Independent contractor vs employee: A simple guide

Struggling to navigate the difference between independent contractors vs employees? Our quick guide breaks it down and offers simple, compliant solutions for global hiring.

As more businesses scale across borders and tap into flexible, remote talent, the line between an independent contractor vs employee can feel increasingly blurred. It’s no longer just a legal distinction—it shapes how you manage taxes, benefits, and long-term obligations.

That’s why getting worker classification right is more important than ever. Missteps can lead to costly fines, compliance issues, or unexpected liabilities.

To clear things up, we’ve put together a simple, side-by-side breakdown of the key differences between independent contractors and employees, so you can make smart, compliant hiring decisions as your business grows.

Independent contractor vs employee: What global businesses need to know

The distinction between an independent contractor vs employee centers on control and tax obligations. Contractors work independently and handle their own taxes, while employees follow employer direction, have set hours, and receive benefits with tax withholdings. Misclassification can result in serious legal and financial consequences.

The table below highlights the key differences.

Independent contractor vs employee: Key differences at a glance

| Criteria | Independent contractor | Employee |

|---|---|---|

| Control over work | Contractor-controlled | Employer-controlled |

| Tax responsibility | The contractor pays their own taxes | Employer withholds taxes |

| Benefits eligibility | Not eligible | Typically eligible |

| Long-term commitment | Project-based or short-term | Ongoing |

| Legal protections | Limited | Complete labor law coverage |

Who is an Independent Contractor?

An independent contractor is a self-employed individual who operates through their own business entity. Unlike traditional employees, they aren’t on a company’s payroll and usually work on a project-by-project or retainer basis.

They typically:

- Set their own schedule and work independently

- Use their own tools and equipment

- Handle their own taxes and insurance

- Aren’t entitled to benefits like healthcare, retirement plans, or paid leave

Independent contractors offer flexibility for both themselves and the businesses they work with, but that freedom also comes with added responsibility.

Who is an Employee?

An employee is hired directly by a company under a formal employment agreement. They’re part of the organization’s structure and typically receive a regular salary or hourly wage.

Employees generally:

- Work under company supervision and follow internal policies

- Receive training and ongoing support from the employer

- Are eligible for benefits like health insurance, retirement plans, and paid time off

- Have their taxes withheld and paid on their behalf by their employer

- Are protected by local labor laws, including wage standards and termination rights

This setup allows them to enjoy more stability and legal protections than independent contractors, but it also comes with stricter rules around how work is assigned and performed.

Why classification matters

As we’ve mentioned, there are several essential reasons why employers need to classify their workers correctly. In the table below, we explain those reasons and why they matter.

| Reason | Why it Matters | |

|---|---|---|

| Legal Compliance | Minimize fines, lawsuits, and penalties for misclassifying workers under labor laws. | |

| Tax Obligations | Misclassification can lead to back taxes, interest, and payroll tax liabilities. | |

| Risk of Reputational Damage | Labor disputes or government action can damage your company’s credibility and brand. | |

| Cost Structure and Planning | Employees come with fixed costs (benefits, leave, insurance); contractors allow for flexible budgeting. | |

| Global Expansion | Proper classification is essential when expanding internationally to stay compliant across borders. | |

