Independent contractor misclassification penalties

Hiring globally? Don’t overlook the risks. Learn what independent contractor misclassification penalties look like—and how to stay compliant when hiring abroad.

As today’s workforce grows more global, many companies are tapping into remote talent across borders, bringing fresh perspectives, unique skills, and, importantly, new responsibilities.

One major responsibility? Making sure workers are correctly classified. Misclassifying employees as independent contractors (or vice versa) can lead to serious consequences.

To help you stay compliant, we’ve outlined the most common independent contractor misclassification penalties below so you know exactly what to watch out for before a costly mistake occurs.

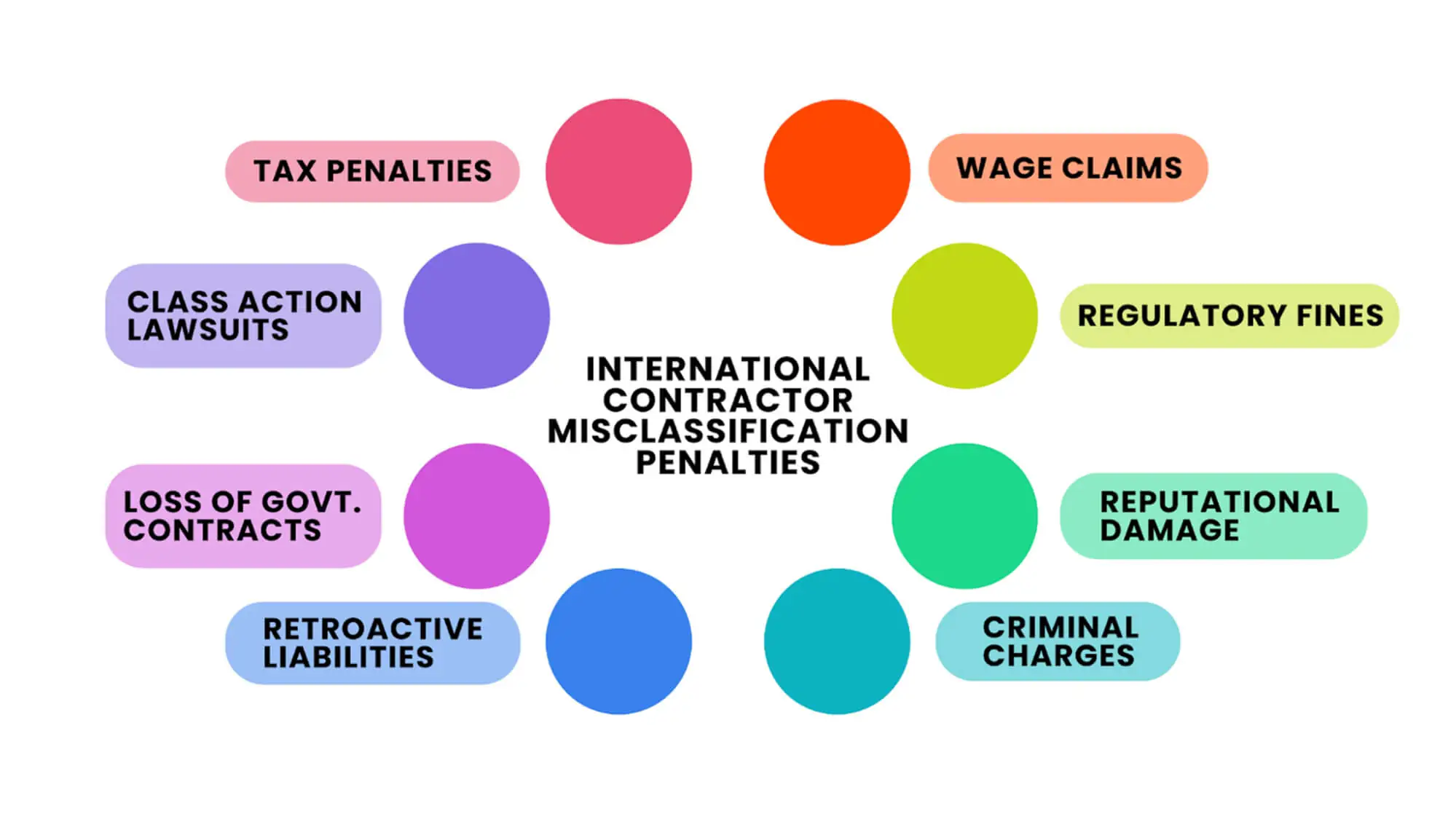

Independent Contractor Misclassification Penalties

It’s critical for employers to consider independent contractor misclassification penalties when hiring globally. Failing to do so could prove to be a massive misstep that results in various harmful factors for your company and operation.

These are explored below.

| Penalty | Explanation |

|---|---|

| Tax Penalties | Fines for failing to withhold income, Social Security, and Medicare taxes. |

| Wage Claims | Claims for unpaid wages, overtime, and benefits by misclassified workers. |

| Regulatory Fines | Civil penalties from labor or tax authorities for non-compliance. |

| Reputational Damage | Legal issues can damage public image and employee trust. |

| Criminal Charges (in severe cases) | In cases of willful misclassification, employers may face fraud charges |

| Retroactive Benefits Liability | Employers may be required to pay back benefits like healthcare or PTO. |

| Loss of Government Contracts or Licenses | Misclassification may disqualify companies from public bids or licenses. |

| Class Action Lawsuits | Groups of workers may sue collectively for misclassification damages. |

Note: The information provided here is for general informational purposes only and is not intended as legal or tax advice. For specific guidance, please consult with a qualified professional.

Tax Penalties

One of the most immediate and likely costly independent contractor misclassification penalties is the tax burden that can fall back on an employer. When a contractor should have been treated as an employee, the company becomes liable for unpaid employment taxes, including:

