Why Now Is the Time for Global E-Commerce Sellers to Diversify Beyond the US

With its high levels of consumer spend, the US has long been a cornerstone market for global e-commerce sellers. It’s also home to some of the world’s most established online retail platforms, making it an attractive territory for sellers aiming for rapid growth.

However, the landscape today looks markedly different from what it did even a year ago. Rising operational costs, shifting regulations, and geopolitical tensions are all putting pressure on sellers who rely heavily on the US market.

In 2025, major carriers like FedEx and DHL implemented average shipping rate increases of 5.9% for U.S. account holders, affecting both domestic and international shipments.

Likewise, Section 301 tariffs have become a sticking point for importers sourcing from China, with high tariffs imposed on certain products. Coupled with the recent escalation of US-China trade restrictions, supply chains are facing increasing uncertainties.

Together, these pressures are forcing e-commerce sellers to rethink their market strategies. Fast fashion companies are establishing warehouses in countries like Vietnam to mitigate risks associated with trade tensions and to diversify their supply chains.

At Payoneer, we’re starting to notice a shift toward broader market diversification. Whether it’s exploring new channels in Europe, testing demand in Southeast Asia, or building direct-to-consumer models in high-growth regions, the conversation is no longer about if e-commerce sellers should diversify, but where to start.

Let’s take a closer look at why the time to act is now, while exploring what’s driving the urgency, and how sellers can build more resilient, global operations without losing momentum in their core markets.

