Payroll solutions for 1099 and W2 employees

Managing a hybrid team? Here’s a quick guide to payroll solutions for 1099 and W2 employees—so you can find the right platform without the guesswork.

Navigating payroll solutions for 1099 and W2 employees can feel like managing two completely different playbooks, like you’re juggling two completely different systems. From tax compliance and contractor classification to international payments and reporting, businesses need a unified approach that’s built to handle complexity without increasing risk.

In this post, we’ll break down your options for managing a blended workforce, highlight common payroll challenges, and help you choose a solution that works for both employee and contractor needs. Typically, payments made to 1099 contractors cannot be referred to as payroll; however, to ease readability, we use the term payroll solution in this article.

What’s the difference between payroll solutions for 1099 and W2 employees?

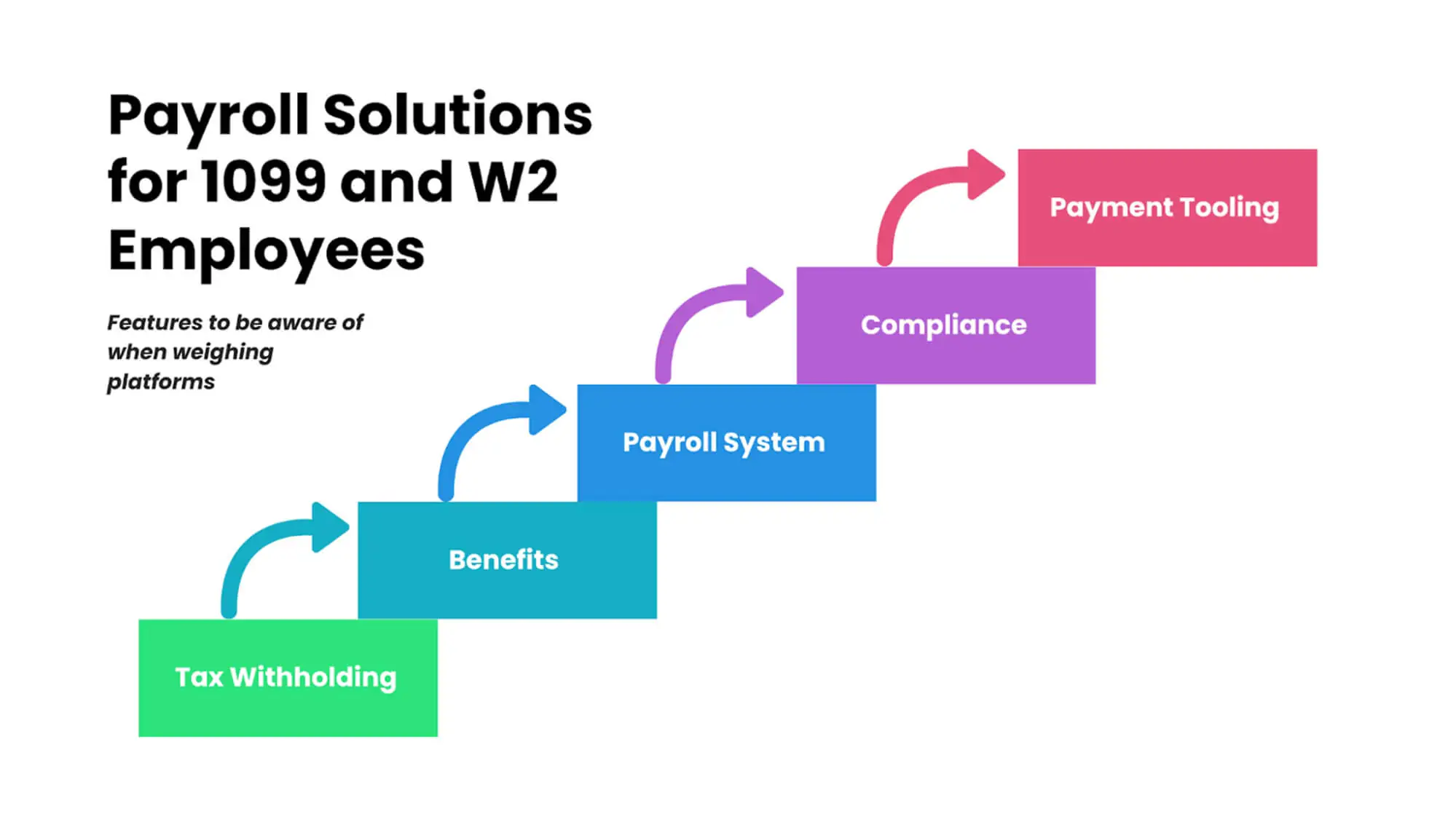

The core distinction between payroll solutions for 1099 and W2 employees comes down to classification, tax, and legal obligations. These are outlined in the following table for ease of understanding.

Payroll solution differences between W2 employees and 1099 contractors

| Feature | 1099 Contractors | W2 Employees |

|---|---|---|

| Tax Withholding | Contractor handles their own | The employer is responsible (Should File Form W-2) |

| Benefits | Not eligible for employer benefits | Eligible for benefits like health insurance, PTO, etc. |

| Payroll System | Often invoice-based or milestone-based | Runs on a schedule (weekly, biweekly) |

| Compliance | Governed by contract and classification | Subject to employment laws |

| Payment Tooling (Payment method) | Often managed via invoicing and disbursement platforms | Typically managed through payroll software |

It’s imperative to get this distinction right, especially worker classification, since misclassified workers lead to serious financial and legal consequences.

What payroll solutions work best for a mixed workforce?

If you’re managing a hybrid workforce, there are a few payroll options that you can explore that can help you manage paying independent contractors effectively. Here are the three most popular.

