Freelancer vs Contractor: does it matter?

Aren’t sure about the difference between “freelancer” vs “contractor.” It’s both simpler and more complex than you think.

When discussing the terms “freelancer” vs “contractor,” the two are commonly used interchangeably. There are certain instances, however, where the terms differ in terms of practical use and implication. The table below covers a few of the major differences:

Freelancer vs Contractor: An Overview

| Freelancer | Contractor | |

|---|---|---|

| Work Style | Commonly work independently for several clients on a project-based work schedule | Typically more integrated with a smaller number of clients over longer-term projects |

| Contracts? | Mostly, but sometimes informally | Always |

| Industry Use | Creative, tech, professional services | Wide range of industries |

| Integration | Operates independently with minimal contact | Operates under similar conditions to other workers, but paid differently |

| Payment | Typically granted upon milestone completion | Typically paid regularly due to longer-term work |

The manner by which freelancers and contractors are classified for employment purposes is still incredibly important, as misclassifying a contractor can result in fines and penalties.

The following article details the semantic differences between a freelancer vs contractor in further detail, as well as important details to watch out for when hiring both.

How are they practically different?

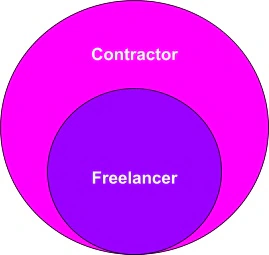

The relationship between freelancer vs contractor is overall one of semantics, best summed up in the Venn diagram below:

In essence, all freelancers are contractors, but not all contractors are considered freelancers. Freelancers are a subset of contractors, operating on specific conditions that prioritize freedom, flexibility, and adaptability. Contractors, on the other hand, create a business model that prioritizes long-term, structured relationships with fewer clients that are less agile.

| Think about the two like different business models; a food truck can zip across town and deliver food wherever business is, while a restaurant stays in one place and garners a clientele of “regulars,” but both would be considered food services. |

This means that the two are practically different, even if they are seen as similar/the same by the law. The main areas of distinction are covered in the subsections below.

Do both use contracts?

Independent contractors typically operate according to a written contract that stipulates the scope of work, method of payment, and other relevant client expectations. Freelancers will sometimes opt to work without one of these contracts due to:

- Reliance on informal arrangements (e.g., verbal agreements, trust)

- Working on the promise of an impending contract

- Rolling assignments with minimal risk

That being said, we should note that contractors of any type should work through a formal contract wherever possible to keep both parties safe. We recommend using a sample independent contractor agreement in the event that you are unfamiliar with the contract creation process.

How integrated are freelancers vs independent contractors?

One of the other minor areas of distinction between a freelancer vs contractor is the level at which they interact and operate alongside your staff:

- Contractors are typically more involved with existing staff, working alongside them for longer periods of time.

- Freelancers typically operate more independently, completing work on their own time and in their own place of work, meaning that employee communication with freelancers is typically more sparse, sporadic, and impersonal.

An important note here is that the more personal nature of contractors makes them more prone to being treated as employees, which can result in significant misclassification fines and penalties.

How is a freelancer vs contractor paid?

Freelancers and contractors typically get paid through invoicing clients, however, the schedule by which they receive payments may vary. There are no hard rules here, but the table below provides common averages for freelancers vs contractors when it comes to payments.

Freelancer vs Contractor: Method of payment

| Freelancer | Contractor | |

|---|---|---|

| Frequency | Upon project/milestone completion | Monthly, weekly, bi-weekly |

| Retainer? | Sometimes, but rarely | Usually |

| Advance | For larger projects (25-50%) | For longer-term projects (Typically 10-30%) |

Are these terms industry-specific?

While the terms “freelancer” vs “contractor” essentially mean the same thing, one is used more commonly than the other, depending on what industry you are working in. The table below provides an overview of common term usage by industry:

Freelancer vs Contractor: Common industry usage

| Industry | Freelancer? | Contractor? |

|---|---|---|

| Administration | ✅ | ✅ |

| Construction | ❌ | ✅ |

| Consulting | Sometimes | ✅ |

| Education | ✅ | Sometimes |

| Film/Media | ✅ | Sometimes |

| Healthcare | ❌ | ✅ |

| IT/Software Engineering | Sometimes | ✅ |

| Legal Services | Sometimes | ✅ |

| Marketing | ✅ | ✅ |

| Writing/Editing | ✅ | ✅ |

| Web Development | ✅ | ✅ |

The sheer number of green checks here should convey a strong message; it mostly doesn’t matter which you use. There are a few instances, however, where using the term “freelancer” (e.g., construction, healthcare, and certain legal instances) will raise some eyebrows.

