Business payments for

today’s global economy

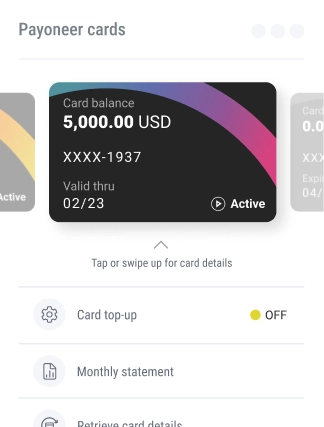

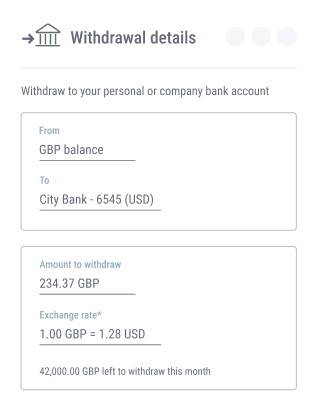

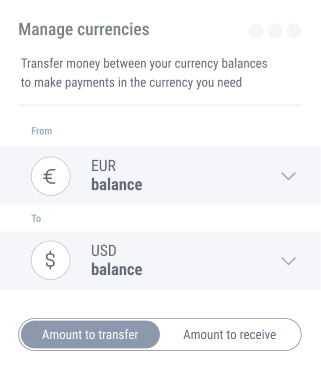

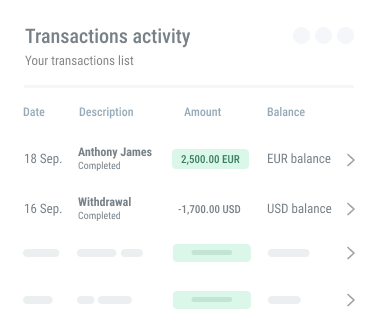

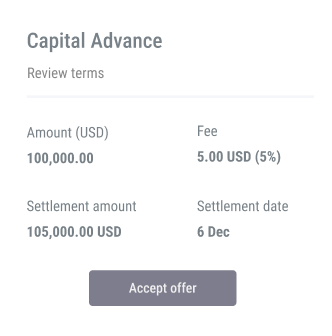

The Payoneer multi-currency account has everything your business needs to help you pay, get paid, and grow globally.

Trusted by millions of customers worldwide

Chosen by leading marketplaces

Think business payments. Think Payoneer.

We believe global business should be just as easy and hassle-free as doing business locally, for everyone. Payoneer’s payment platform empowers you to reach new markets, do business in multiple currencies, and comply with local regulations – all while simplifying the payment experience for you and your clients, partners, and suppliers.

What’s in it for you?

Open a Payoneer account and you, your customers and clients, and your suppliers will find payments less complicated, no matter where you are in the world.

Who are our customers?

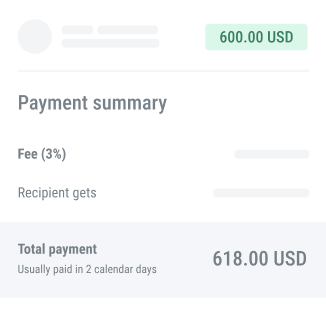

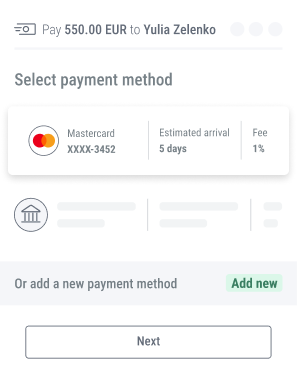

Get to know our fees

We’ve made our pricing easy to understand, the way it should be.

About us – DON’T USE THIS!!

Payoneer is the world’s go-to partner for digital commerce, everywhere. From borderless payments to boundless growth, Payoneer promises any business, in any market, the technology, connections, and confidence to participate and flourish in the new global economy.

5M+

customers worldwide

2,000+

employees

worldwide

24

global

offices

70

currencies

supported

190+

countries

covered

22+

languages

supported

About us

Payoneer is the world’s go-to partner for digital commerce, everywhere. From borderless payments to boundless growth, Payoneer promises any business, in any market, the technology, connections, and confidence to participate and flourish in the new global economy.

Millions

CUSTOMERS AND COUNTING

70

CURRENCIES SUPPORTED

2,000+

EMPLOYEES WORLDWIDE

24/7

CUSTOMER SUPPORT

25+

GLOBAL OFFICES

17

Languages

It’s a word-of-mouth thing

Want to know what it’s like to do business with us? Hear from our customers – and maybe check out some of our Trustpilot reviews.