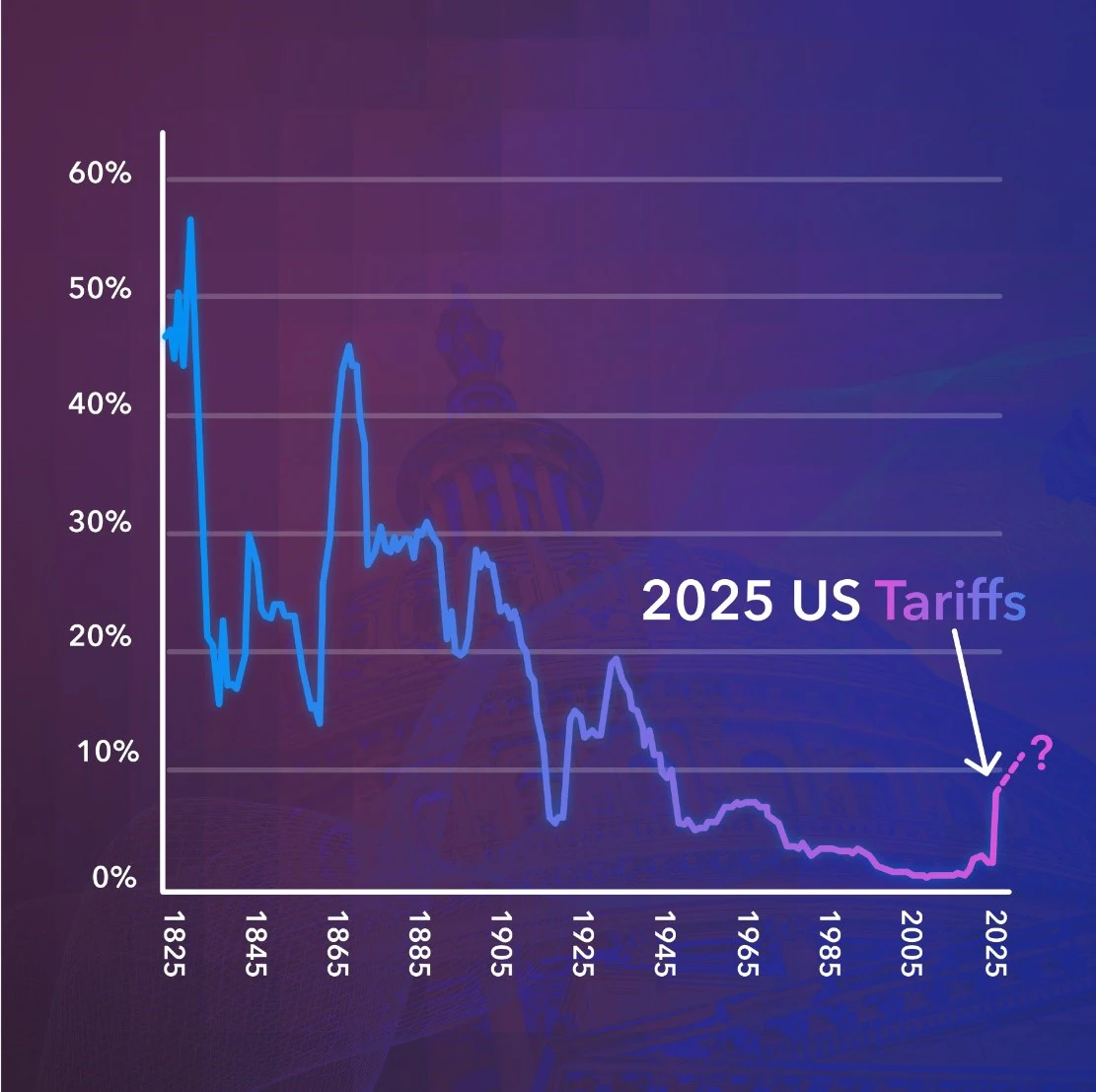

“Liberation Day” tariffs and shifting U.S. trade policies

On April 2, 2025, The U.S. announced sweeping new tariff measures that have further complicated the global trade environment for e-commerce sellers.

Branded by the administration as “Liberation Day” tariffs, the policy introduced a 10% baseline duty on imports from all countries, except for Canada and Mexico. The move took effect just three days later, on April 5.

Beyond the flat baseline tariff, the policy also introduced a framework of country-specific “reciprocal” tariffs. These tariffs target approximately 60 nations that are deemed to have unfair trade practices. The result is a tiered tariff system that adds another layer of unpredictability for importers.

In response to the U.S. tariff increases, China introduced new measures of its own. As of March 2025, additional tariffs came into effect on a range of U.S. agricultural products. New tariffs include a 15% duty on items like chicken, wheat, corn, and cotton. Likewise, the country introduced a 10% tariff on sorghum, soybeans, pork, beef, seafood, fruits, vegetables, and dairy.

While these products might not be a mainstay in most e-commerce stores, China’s response makes it clear that cross-border tensions are heating up again.

Original image: https://www.statista.com/chart/34236/average-effective-tariff-rate-on-us-imports/

So, what’s changing for global e-commerce sellers in 2025?

Global trading is evolving, and global eCommerce trends in 2025 point to increased regulation, new tariffs, and regional supply chain investments. Sellers with tight exposure to US marketplaces, or China-centric supply chains, are feeling the impact more directly, but the ripples are being felt globally.

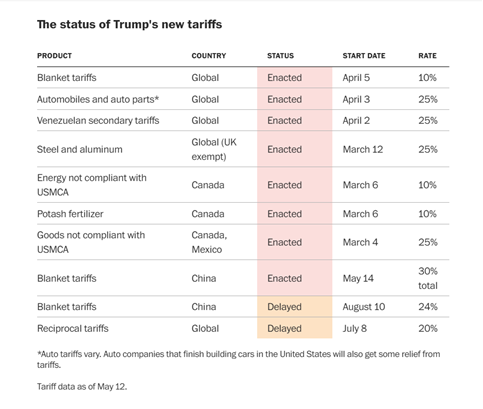

According to recent data from MetricsCart, baseline rates have increased to around 10%, with tariffs as high as 145% on Chinese imports. That said, as of May 2025, a temporary reduction has brought many tariffs down to around 30–50%.

As such, these rates are subject to change, and businesses should aim to stay informed about ongoing negotiations and potential adjustments.

Image source: https://www.washingtonpost.com/business/2025/05/12/china-tariffs-trump-deal-markets/

At Payoneer, we know that many sellers are already feeling the squeeze on margins, especially in low-cost, high-volume categories like electronics and beauty products. Products that were once viable to import may no longer stack up, leading businesses to rethink suppliers, explore domestic options, or try to share costs through new terms.