So does it matter how I classify them?

Yes, but not how you think.

The distinction between a freelancer vs contractor is purely one of colloquial usage; there is no legal distinction between the two. Employers do, however, get legal trouble when they classify a worker who should be an employee as a contractor.

Employee vs Freelancer/Contractor

Employee vs contractor employment is significantly more detailed; so much so that the IRS has had to create several tools to correctly identify them, including a 20-point checklist delineating the differences between the two.

To give you an idea of the major differences between the two, the table below uses the same categories we’ve used to differentiate a freelancer vs contractor to evaluate the differences between both and an employee:

Freelancer/Contractor vs Employee: An overview

| Freelancer/Contractor | Employee | |

|---|---|---|

| Work Style | Contractors manage their own work, leverage their own equipment, and typically work on a deadline-oriented basis | Employees have the nature of their work determined for them by the employer |

| Contracts? | Yes | No |

| Tax | Contractors handle their own taxes | Employers manage an employee’s taxes |

| Integration | Sometimes | Always |

| Payment | By invoice | By paycheck |

Ensuring that your worker is correctly classified as either a freelancer/contractor vs employee is essential when hiring. If you are still unsure about the correct classification even after using the tools provided above, some alternative options are:

- Hire an Expert: Many businesses keep legal retainers on hand for this exact reason, but companies wanting a more comprehensive solution can also use an agent of record (AOR) platform to seamlessly manage worker classification.

- Request IRS Assistance: It takes a bit longer, but IRS Form SS-8 allows companies to formally request IRS assistance when determining worker status.

What to do next

At the end of the day, there’s very little difference between these terms – whether you use freelancer vs contractor, you are likely referring to the same, if not a similar, position. That being said, the concerns around worker misclassification are essential to understand and typically require a good bit of expertise and experience to successfully navigate.

For companies looking to outsource these responsibilities to a more experienced partner, Payoneer Workforce Management provides comprehensive tools to manage freelancers, contractors and employees with ease, when hiring internationally.

Related resources

Latest articles

-

Employment laws in Sweden

Explore the employment laws in Sweden, a comprehensive guide to employees’ rights, employer obligations, and fair labor practices.

-

Employment laws in Poland

Explore the ins and outs of employment laws in Poland, an info-rich guide to employees’ rights, employer obligations, and fair labor practices that shape the future.

-

Employment laws in Indonesia

Find out more about Indonesia labor laws that dictate how employees should be contracted, managed, and paid, both on a national and state/territory level.

-

Employment laws in France

Learn about France’s labor laws dictating minimum wage, benefits, and more. Plus, discover the consequences of non-compliance with employment laws in France.

-

Employment laws in Spain

Find out more about Spain’s labor laws, from contracts and benefits to termination rules.

-

Employment laws in Australia

Find out more about the employment laws in Australia that dictate how employees should be contracted, managed, and paid, both on a national and state/territory level.

Disclaimer

The information in this article/on this page is intended for marketing and informational purposes only and does not constitute legal, financial, tax, or professional advice in any context. Payoneer and Payoneer Workforce Management are not liable for the accuracy, completeness or reliability of the information provided herein. Any opinions expressed are those of the individual author and may not reflect the views of Payoneer or Payoneer Workforce Management. All representations and warranties regarding the information presented are disclaimed. The information in this article/on this page reflects the details available at the time of publication. For the most up-to-date information, please consult a Payoneer and/or Payoneer Workforce Management representative or account executive.

Availability of cards and other products is subject to customer’s eligibility. Not all products are available in all jurisdictions in the same manner. Nothing herein should be understood as solicitation outside the jurisdiction where Payoneer Inc. or its affiliates is licensed to engage in payment services, unless permitted by applicable laws. Depending on or your eligibility, you may be offered the Corporate Purchasing Mastercard, issued by First Century Bank, N.A., under a license by Mastercard® and provided to you by Payoneer Inc., or the Payoneer Business Premium Debit Mastercard®, issued and provided from Ireland by Payoneer Europe Limited under a license by Mastercard®.

Skuad Pte Limited (a Payoneer group company) and its affiliates & subsidiaries provide EoR, AoR, and contractor management services.