- While US companies hiring abroad are generally not required to withhold US payroll taxes, they must collect Form W-8BEN (or W-8BEN-E for entities) to confirm non-US tax status and avoid IRS backup withholding rules.

- Local tax authorities in the contractor’s home country may reclassify your contractor as an employee under local labor laws, potentially holding your business liable for unpaid employer contributions and taxes.

Wage Claims

While US wage and hour laws typically don’t apply to foreign contractors, many other countries do enforce back pay and benefits claims for misclassified workers.

- Some countries impose mandatory overtime pay, paid holidays, and 13th-month bonuses, all of which become liabilities if the contractor is deemed an employee.

- Under their local laws, these former contractors may also demand compensation for missed benefits, severance, or wrongful termination.

Regulatory Fines

Internationally, fines for worker misclassification often come from labor ministries, tax agencies, and social security bodies.

For example:

- Typically, European countries often impose a per-violation fine for non-compliance.

- In some countries, fines may be coupled with mandatory registration of the worker and retroactive benefit payments.

Reputational Damage

Reputation is one of the most critical factors for any company, especially those operating across borders. Violations of local labor laws can harm your brand abroad just as much as at home.

- In regions with strong labor protections, media or activist attention on misclassification can trigger boycotts, negative press, and employee churn.

- This is especially risky for companies expanding into new markets or those engaging in socially responsible branding.

Criminal Charges

Independent contractor misclassification penalties rarely include criminal charges. However, in some countries, willful misrepresentation to tax or labor authorities is a criminal offense.

For example:

- Tax fraud or evasion related to worker misclassification could trigger criminal investigations in some European countries.

- In cases involving forged documents or false residency declarations, the risk of criminal liability for executives or local managers increases significantly.

Retroactive Benefits Liability

Many countries require employers to offer specific benefits, including pension contributions, paid leave, healthcare, or termination protections. If your contractor is later reclassified, you may be liable for years of back benefits and fines.

It’s also worth noting that some jurisdictions assume an employment relationship by default until you declare independence.