| Global Workforce Management Platforms (e.g., Payoneer Workforce Management) | Full-Service Payroll Providers | Contractor-Only Platforms | |

|---|---|---|---|

| Handles W2 Employee Payroll | ✅ | ✅ | ❌ |

| Handles 1099 Contractor Payments | ✅ | ❌ | ✅ |

| Global Payment Support | ✅ | ❌ | ✅ |

| Contractor Classification Assistance | ✅ | ❌ | ✅ |

| Integrated Compliance Tools | ✅ | ✅ | ❌ |

| Ideal for Blended (W2 + 1099) Workforces | ✅ | ❌ | ❌ |

1) Global Workforce Management Platforms (Like Payoneer Workforce Management)

Payoneer Workforce Management supports both employees and contractors, offering a centralized platform that streamlines global payroll, classification, tax documentation, and compliance. It’s ideal for companies hiring internationally or scaling remote-first operations.

2) Full-Service Payroll Providers

These providers handle tax calculations, W2 filings, and employee benefits. They work well for traditional teams operating within the U.S.

3) Contractor-Only Platforms

These platforms are designed for freelancer-heavy teams, offering contractor payments and, in many cases, basic classification support. However, they typically lack the full capabilities needed to manage employee payroll.

Why Payoneer Workforce Management stands out

You don’t need separate systems or messy workarounds to manage your hybrid workforce. What you do need, however, is a platform built for how modern teams actually work. With Payoneer Workforce Management, you can:

- Streamline payroll for W2 employees and 1099 contractors

- Stay compliant in 160+ countries

- Issue timely global payments in 70 currencies

- Reduce misclassification risk with seamless support and documentation workflows

Ready to simplify your workforce payroll solutions?

When it comes to payroll solutions for 1099 and W2 employees, Payoneer Workforce Management helps reduce the complexity when managing hybrid workforces.

We’ve helped businesses of all sizes scale with confidence by simplifying global payroll, streamlining compliance, and giving teams the freedom to focus on what they do best: delivering exceptional solutions to their clients.