Tariffs will also make pricing trickier. Some sellers may raise prices, whereas others might absorb the hit to stay competitive. Either way, it’ll impact demand and positioning.

On the operational side, there’s likely to be more focus on total landed costs and supply chain flexibility. As such, we’re likely to see sellers diversifying suppliers, carrying more stock, or dropping certain products altogether. For those tied to Chinese manufacturing, adaptability will be key.

Geopolitical tensions with China aren’t confined to tariff issues either. In 2025, the conversation has moved into broader national security concerns, including restrictions on sensitive technology, increased customs inspections, and closer scrutiny of Chinese-linked platforms and logistics providers.

As reported by the Washington Post, despite a 90-day reduction in May 2025, tariffs remain historically high, and future increases are likely if no long-term deal is reached.

For e-commerce sellers, this creates an unpredictable trading environment that goes beyond simple cost calculations. Stricter customs procedures could lead to shipping delays, higher clearance costs, and more paperwork.

Products flagged for additional checks may get held up at the border, which in turn could increase lead times and diminish customer trust – particularly for sellers who rely on ‘‘just-in-time’’ fulfillment models. Likewise, sellers that depend on tools, warehousing, or logistics with ties to China might face sudden compliance issues or be forced to switch providers.

What’s more, as of May 2025, the U.S. removed the de minimis exemption for low-value imports from China and Hong Kong. So, goods valued at $800 or less from these regions are now subject to duties starting at 120% for shipments via the Universal Postal Union (UPU). And from June, these rates are set to rise to 200%.

This shift will hit fast-fashion and direct to consumer platforms particularly hard, given their reliance on low-cost, high-volume deliveries. For sellers importing similar volumes or products, it’s a clear signal that low-value parcel strategies are becoming more difficult to sustain under current trade conditions.

The risks of over-reliance on the US market

Overall, tariffs are likely to drive retail prices up, which will increase the risk of consumers abandoning carts and spending more cautiously.

So, e-commerce businesses need to strategically balance price increases to maintain margins, while diversifying their supply chains to mitigate costs.

For many global sellers, the US market has delivered growth, scale, and visibility. But relying too heavily on a single territory (especially one under increasing pressure) introduces a level of risk that can quietly undermine long-term sustainability.

Tariffs are already pushing retail prices up, which is putting more pressure on buyers. As a result, cart abandonment is rising and price sensitivity is becoming harder to manage for sellers.

To stay profitable, e-commerce businesses need to strike a balance between maintaining margins and absorbing new costs. However, beyond pricing, the bigger issue is structural. The “Liberation Day” tariffs, China’s new measures, and the removal of de minimis exemptions points to a longer-term shift. Global trade is becoming more fragmented.

For many sellers, the US market has provided scale and consistency for years. That consistency is now less predictable. Relying too heavily on a single sales region or supply chain means being vulnerable to decisions that are outside the control of e-commerce sellers.

As such, diversifying markets and supply chains is a practical way to reduce exposure, maintain momentum, and build a more resilient business over time.

Economic risk: Demand volatility and consumer pressure

US consumers are still spending, but not across the board. The ripple effects of the last few years (especially inflation) have squeezed household budgets, particularly for lower- and middle-income shoppers.

According to the Federal Reserve, credit card debt hit a record $1.18 trillion in early 2025. So, although e-commerce is still ticking along, it’s clear that demand for non-essentials has taken a hit.

It’s therefore important for sellers to maximise the services offered by cross-border payment providers like Payoneer. Features like fast currency conversion for transactions, multi-currency pricing, and local payment options can help improve affordability for international buyers, reduce cart abandonment, and protect margins in markets where demand is still holding up.

Political risk: Tariffs, trade shifts, and regulations

Section 301 tariffs are already making it harder for sellers to plan and price products reliably. And now those tensions are spilling into other areas like tech and logistics.

New regulatory proposals around data localization and platform accountability are working their way through Congress. Even if some don’t pass, just the discussion can be enough to rattle investors and shake confidence among business partners.

