Vague descriptions

Provide full details of descriptions of the goods or services in question. This clarifies everything for both parties and makes sure the buyer and the seller are on the same page. - No follow-up plan

Make sure you have a system in place to follow up on overdue invoices. Payoneer’s tracking features can help you identify and address unpaid invoices promptly.

By addressing these common pitfalls, you can create invoices that are accurate, professional, and more likely to be paid on time.

Frequently asked questions (FAQs)

The simplest way to create an invoice is by using an invoice generator like the one offered on Payoneer. It automates the process, allowing you to quickly create professional and compliant invoices. You simply fill in the details, list the services or products provided, and include payment terms.

Yes, many platforms offer free invoice templates or tools. Payoneer also provides extras and perks that are not all free but add extra layers of convenience like automated calculations and payment tracking. This helps you manage invoices and payments seamlessly. Learn more about international payment processing.

An invoice is a final document issued to request payment for goods or services already delivered. A proforma invoice, however, is a preliminary bill or estimate sent before the transaction is completed. It’s often used to confirm terms or provide cost details.

To ensure compliance, include all necessary details such as your tax identification number, the client’s information, and any applicable tax rates. Using tools like Payoneer’s invoice generator can help you comply with local and international tax requirements without needing to overthink it.

To ensure compliance, include all necessary details such as your tax identification number, the client’s information, and any applicable tax rates. Using tools like Payoneer’s invoice generator can help you comply with local and international tax requirements without needing to overthink it.

Standard practice is to send a polite reminder to your client a few days before and after the due date. Payoneer makes it easy for you to track overdue invoices in your dashboard and send follow-ups to ensure timely payments.

Absolutely! Payoneer simplifies recurring invoicing for clients that you bill regularly, allowing you to save their information for future invoicing purposes. You can also automate invoices and ensure smooth payments with little to no manual intervention.

Related resources

Latest articles

-

Using an Employer of Record in Morocco

Looking for an Employer of Record in Morocco? See how Payoneer Workforce Management’s EOR services help simplify engaging talent in Morocco.

-

Using an Employer of Record in Jordan

Need an Employer of Record in Jordan? Here’s what you need to know about using an EOR in Jordan and how Payoneer Workforce Management can help you engage talent in Jordan.

-

Multi-currency Account: How It Helps Businesses Work With Customers Around the World

Optimize international payments for your IT, eCommerce, or SaaS business with a multicurrency account and easily receive funds from clients from abroad.

-

How to Open an Electronic Wallet: A Guide for Entrepreneurs and Businesses

How quickly and easily can you create an invoice with Payoneer? Learn how it helps businesses accept international payments, track them, and save time.

-

Wire Transfer in Ukraine: What Businesses Need to Know

Wire transfer in Ukraine for business, complete guide: how to make a transfer and receive an international Wire transfer on the account, terms and fees, tips, and examples.

-

Swift, ACH, or Wire: Which International Payment Method Should Businesses Choose?

SWIFT, ACH, or Wire for Ukrainian business: how they work, how they differ, which is cheaper and faster.

Disclaimer

The information in this article/on this page is intended for marketing and informational purposes only and does not constitute legal, financial, tax, or professional advice in any context. Payoneer and Payoneer Workforce Management are not liable for the accuracy, completeness or reliability of the information provided herein. Any opinions expressed are those of the individual author and may not reflect the views of Payoneer or Payoneer Workforce Management. All representations and warranties regarding the information presented are disclaimed. The information in this article/on this page reflects the details available at the time of publication. For the most up-to-date information, please consult a Payoneer and/or Payoneer Workforce Management representative or account executive.

Availability of cards and other products is subject to customer’s eligibility. Not all products are available in all jurisdictions in the same manner. Nothing herein should be understood as solicitation outside the jurisdiction where Payoneer Inc. or its affiliates is licensed to engage in payment services, unless permitted by applicable laws. Depending on or your eligibility, you may be offered the Corporate Purchasing Mastercard, issued by First Century Bank, N.A., under a license by Mastercard® and provided to you by Payoneer Inc., or the Payoneer Business Premium Debit Mastercard®, issued and provided from Ireland by Payoneer Europe Limited under a license by Mastercard®.

Skuad Pte Limited (a Payoneer group company) and its affiliates & subsidiaries provide EoR, AoR, and contractor management services.