Hire anyone, anywhere – easily and compliantly

Contractor Management

Pay your contractors wherever they are, seamlessly.

Agent of Record

Hire, pay, and manage contractors internationally, in compliance with local laws.

Employer of Record

Hire, pay, and manage global employees without setting up local legal entities.

In good company

We work with businesses and marketplaces of every size, including many you might recognize.

The simple way to manage a global workforce

In one platform, you can easily control every stage of your workforce management, including global employment, payroll, benefits, contractors, and more.

Onboarding without obstacles

Onboard your contractors and employees worldwide, seamlessly and in compliance with local laws:

- Calculate and analyze the cost to hire anyone, anywhere

- Create and send localized contracts in minutes

- Quickly collect all the necessary employment documentation

- Get expert support for issuing and managing work devices

Flexible ways to pay

Pay your employees and contractors in 70 currencies, through a wide range of payment methods:

- Invoice payments

- Credit card

- Direct bank transfer

- Wire Transfer

- ACH Transfer

Plus, you can manage bulk payments, invoicing, deductions, pay slips and more — all at the touch of a button.

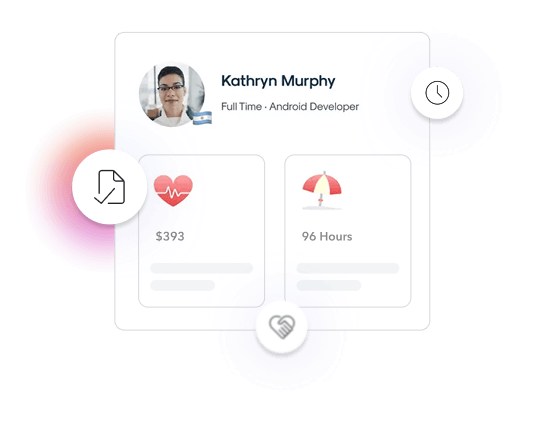

Employment made easy

Whenever you hire contractors or employees, all over the world, we’ll help you offer the best benefit packages, handle timesheets and expense management, and more – all in one platform for the complete employment lifecycle.

Keeping you compliant

With legal and compliance expertise in 160+ countries, we can help you stay on top of changing employment laws, mitigate risks, and ensure you’re complying with local regulations, everywhere you hire.

We can help you build your dream global team

Talent discovery

Helping you find the perfect candidate across the globe.

Background checks

Ensuring trust, compliance, and the right fit.

Coworking spaces

Helping you provide your team with workspace and conference rooms.

Visas and work permits

Making sure the people you hire have the legal right to stay and work.

Equipment for new hires

Setting up everyone you hire for success from day one.

Global Hiring Toolkit

From local salary benchmarks to employment costs, learn all you need to know about hiring, paying, and managing an international team.

Global hiring guides

Explore and benchmark salaries

Employee cost calculator

Hire, onboard, pay, and manage your remote team with Payoneer

160+

Countries

covered

100%

Transparency in

fee structure

70

Currencies

for payroll

24×5

Dedicated

support

Skuad Pte Limited (a Payoneer group company) and its affiliates & subsidiaries shall provide EoR, AoR, and contractor management services.