With the tariff impact on e-commerce now extending beyond cost into logistics and compliance, e-commerce businesses need to stay one step ahead. They can do this by leaning on cross-border payment providers that support pricing flexibility and tax management tracking across different regions. Platforms like Payoneer can give sellers more control in markets where regulation and cost structures are shifting fast.

Platform risk: Leading global marketplace rule changes and fee increases

Sellers who rely heavily on leading global marketplaces are likely feeling the pressure more than most. Fee hikes introduced in early 2025 have pushed up costs across fulfilment, referral, and storage. In turn, this will cut into profit margins across several categories.

On top of that, changes to policies around account health, suspensions, and listing restrictions have caught a lot of sellers off guard, forcing them to try to recover lost ground after unexpected setbacks.

E-commerce sellers would therefore do well to access receiving accounts with low currency conversion fees for transactions that can improve cash flow visibility. Some providers also offer integration with accounting software, which can make it easier to forecast earnings and stay financially agile.

Diversification opportunities in other markets

Diversifying beyond the US doesn’t need to mean starting from scratch. There are several ways to diversify e-commerce markets based on category, logistics, and customer demand.

International markets are open for business and are actively encouraging global sellers to step in. Sellers who have built strong operations on major e-commerce platforms have a real opportunity to move their business into less saturated, more margin-friendly regions.

Europe

Europe, for example, remains a steady option for e-commerce growth thanks to strong logistics, high purchasing power, and clearer digital tax systems. Demand for niche and premium products is rising, especially in lifestyle and eco-friendly segments.

The European premium beauty market for one, is projected to grow at a compound annual growth rate (CAGR) of 3.75% from 2023 to 2029 – reaching $25.35 billion by 2029.

This growth is fueled by increasing consumer interest in self-care, high-quality products, and sustainability.

Latin America

Likewise, the Latin American market is growing fast, driven by a young, mobile-savvy population and increasing middle-class demand.

Regional and global e-commerce platforms are capturing a growing share of consumer traffic across the region. Logistics also are catching up quickly, especially in last-mile delivery.

For instance, one leading marketplace has announced plans to invest $2.6 billion in Argentina in 2025, focusing on enhancing logistics, marketing, and technology infrastructure.

Middle East

In the Middle East, the United Arab Emirates (UAE), Saudi Arabia, and Qatar are expanding digital and logistics infrastructure.

Overall, the Middle East’s e-commerce market was valued at $1,888 billion in 2024, and is projected to reach $10,957 billion by 2033.

The region’s growth is driven by rapid digital transformation, high-speed internet, and smartphone penetration.

Southeast Asia

Similarly, e-commerce markets in Southeast Asia are experiencing rapid growth. Regional online marketplaces with strong local presence continue to dominate, as platforms that tailor their strategies to local preferences consistently outperform more generic, international approaches.

For example, one leading Southeast Asian marketplace commands 48% market share in the Southeast Asian e-commerce market. Likewise, payments and delivery have improved significantly, making the region increasingly viable for cross-border sellers.

Expanding into these regions gives e-commerce sellers a chance to reach customers who aren’t being fully served. With less competition in many of these markets, there’s often more room for margin, especially where imported goods are seen as higher value.

On the operational side, logistics and payments have made real progress. Local marketplaces are actively building the kind of infrastructure that makes it easier for international sellers to plug in.

And with online buying now well established across most of these regions, the gap between “emerging” and “ready” is closing fast.

Indeed, sellers who get in early will build more resilience by relying less on markets that are becoming harder to predict.

Developing an international selling strategy

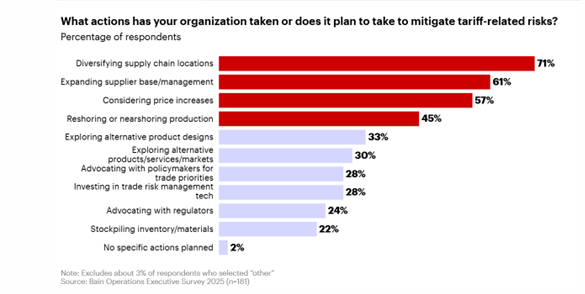

According to global management consultancy Bain and Company, the top action organizations are taking (or planning to take) to reduce exposure to tariffs is diversifying their supply chain locations.

