Invoicing international clients: Best practices

As a business owner, smooth cashflow is essential–and sending professional, accurate, timely invoices play a vital role. Learn best practices for invoicing international clients here.

Invoicing international clients: best practices

As a business owner, smooth cashflow is essential–and sending professional, accurate, timely invoices play a vital role. A poorly crafted invoice can hinder operations, leading to delayed payments or even non-payments.

One of the ways businesses can boost the efficiency of operations is via professional invoice management. It can be challenging, especially when dealing with international clients and international freelancers, suppliers, and stakeholders. Plus, each invoice must be meticulously crafted to maintain trust and operational integrity. An effective invoicing management system can make end-of-month invoices more manageable.

Clients are expected to adhere to the pre-arranged terms and conditions on the receiving end, but this doesn’t always happen in practice. As a result, late payments, partial payments, and cash flow issues can disrupt your business’s financial stability. That’s why running a tight ship from invoicing to receipt of payment is crucial for every business.

To overcome these challenges, it’s essential to establish clear communication channels with clients, define payment terms explicitly, and consider utilizing invoicing software or platforms that streamline the process. By incorporating these strategies, you can create a seamless invoicing workflow that minimizes errors, promotes professionalism, and facilitates cash flow.

What to include

Provide a comprehensive and detailed breakdown when describing the services rendered or products delivered. Itemize each line item to avoid confusion or misunderstandings.

- Your info: Always include your name, company name, registered business address, and contact details.

- Recipient information: Provide the recipient’s name, company name, registered business address, and contact details.

- Invoice number: Assign a unique invoice number. If you use invoicing software, it can generate this for you automatically.

- Invoice date: Mention the date when the invoice was prepared.

- Payment due date: Clearly state the date by which payment should be made.

- Itemized list: Include a detailed breakdown of all products or services provided. Each type of product or service should be listed separately on its own line.

By including these essential elements, you can ensure invoicing best practices with clarity and professionalism throughout.

Offering the right payment methods

Ensure a smooth payment experience by offering reliable and convenient payment methods tailored to your clients’ territory. Here are some key factors to consider when selecting the right payment method:

- Transfer speed: Choose a payment method that expedites the funds’ clearing process, minimizing the waiting time for you to access your hard-earned money.

- Traceability: Opt for a payment method that allows both you and your client to track the progress of the payment, providing transparency and peace of mind. It’s comforting to know when payments are made and received.

- Low fee structure: Select a payment method with reasonable fees, ensuring that you and your client don’t incur unnecessary additional costs when sending or receiving payments. Many popular payment options have fallen out of favor for being too costly. Pick wisely!

- Safety and security: Prioritize payment methods that offer robust security measures, safeguarding your funds and ensuring they reach the intended account without any risks or complications.

- Flexibility: Look for payment methods that offer enhanced flexibility, allowing you to access your cash conveniently in the way that suits you best.

Invoicing best practices for payments: Wire transfers

Wire transfers, such as SWIFT, are commonly considered a secure payment option for businesses. However, they have several drawbacks that can hinder your invoicing process.

One notable drawback of wire transfers is their slow processing time. Funds can take days or weeks to clear, causing delays in receiving your payments. Additionally, wire transfers often entail high fees and time-consuming paperwork for your clients, which can be inconvenient and potentially discourage prompt payments.

Another challenge with wire transfers is the potential loss of money due to unfavorable exchange rates and fees when converting funds from a different currency into your local currency. This can significantly impact your overall earnings.

Furthermore, wire transfers are harder to track than digital payments, making it more challenging to identify any issues if a payment does not arrive as expected. This can lead to uncertainty and confusion, making keeping accurate records of payments received and outstanding invoices challenging.

Reconciling payments with specific invoices can be laborious when relying solely on wire transfers. In addition, this can result in a loss of visibility and control over who has paid and who still needs to settle their invoices, potentially causing financial discrepancies and administrative headaches.

Invoicing best practices for payments: Local bank transfers

Local bank transfers, such as ACH bank debit or direct debits, are great for international clients due to their low fees and quick processing. However, there are some considerations, especially if you don’t have a bank account in the relevant currency.

Opening a USD, GBP, or EUR bank account can be time-consuming and frustrating, often accompanied by high fees and minimum balance requirements that can tie up your cash flow. This can pose challenges and hinder your ability to receive payments efficiently.

Payoneer offers a convenient and cost-effective solution to this problem: local receiving accounts.

Open accounts in up to 11 major currencies including USD, GBP, and EUR, to serve clients or to support your global business entities. You can get paid from 190+ countries and territories, and payments can land in minutes with low fees.