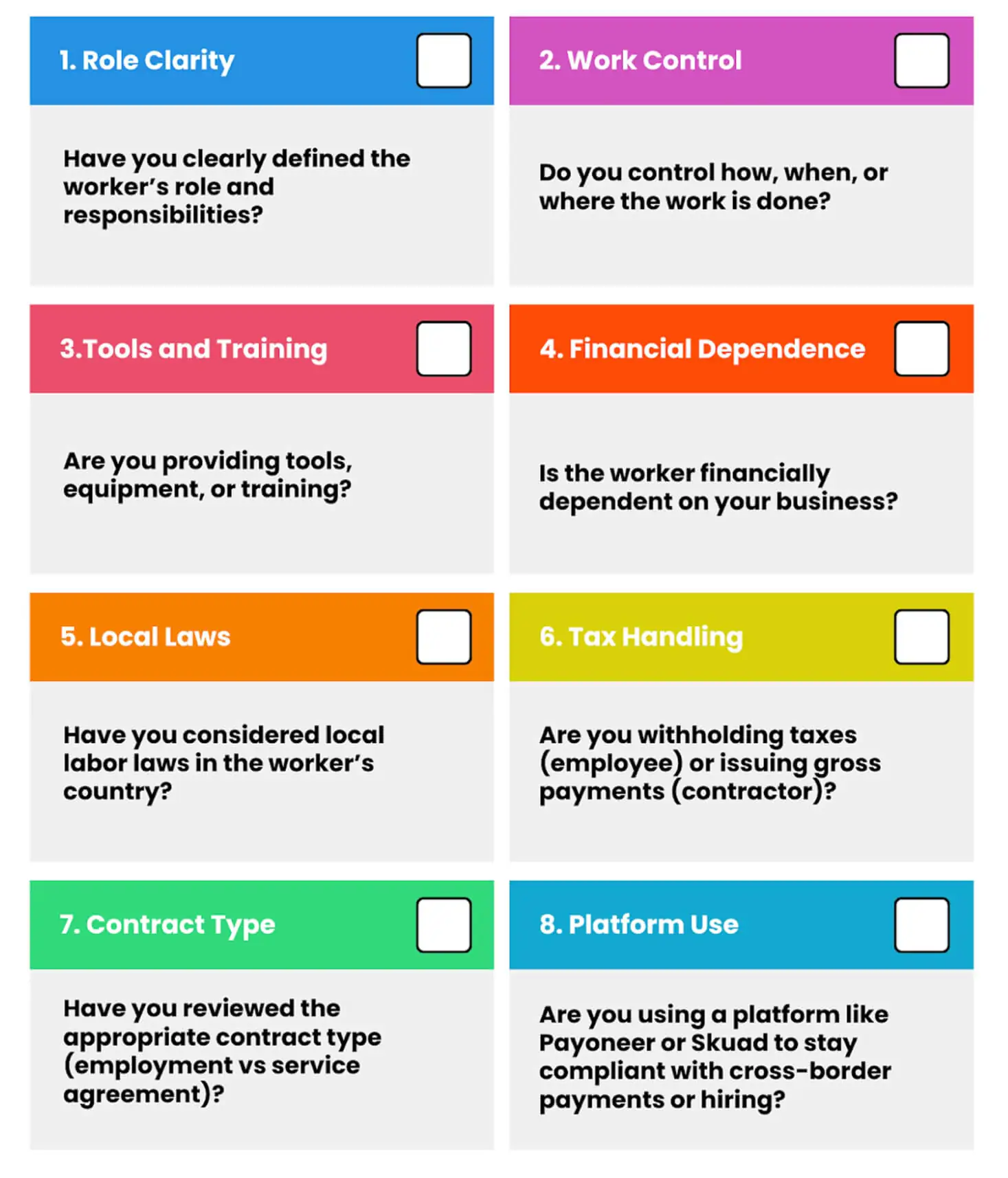

Worker classification checklist for employers

Simplifying global contractor payments with Payoneer Workforce Management

Managing a global workforce sounds simple—until you’re juggling tax laws, labor rules, and compliance in multiple countries. That’s where Payoneer Workforce Management offers a way to streamline contractor management.

With Payoneer Workforce Management, businesses can seamlessly pay contractors and freelancers in 160+ countries and 70 currencies with support to mitigate misclassification risks.

As remote work becomes the norm, hiring globally is becoming increasingly strategic for growing businesses. However, knowing the difference between an independent contractor vs employee isn’t always cut and dry. It depends on where your team lives, how they work, and how you engage them.

Classification isn’t just a legal formality—it’s the backbone of efficient, sustainable growth.

Ready to grow your business by managing global contractors? Schedule a free demo today to learn how we can simplify your global workforce payments.

FAQs

1. How does the IRS determine whether someone is an independent contractor?

The IRS looks at three main factors: behavioral control, financial control, and the relationship between the worker and the business. If the worker controls how the work is done, uses their own tools, and is not treated like an employee, they are likely an independent contractor.

2. Can an individual be both an employee and an independent contractor?

Yes, but only if the roles are completely separate. The contractor’s work must be outside the scope of their employee duties and meet IRS criteria for independent contractors to avoid misclassification.

3. What is the ABC rule for independent contractors?

The ABC rule is a legal test used in some states to determine if a worker is truly an independent contractor. To qualify, the worker must:

A) be free from control and direction,

B) perform work outside the usual business of the employer, and

C) be independently established in that trade or business.

All three conditions must be met.

Related resources

Latest articles

-

Employment laws in Sweden

Explore the employment laws in Sweden, a comprehensive guide to employees’ rights, employer obligations, and fair labor practices.

-

Employment laws in Poland

Explore the ins and outs of employment laws in Poland, an info-rich guide to employees’ rights, employer obligations, and fair labor practices that shape the future.

-

Employment laws in Indonesia

Find out more about Indonesia labor laws that dictate how employees should be contracted, managed, and paid, both on a national and state/territory level.

-

Employment laws in France

Learn about France’s labor laws dictating minimum wage, benefits, and more. Plus, discover the consequences of non-compliance with employment laws in France.

-

Employment laws in Spain

Find out more about Spain’s labor laws, from contracts and benefits to termination rules.

-

Employment laws in Australia

Find out more about the employment laws in Australia that dictate how employees should be contracted, managed, and paid, both on a national and state/territory level.

Disclaimer

The information in this article/on this page is intended for marketing and informational purposes only and does not constitute legal, financial, tax, or professional advice in any context. Payoneer and Payoneer Workforce Management are not liable for the accuracy, completeness or reliability of the information provided herein. Any opinions expressed are those of the individual author and may not reflect the views of Payoneer or Payoneer Workforce Management. All representations and warranties regarding the information presented are disclaimed. The information in this article/on this page reflects the details available at the time of publication. For the most up-to-date information, please consult a Payoneer and/or Payoneer Workforce Management representative or account executive.

Availability of cards and other products is subject to customer’s eligibility. Not all products are available in all jurisdictions in the same manner. Nothing herein should be understood as solicitation outside the jurisdiction where Payoneer Inc. or its affiliates is licensed to engage in payment services, unless permitted by applicable laws. Depending on or your eligibility, you may be offered the Corporate Purchasing Mastercard, issued by First Century Bank, N.A., under a license by Mastercard® and provided to you by Payoneer Inc., or the Payoneer Business Premium Debit Mastercard®, issued and provided from Ireland by Payoneer Europe Limited under a license by Mastercard®.

Skuad Pte Limited (a Payoneer group company) and its affiliates & subsidiaries provide EoR, AoR, and contractor management services.