Loss of Government Contracts or Licenses

This risk primarily applies if your company:

- Operates a foreign subsidiary that violates local labor laws, or

- Bid on government contracts in countries with strict labor compliance standards.

Companies found to be non-compliant may be blacklisted from public tenders or potentially have their operating licenses revoked in regular sectors.

Class Action Lawsuits

While not as common outside the US, collective or representative actions for misclassification do exist in several countries.

- In Canada, the U.K., and EU nations, workers can often bring group complaints through trade unions or statutory bodies.

- If your overseas team is large and centralized, you may still face mass misclassification litigation through class-like legal mechanisms.

Seamless contractor management by Payoneer Workforce Management

Understanding the risks of independent contractor misclassification penalties is only half the battle; staying compliant while hiring internationally requires the right tools and trusted expertise.

That’s where Payoneer Workforce Management’s platform comes in.

Our all-in-one solution helps you manage international contractors with ease, accuracy, and transparency, so you can stay focused on growth and reduce compliance complexity.

Here’s how:

| Feature | The Payoff |

|---|---|

| Global Contractor Payments | Pay contractors in 160+ countries and 70 currencies, typically fast and with fewer hassles. |

| Local Receiving Accounts | Let contractors get paid in their local currency, straight to their bank. |

| Employer of Record and Agent of Record Services | Offload contracts, benefits, and compliance, Payoneer Workforce Management helps manage it seamlessly. |

| Global Payroll | Pay global teams on time and in line with local laws. |

| Worker Classification Tools | Confidently classify workers with our support and tools. |

Payoneer Workforce Management makes it easy for employers to stay compliant while expanding into global labor markets. Our comprehensive tools help you manage freelancers, contractors, and employees with clarity and confidence.

If you’re ready to take charge of your global workforce, reach out today for a free demo.

Related resources

Latest articles

-

Employment laws in Sweden

Explore the employment laws in Sweden, a comprehensive guide to employees’ rights, employer obligations, and fair labor practices.

-

Employment laws in Poland

Explore the ins and outs of employment laws in Poland, an info-rich guide to employees’ rights, employer obligations, and fair labor practices that shape the future.

-

Employment laws in Indonesia

Find out more about Indonesia labor laws that dictate how employees should be contracted, managed, and paid, both on a national and state/territory level.

-

Employment laws in France

Learn about France’s labor laws dictating minimum wage, benefits, and more. Plus, discover the consequences of non-compliance with employment laws in France.

-

Employment laws in Spain

Find out more about Spain’s labor laws, from contracts and benefits to termination rules.

-

Employment laws in Australia

Find out more about the employment laws in Australia that dictate how employees should be contracted, managed, and paid, both on a national and state/territory level.

Disclaimer

The information in this article/on this page is intended for marketing and informational purposes only and does not constitute legal, financial, tax, or professional advice in any context. Payoneer and Payoneer Workforce Management are not liable for the accuracy, completeness or reliability of the information provided herein. Any opinions expressed are those of the individual author and may not reflect the views of Payoneer or Payoneer Workforce Management. All representations and warranties regarding the information presented are disclaimed. The information in this article/on this page reflects the details available at the time of publication. For the most up-to-date information, please consult a Payoneer and/or Payoneer Workforce Management representative or account executive.

Availability of cards and other products is subject to customer’s eligibility. Not all products are available in all jurisdictions in the same manner. Nothing herein should be understood as solicitation outside the jurisdiction where Payoneer Inc. or its affiliates is licensed to engage in payment services, unless permitted by applicable laws. Depending on or your eligibility, you may be offered the Corporate Purchasing Mastercard, issued by First Century Bank, N.A., under a license by Mastercard® and provided to you by Payoneer Inc., or the Payoneer Business Premium Debit Mastercard®, issued and provided from Ireland by Payoneer Europe Limited under a license by Mastercard®.

Skuad Pte Limited (a Payoneer group company) and its affiliates & subsidiaries provide EoR, AoR, and contractor management services.