Once you have a Payoneer account, you can invite your international clients to pay using a local bank transfer.

By utilizing Payoneer’s local receiving accounts, you bypass the need for foreign bank accounts while still enjoying the benefits of local bank transfers. This streamlines your payment process, eliminates unnecessary fees and complications, and enables you to maintain a healthy cash flow.

Invoicing best practices for payments: credit and debit cards

When invoicing international clients, leveraging credit cards and debit cards offers a straightforward and convenient payment solution. Credit card payments provide simplicity and traceability, streamlining your bookkeeping and accounting processes. But it’s important to consider the potential drawbacks.

While credit card payments are universally accepted, you should be aware of the potential high currency conversion fees your clients may incur if they pay in your local currency. This can create a substantial financial burden for them. On the other hand, if you receive payments in USD and need to convert them to your local currency, you might encounter fees on your end.

With credit cards and debit cards, you’re effectively trading convenience for cost: there are better ways to send and receive payments. The devil is in the details – check out the currency conversion rates, fees, and commissions in the fine print.

Level up your invoicing process with Payoneer

Our useful Request a payment feature allows you to attach an invoice to your request, providing your clients with an embedded payment link. With Payoneer, you can offer your clients the flexibility to make instant online payments using their credit cards or opt for the convenience of ACH bank debit or local bank transfers.

When you choose us, you benefit from our expertise in handling currency conversions. Our platform ensures you receive competitive exchange rates and incur minimal fees and commissions, eliminating the complexities and costs associated with currency conversion (foreign exchange rates).

Experience the seamless synergy of convenience, efficiency, and cost-effectiveness with our effective payment services. We streamline your invoicing process and optimize your payment collection, allowing you to put your entrepreneurial energy to good use – building your business.

Invoicing best practices: Unique global payments solutions

Digital payment processing has come a long way in the last few years, and that means lower costs for your global clients and your business. But it’s not just the cost benefits we all enjoy; it’s payment processing speed, convenience, and ease of use. Plus, valuable business services such as automatic payments are readily available too.

With Payoneer, your USD funds provide incredible flexibility. Keep your funds in USD to cover local expenses like taxes or online purchases. Seamlessly transfer funds to other Payoneer users via Payoneer payments, utilizing your Payoneer balance.

Should you need to make a payment in a different currency, converting your USD funds to your local currency is a breeze. Withdraw funds directly to your bank account or access them conveniently at ATMs, ensuring your financial resources are readily available whenever and wherever you need them.

Invoicing best practices: US Clients

Divide the total amount due in USD by line item for transparent and precise invoicing. If applicable, include the total sales tax, VAT, and the corresponding tax rate applied.

- Include the IBAN and BIC codes required for hassle-free SWIFT Wire transfers.

- Facilitate secure ACH bank transfers by providing your bank details.

- Specify the mailing address where clients should send checks, ensuring smooth processing.

- For convenient payment options, always include a link to your online payments solution, allowing clients to conveniently make payments using credit or debit cards.

Following these guidelines for invoicing best practices and providing the appropriate payment method details ensures professionalism, minimizes payment delays and nurtures strong relationships for US-based clients.

Always include taxes and/or VAT

Include any applicable taxes your client must pay, such as sales taxes, VAT, or US income tax withholding. It’s important to note that tax requirements can vary based on the specific circumstances. For example:

Service providers: Most states may not require business consultants or graphic designers to charge sales tax. However, it’s essential to check the sales tax regulations in each state individually, as some states, like New Mexico and South Dakota, may impose sales tax on certain services.

According to the Tax Foundation, sales tax regulations vary across the United States, with 45 states and the District of Columbia collecting statewide sales taxes. An additional 38 states impose local sales taxes, which can exceed state rates.

The highest average combined state and local sales tax rates are found in Louisiana, Tennessee, Arkansas, Alabama, and Oklahoma. State rates have remained unchanged, except for New Mexico, reducing its sales tax rate in July 2022.

These are averages and specific city or county taxes can vary within these states.

These variations in sales tax rates and bases can influence consumer behavior, leading to cross-border shopping and online purchases. Stay informed about specific sales tax regulations in each state for accurate invoicing.

For instance, if the warehouse is in California, you’ll need to charge and remit California sales tax, regardless of where your customers are. Other popular online marketplaces may have similar requirements.

Online store owners: If you sell products through your website, you must collect and remit sales tax according to the state where the sales are made. For instance, if you sell t-shirts to customers in Kentucky, you’ll need to charge and pay Kentucky sales tax. Similar rules apply to sales made to customers in other states.