For e-commerce sellers, diversifying production means protecting margins, reducing the chance of disruption, and developing more resilience to future trade changes.

By sourcing from multiple regions, building relationships with local suppliers, and using third-party logistics networks, sellers can effectively manage cross-border fulfilment.

Image source: https://www.bain.com/insights/beyond-tariffs-the-supply-chain-reinvention-imperative/

Adapting to local expectations

Selling internationally means meeting different expectations on elements like product descriptions, sizing charts, payment options, and customer service. It also means ensuring that translations go beyond literal accuracy. Messaging needs to reflect local language nuances, cultural norms, and buyer expectations to build trust and drive conversion.

For example, a skincare product marketed with US-centric language might not connect with consumers in markets where ingredient awareness or regulatory standards differ.

So, we recommend that sellers should focus on their top-performing products and adapt the messaging based on local buying behaviours. They can then make sure images comply with platform norms and local sensibilities.

On the compliance front, each country brings its own set of requirements. These might include value added tax (VAT) or goods and services tax (GST) registration, packaging rules, and safety certifications – especially for electronics, cosmetics, and food-related items.

For sellers operating in Europe, Payoneer will simplify your VAT payments. You can pay EU tax authorities directly from earnings in your account – and without fees. Unlike traditional VAT payment providers, there are no extra costs with Payoneer, so, means you skip the fee when you withdraw funds to your bank account.

Likewise, Payoneer’s receiving accounts give you more freedom to get paid like a local in more currencies and markets. You can accept international payments in global currencies and get paid by clients and marketplaces in the US, UK, Europe, Japan, Canada, Australia, Singapore, Hong Kong, and UAE.

Marketplace selection

With so many channels available globally, it’s tempting to go wide. But spreading too thin too soon often leads to fragmented logistics, diluted performance, and overstretched support teams. A better approach is to start with one or two target markets that align with your category, price point, and operational strengths.

For example, major European marketplaces that integrate with widely used fulfilment networks offer a smoother expansion path for sellers already familiar with those systems—especially when pan-regional logistics options are available. In contrast, some Latin American platforms present high barriers to entry but strong rewards for sellers willing to invest in local inventory and pricing strategy.

Some regional platforms in Southeast Asia offer subsidized shipping programs and country-specific promotions, helping new sellers gain visibility and compete more effectively. In parallel, newer marketplaces in the Middle East are expanding their seller support tools and fulfilment infrastructure, making it easier for merchants to gain early traction—particularly in higher-end product segments.

In general, your choice of platform should be based on buyer behavior in your category, as well as shipping and fulfilment lead times, and available language support. Likewise, advertising reach and cost-per-click dynamics are importance considerations.

Remember, your e-commerce business doesn’t need to be everywhere, it just needs to be visible where it counts. Choosing the right platform means your products meet the right customers, under the right conditions.

How Payoneer supports global e-commerce sellers

Expanding into new markets as an e-commerce seller is rewarding, but it comes with a set of challenges that can slow momentum. Obstacles like managing cross-border payments, working capital gaps, and local currency can quickly eat into your time, margins, and growth plans if they’re not handled efficiently.

This is where Payoneer can help. Our platform is well-suited to e-commerce sellers looking to scale internationally. We provide the tools you need to manage payments, access funding, and stay compliant.

Secure, payouts

Global sellers need to move fast, keep costs low, and ensure a smooth experience for their customers and payees. Payoneer helps you do all three.

Through our secure and compliant mass payouts feature, you can send payments to over 190 countries and territories in 70 currencies. Whether you’re paying suppliers, freelancers, or affiliate partners, Payoneer simplifies the process by minimizing the risks of delays or fraud.

Some leading affiliate and partner marketing platforms have already leveraged cross-border payment solutions to process significant volumes—reaching $53.8 million in a single year in some cases.