Request a free demo of Payoneer Workforce Management today and see how seamless payroll solutions for 1099 and W2 employees can be.

FAQs

1. Can I use the same payroll software for W2 and 1099 workers?

Yes, with the caveat that most platforms are not built for both. While traditional payroll software may support basic payments to 1099 contractors functionality, only integrated solutions provide the end-to-end tools necessary to effectively manage both workers under one platform, especially when hiring globally.

2. How do I stay compliant when paying 1099 contractors?

- Classify workers correctly under local labor laws

- Collect Form W-9 and issue 1099-NEC forms

- Avoid treating one group like the other (e.g., treating an employee like a contractor or vice versa)

A comprehensive workforce management platform like Payoneer Workforce Management simplifies onboarding, tax documentation, and classification.

3. Is the process the same for paying 1099 contractors and W-2 employees?

No, the process is different. W-2 employees have taxes withheld by the employer and receive benefits. 1099 contractors handle their own taxes, and employers only issue payments and, if required, a 1099 form.

4. How do I file taxes if I have both a 1099 and a W-2?

You’ll report your W-2 income as wages and your 1099 income as self-employment income on your tax return. You may need to file additional forms like Schedule C and pay self-employment tax on your contractor earnings.

5. Can an individual be both an employee and an independent contractor?

Yes, but only if the roles are completely separate. The work done as a contractor must be outside the scope of the employee’s regular duties and meet IRS guidelines for independent contractor classification.

Related resources

Latest articles

-

Using an Employer of Record in Morocco

Looking for an Employer of Record in Morocco? See how Payoneer Workforce Management’s EOR services help simplify engaging talent in Morocco.

-

Using an Employer of Record in Jordan

Need an Employer of Record in Jordan? Here’s what you need to know about using an EOR in Jordan and how Payoneer Workforce Management can help you engage talent in Jordan.

-

Multi-currency Account: How It Helps Businesses Work With Customers Around the World

Optimize international payments for your IT, eCommerce, or SaaS business with a multicurrency account and easily receive funds from clients from abroad.

-

How to Open an Electronic Wallet: A Guide for Entrepreneurs and Businesses

How quickly and easily can you create an invoice with Payoneer? Learn how it helps businesses accept international payments, track them, and save time.

-

Wire Transfer in Ukraine: What Businesses Need to Know

Wire transfer in Ukraine for business, complete guide: how to make a transfer and receive an international Wire transfer on the account, terms and fees, tips, and examples.

-

Swift, ACH, or Wire: Which International Payment Method Should Businesses Choose?

SWIFT, ACH, or Wire for Ukrainian business: how they work, how they differ, which is cheaper and faster.

Disclaimer

The information in this article/on this page is intended for marketing and informational purposes only and does not constitute legal, financial, tax, or professional advice in any context. Payoneer and Payoneer Workforce Management are not liable for the accuracy, completeness or reliability of the information provided herein. Any opinions expressed are those of the individual author and may not reflect the views of Payoneer or Payoneer Workforce Management. All representations and warranties regarding the information presented are disclaimed. The information in this article/on this page reflects the details available at the time of publication. For the most up-to-date information, please consult a Payoneer and/or Payoneer Workforce Management representative or account executive.

Availability of cards and other products is subject to customer’s eligibility. Not all products are available in all jurisdictions in the same manner. Nothing herein should be understood as solicitation outside the jurisdiction where Payoneer Inc. or its affiliates is licensed to engage in payment services, unless permitted by applicable laws. Depending on or your eligibility, you may be offered the Corporate Purchasing Mastercard, issued by First Century Bank, N.A., under a license by Mastercard® and provided to you by Payoneer Inc., or the Payoneer Business Premium Debit Mastercard®, issued and provided from Ireland by Payoneer Europe Limited under a license by Mastercard®.

Skuad Pte Limited (a Payoneer group company) and its affiliates & subsidiaries provide EoR, AoR, and contractor management services.