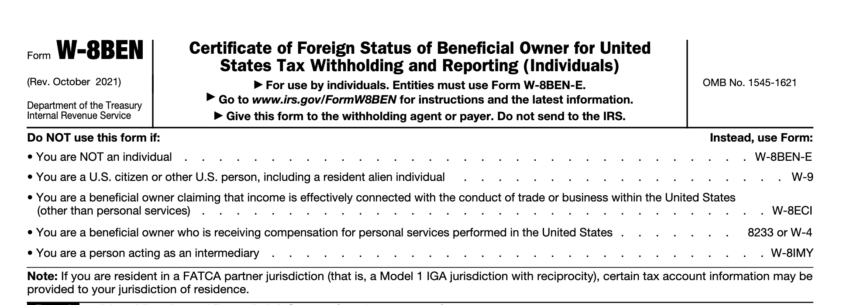

US income tax withholding: Online service providers and freelancers must comply with US income tax laws. Your US clients are required to withhold 30% of your income and remit it to the government (unless the contractor provides a W8BEN form, claiming tax treaty benefits to reduce or eliminate this withholding).

If you already pay income tax in your country of residence, you can claim an exemption by completing Form W8BEN and providing it to your client for their records. This exemption ensures that you won’t be subject to double taxation. It’s important to communicate with your clients and provide the necessary documentation to avoid unnecessary withholding.

Send your clients the right tax paperwork

When working with US clients, invoicing best practices demand a streamlined process of collecting all necessary and relevant documentation, such as the W9 form (below). US clients require this form to report payments made to vendors, like you, to the US tax authorities annually. Instead of waiting for your client to request the W9 form, providing it proactively showcases excellent customer service.

The W9 form can be easily found online, and by including it with your first invoice, you demonstrate professionalism and efficiency. In addition, once your client has submitted the W9 form for your records, they have a compelling reason to continue working with you, as they won’t need to obtain a new form for subsequent engagements.

Leveraging Payoneer’s Request a Payment service adds further convenience. You can attach your completed W9 form and invoice, ensuring all the required documentation is readily available for your client’s records.

By taking the initiative to provide the W9 form promptly and utilizing our comprehensive invoicing features, you streamline the administrative process, enhance your professional image, and foster stronger client relationships.

Invoicing best practices rule: Use e-invoicing as your default option

Simplify your invoicing process with electronic invoicing or e-invoicing. This digital approach allows you to send invoices as data files, such as XML or EDI, eliminating the risk of lost documents. In addition, E-invoicing is faster and more efficient, as it automatically populates invoices by pulling information from your databases.

E-invoices offer benefits to your US clients as well. Unlike paper or PDF attachments, many businesses have automated digital invoicing systems that can swiftly process e-invoices. In addition, these systems streamline the sharing of information across departments.

Remember, e-invoices can feature a convenient pay now button, leading clients directly to secure payment pages for credit/debit card or ACH bank debit payments. Some e-invoices even support mobile payments, ensuring a seamless payment experience for your clients.

Top 10 tips for issuing American invoices

- Use USD as the payment currency.

- Assign unique invoice numbers.

- Seek client feedback on draft invoices.

- Use American measurement units.

- Keep copies of invoices for record-keeping.

- Clearly state payment terms and due dates.

- Include detailed descriptions of products or services.

- Provide multiple payment options for convenience.

- Include clear and concise payment instructions.

- Send invoices promptly and follow up on payment deadlines.

We can help your business with invoicing American clients

Invoicing best practices warrant professional guidance for American clients. At Payoneer, we go beyond just providing payment solutions – we offer a comprehensive suite of tools and features designed to enhance your invoicing experience. Here’s how we can assist you in effectively invoicing your American clients:

- Versatile payment options: Offer diverse payment methods like credit/debit cards, ACH bank transfers, and local bank transfers, providing the utmost convenience for your US clients.

- Professional invoice formatting: Create visually appealing, clear, and consistent invoices that exude professionalism and leave a lasting impression on your US clients.

- Seamless W9 form attachment: Easily include the necessary W9 form with your invoices, ensuring compliance without any hassle or delays.

- Streamlined workflow: Our user-friendly platform simplifies the entire invoicing process, from generation to payment tracking, saving you valuable time and effort.

Disclaimer

The information provided on this blog is intended solely for informational purposes and does not constitute professional, financial, or legal advice. Payoneer makes no representations or warranties regarding the accuracy, completeness, or reliability of the information presented herein. Users should consult with a qualified professional for advice tailored to their individual circumstances. Payoneer disclaims all liability for any errors or omissions in the information provided.