Payoneer up:date

GROW SMARTER IN 2025

Automate your workflows, simplify how you get paid, and manage your finances with more control – all with the latest updates from Q1 and Q2.

See what’s new

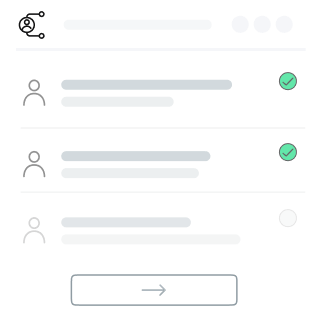

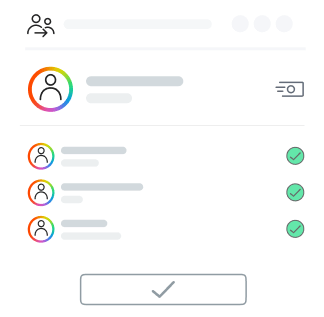

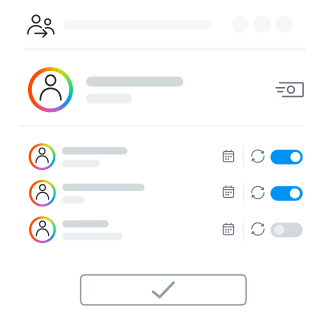

Smarter Payout Workflows

Scale your operation more easily with tools that help your team manage payouts, workflows, and financial operations–giving you more control and less friction.

Get Paid, Your Way

Collect payments your way, with more options, less manual work, and full visibility across every request.

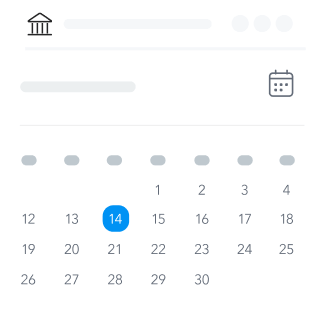

Smarter Currency Management

Take charge of your currency strategy with smarter tools for timing, visibility, and control.

Spend with Confidence

Empower your teams with flexible, trackable ways to spend–and stay in control at every step.

Nothing herein should be construed as if Payoneer Inc. or its affiliates are soliciting or inviting any person outside the jurisdiction where it operates/is licensed to engage in payment services provided by Payoneer Inc. or its affiliates, unless permitted by applicable laws. Any products/services availability are subject to customer’s eligibility. Not all products/services are available in all jurisdictions in the same manner.

Depending on or your eligibility, you may be offered with the Corporate Purchasing Mastercard, issued by First Century Bank, N.A., under a license by Mastercard® and provided to you by Payoneer Inc., or the Payoneer Business Premium Debit Mastercard®, issued and provided from Ireland by Payoneer Europe Limited under a license by Mastercard. The Payoneer Business Premium Debit Mastercard® cannot be used at merchants or ATMs in Hong Kong or for HKD payments.

If you are located in the EEA, all Payoneer Services will be provided to you by Payoneer Europe Limited, trading as Payoneer and regulated by the Central Bank of Ireland.