Access to working capital

Growth often depends on timing, and Payoneer’s Capital Advance is designed to help sellers seize the right moment.

Based on your monthly sales volume, you may be eligible for funding offers of up to 140% (capped at $750,000 USD), with settlement periods of up to 6 months for marketplace sellers.

These short-term capital boosts are ideal for stocking up on inventory, hiring seasonal help, or investing in advertising during key sales periods

Tax services

Handling taxes across different markets is one of the least enjoyable parts of selling globally, but it’s also one of the most important. Payoneer’s end-to-end tax automation tools help sellers stay compliant and save hours of admin.

Whether you’re dealing with 1099 or 1042 forms, Payoneer helps distribute, collect, verify, and submit everything to the IRS, so you don’t have to juggle multiple service providers.

This kind of automation not only reduces the risk of filing errors, but also frees up your time and budget to focus on more valuable work, like selling, scaling, and reaching new markets.

Now is the time to rethink your market strategy

Between trade volatility, platform pressures, and policy unpredictability, the US market isn’t the same safe bet it once was. For sellers, the signals are becoming harder to ignore, and selling beyond the US is a way to regain control and reduce risk.

For e-commerce sellers, now is the right time to reset. New markets are accessible, and they’re actively inviting cross-border sellers in. The infrastructure is in place, platforms are maturing, and the tools required to adapt are better than they’ve ever been.

Sellers who act now have the benefit of momentum. They can shape the way they enter new regions, picking their channels carefully, and building leaner, more resilient operations with a broader reach.

To learn more about how to diversify your e-commerce business beyond the US, talk to our Growth Team today.

Arrange a Call

Related resources

Latest articles

-

Using an Employer of Record in Morocco

Looking for an Employer of Record in Morocco? See how Payoneer Workforce Management’s EOR services help simplify engaging talent in Morocco.

-

Using an Employer of Record in Jordan

Need an Employer of Record in Jordan? Here’s what you need to know about using an EOR in Jordan and how Payoneer Workforce Management can help you engage talent in Jordan.

-

Multi-currency Account: How It Helps Businesses Work With Customers Around the World

Optimize international payments for your IT, eCommerce, or SaaS business with a multicurrency account and easily receive funds from clients from abroad.

-

How to Open an Electronic Wallet: A Guide for Entrepreneurs and Businesses

How quickly and easily can you create an invoice with Payoneer? Learn how it helps businesses accept international payments, track them, and save time.

-

Wire Transfer in Ukraine: What Businesses Need to Know

Wire transfer in Ukraine for business, complete guide: how to make a transfer and receive an international Wire transfer on the account, terms and fees, tips, and examples.

-

Swift, ACH, or Wire: Which International Payment Method Should Businesses Choose?

SWIFT, ACH, or Wire for Ukrainian business: how they work, how they differ, which is cheaper and faster.

Disclaimer

The information in this article/on this page is intended for marketing and informational purposes only and does not constitute legal, financial, tax, or professional advice in any context. Payoneer and Payoneer Workforce Management are not liable for the accuracy, completeness or reliability of the information provided herein. Any opinions expressed are those of the individual author and may not reflect the views of Payoneer or Payoneer Workforce Management. All representations and warranties regarding the information presented are disclaimed. The information in this article/on this page reflects the details available at the time of publication. For the most up-to-date information, please consult a Payoneer and/or Payoneer Workforce Management representative or account executive.

Availability of cards and other products is subject to customer’s eligibility. Not all products are available in all jurisdictions in the same manner. Nothing herein should be understood as solicitation outside the jurisdiction where Payoneer Inc. or its affiliates is licensed to engage in payment services, unless permitted by applicable laws. Depending on or your eligibility, you may be offered the Corporate Purchasing Mastercard, issued by First Century Bank, N.A., under a license by Mastercard® and provided to you by Payoneer Inc., or the Payoneer Business Premium Debit Mastercard®, issued and provided from Ireland by Payoneer Europe Limited under a license by Mastercard®.

Skuad Pte Limited (a Payoneer group company) and its affiliates & subsidiaries provide EoR, AoR, and contractor management services.